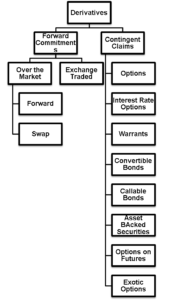

Derivatives

What are Derivatives in Finance?

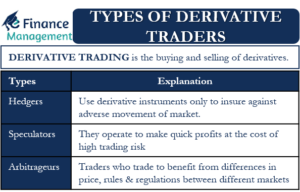

Derivatives are instruments to manage financial risks. Since risk is an inherent part of any investment, financial markets devised derivatives as their own version of managing financial risk. Derivatives are structured as contracts and derive their returns from other financial instruments.

Definition of Derivatives

If the market consisted of only simple investments like stocks and bonds, managing risk would be as easy as changing the portfolio allocation among risky stocks and risk-free bonds. However, since that is not the case, risk can be handled in several other ways. Derivatives are one of the ways to ensure your investments against market fluctuations. A derivative is defined as a financial instrument designed to earn a market return based on the returns of another underlying asset. It is aptly named after its mechanism, as its payoff is derived from some other financial instrument.

Derivatives are designed as contracts signifying an agreement between two different parties, where both are expected to do something for each other. It could be as simple as one party paying some money to the other and in return, receiving coverage against future financial losses. There also could be a scenario where no money payment is involved upfront. In such cases, both the parties agree to do something for each other at a later date. Derivative contracts also have a limited and defined life. Every derivative commences on a certain date and expires on a later date. Generally, the payoff from a certain derivative contract is calculated and/or is made on the termination date, although this can differ in some cases.

As stated in the definition, the performance of a derivative is dependent on the underlying asset’s performance. Often this underlying asset is simply called as an “underlying”. This asset is traded in a market where both the buyers and the sellers mutually decide its price, and then the seller delivers the underlying to the buyer and is paid in return. Spot or cash price is the price of the underlying if bought immediately.

Types of Derivatives

Derivative contracts can be differentiated into several types. All the derivative contracts are created and traded in two distinct derivatives markets and hence are categorized as following based on the markets:

Exchange-Traded Contract

Exchange-traded contracts trade on a derivatives facility that is organized and referred to as an exchange. These contracts have standard features and terms, with no customization allowed, and are backed by a clearinghouse.

Over The Counter Contract

Over-the-counter (OTC) contracts are those transactions that are created by both buyers and sellers anywhere else. Such contracts are unregulated and may carry the default risk for the contract owner.

Derivative Categories

Generally, the derivatives are classified into two broad categories:

- Forward Commitments

- Contingent Claims

Forward Commitments

Forward commitments are contracts in which the parties promise to execute the transaction at a specific later date at a price agreed upon in the beginning. These contracts are further classified as follows:

Over the Counter Contracts

Over the counter contracts are of two types:

Forward

In this type of contract, one party commits to buying, and the other commits to sell an underlying asset at a certain price on a certain future date. The underlying can either be a physical asset or a stock. The loss or gain of a particular party is determined by the price movement of the asset. If the price increases, the buyer incurs a gain as he still gets to buy the asset at the older and lower price. On the other hand, the seller incurs a loss in the same scenario.

For a detailed understanding, you can read our exclusive post on Forward Contract.

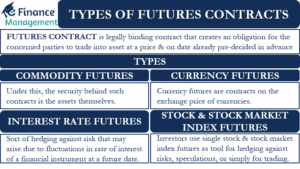

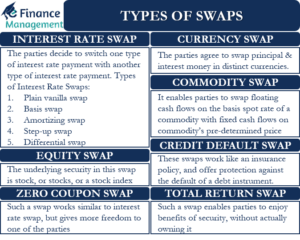

Swap

A swap can be defined as a series of forward derivatives. It is essentially a contract between two parties where they exchange a series of cash flows in the future. One party will consent to pay the floating interest rate on a principal amount, while the other party will pay a fixed interest rate on the same amount in return. Currency and equity returns swaps are the most commonly used swaps in the markets.

