What is Payoff for Call Option?

A call option is a financial contract that gives its buyer a right to purchase underlying security or an asset at a price and time fixed at the time of entering into the contract. The payoff for call option is the profit or loss that the parties to the contract make at the expiry of the contract. This may vary due to the change in the market price of the underlying asset until that day. The underlying asset can be a share, bond, or any commodity such as gold, etc.

The buyer of the option does not have any obligation to necessarily buy the asset. He will do so only if it is financially viable for him. But the seller or writer of the contract will have an obligation to fulfill the contract if the buyer wishes so at the expiry of the contract period. He will have to sell the asset to the buyer at the price they have decided upon in the contract. He may even have to suffer a loss in the process.

The price at which the buyer and the seller of the contract mutually agree to settle the trade at the end of the contract period is known as the strike price. The Premium amount is the charge that the seller of the contract takes for the risk that he undertakes. The payoff for the call option buyer gets higher with an increase in the price of the asset over the strike price. On the contrary, the payoff for the seller of the contract will be in red in the above case. Also, the value of the call option contract will go up with an increase in the market price of the asset and vice-versa.

How to Calculate Payoff for Call Option?

There is no upside limit to the payoff for a call option from the buyer’s point of view. His profit will keep on rising with an increase in the price of the underlying asset. The maximum he can lose from a call option is the amount of premium that he has to pay for the contract.

From the seller’s point of view, he has a lot to lose when the prices of the underlying security increase in the market. To look at it technically, his losses can go as high as the stock price can climb over the contract period. On the other hand, his profit from the contract is limited to the premium amount he gets for writing the call option.

The break-even point or a point of no-profit-no-loss for both the parties to a call option contract is the price point equal to the strike plus the premium amount for the contract.

Therefore, we can summarize the above situation with the help of the following formula:

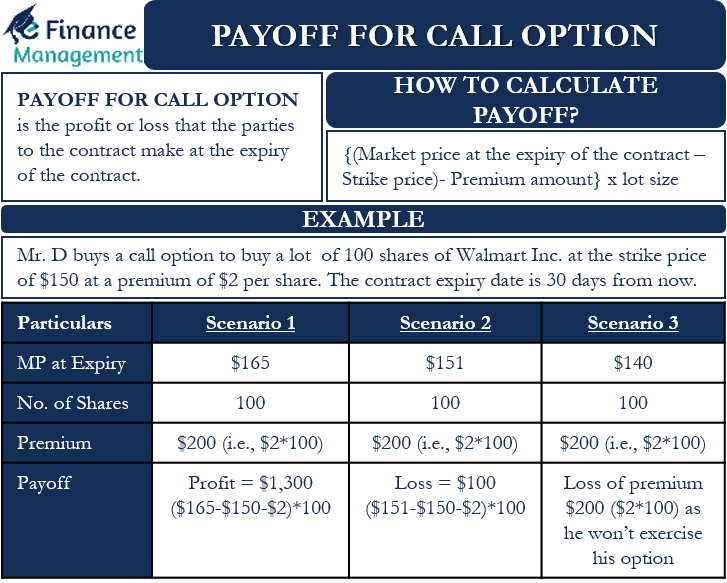

The payoff for Call Option = {(Market price at the expiry of the contract – Strike price)- Premium amount} x lot size

This equation is only applicable in cases when the market price at the expiry of the contract is higher than the strike price. The equation will give us the gain/loss of the buyer. It will also provide the loss of the seller of the call option. The buyer can face a no-profit situation or a loss when the market price is equal to or lower than the sum of the strike price and premium that he pays. Let us understand the payoff for the call option with the help of an example.

Example

Mr.D buys a call option from Mr.E to buy the shares of Walmart Inc at the strike price of $150 at a premium of $2 per share. The contract lot size is 100 shares. The contract expiry date is 30 days from the current date.

Also Read: Payoff from Put Option

Situation 1: Market Price is $165 at the Time of Expiry

Let us assume that the market price of the above shares is $165 at the time of expiry of the contract. The buyer of the call option will definitely exercise his option. He can buy the lot at a cheaper price than what is available in the open market. We can calculate his payoff from the situation with the help of the above equation.

Payoff for Mr.D= {($165 – $150)- $2} x 100 shares = $1300 profit

The payoff for Mr.E will be an equal amount loss of $1300.

Situation 2: Market Price is $151 at the Time of Expiry

Now suppose that the market price of the shares is $151 at the time of contract expiry. The buyer will again exercise his option to narrow his losses. The payoff for the call option, in this case, will be:

{($151- $150) – $2} x 100 shares= $100 loss for the buyer or Mr.D

Mr.E will have a profit of $100 from the above situation.

Situation 3: Market Price is $140 at the Time of Expiry

Let us assume a third scenario in which the market price of the share falls to $140 at the contract expiry time. Mr.D will not exercise his call option since he can easily purchase the share from the open market at a much lower price than the strike price. His payoff for call option in this situation will be a loss of premium amount. This amount is $2 x 100 shares= $200 in our case.

Mr.E will gain a similar amount of $200 in the form of premium charges.

Summary

Call options are a very attractive choice for buyers. There is an opportunity for unlimited gains at the price of just the premium amount. Also, the premium amount is the maximum loss that they can suffer. If the market moves in their favor, they stand to gain a lot. The value of the call option increases with the increase in the market value of the underlying asset. The buyer can sell the call option at a profit before the expiry of the contract and exit his position. This gives him added flexibility and convenience.

Call options are much riskier for the writer or the seller. There is no limit to the losses they may suffer. Their losses will increase with an increase in the market price of the underlying security. Also, their gains are just limited to the premium amount they charge. Hence, call option writers should be experienced enough to know the level of risk they are undertaking. Also, they should be aware of the extent of losses they may suffer.

Whereas, if the call option writer is already in possession of the underlying shares at a price that is less than the strike price. He will lose out on loss of profit only.

RELATED POSTS

- What are the Factors Affecting Option Pricing? How and Why?

- Put Options – Meaning, How it Works, Strategies, and More

- Option Pricing Model

- Lookback Option – Meaning, How it Works, Types and More

- What are Options in Trading – Types, Pros, Cons, and More

- American vs European Option – All You Need to Know