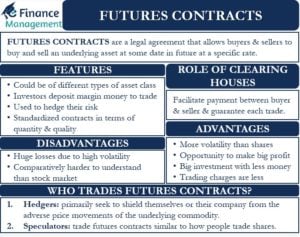

Exchange-Traded Contracts

Exchange-traded forward commitments are called futures. A future contract is another version of a forward contract, which is exchange-traded and standardized. Unlike forward contracts, future contracts are actively traded in the secondary market, have the backing of the clearinghouse, follow regulations, and involve a daily settlement cycle of gains and losses.

Also, read Exchange Traded Funds.

Contingent Claims

Contingent claims are contracts in which the payoff depends on the occurrence of a certain event. Unlike forward commitments, where the contract is bound to be settled on or before the termination date, contingent claims are legally obliged to settle the contract only when a specific event occurs. Contingent claims are also categorized into OTC and exchange-traded contracts, depending on the type of contract. The contingent claims are further sub-divided into the following types of derivatives:

Options

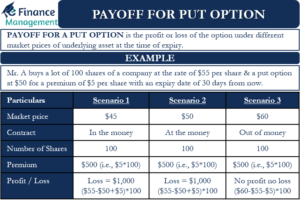

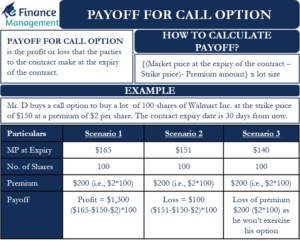

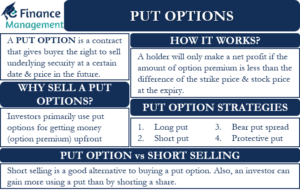

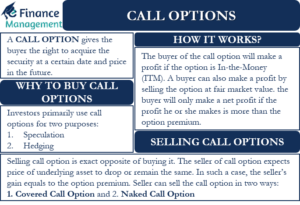

Options are the type of contingent claims that are dependent on the price of the underlying at a future date. Unlike the forward commitments derivatives, where payoffs are calculated keeping the movement of the price in mind, the options have payoffs only if the price of the underlying crosses a certain threshold. Options are of two types: Call and Put. A call option gives the option holder right to buy the underlying asset at exercise or strike price. A put option gives the option holder right to sell the underlying asset at exercise or strike price.

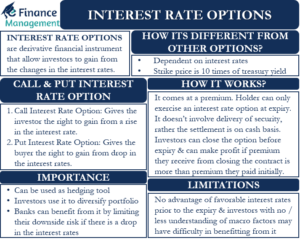

Interest Rate Options

Options where the underlying is not a physical asset or a stock, but the interest rates are interest rate options. It includes Interest Rate Cap, floor, and collar agreements. Further forward rate agreement can also be entered upon.

Warrants

Warrants are the options that have a maturity period of more than one year and hence, are called long-dated options. These are mostly OTC derivatives.

Convertible Bonds

Convertible bonds are the type of contingent claims that gives the bondholder an option to participate in the capital gains caused by the upward movement in the stock price of the company without any obligation to share the losses.

Callable Bonds

Callable bonds provide an option to the issuer to completely pay off the bonds before their maturity.

Asset-Backed Securities

Asset-backed securities are also a type of contingent claim as they contain an optional feature, which is the prepayment option available to the asset owners.

Options on Futures

Options on futures are types of options that are based on futures contracts.

Exotic Options

Exotic Options are the advanced versions of the standard options, having more complex features.

In addition to the categorization of derivatives on the basis of payoffs, they are also sub-divided on the basis of their underlying asset. Since a derivative will always have an underlying asset, it is common to categorize derivatives on the basis of the asset. Equity derivatives, weather derivatives, interest rate derivatives, commodity derivatives, exchange derivatives, etc., are the most popular ones that derive their name from the asset they are based on. There are also credit derivatives where the underlying is the credit risk of the investor or the government.

Derivatives take their inspiration from the history of mankind. Agreements and contracts have been used for ages to execute commercial transactions, and so is the case with derivatives. Likewise, financial derivatives have also become more important and complex to execute smooth financial transactions. This makes it important to understand the basic characteristics and the type of derivatives available to the players in the financial market.

Also, read – Embedded Derivatives.

References

- Study Session 17, CFA Level 1 Volume 6 Derivatives and Alternative Investments, 7th Edition