What is Payoff for Put Option?

A put option is a financial agreement that gives its buyer a right to sell an asset such as a stock or a bond at a price and time that have been pre-decided at the time of entering into the contract. The put option buyer does not have an obligation to complete the sale at the time of expiry of the contract. It depends upon the market price of his asset at that time. There are two parties to the contract in such options – the buyer and the seller (or the writer). The payoff for a put option is the profit or loss of the option under different market prices of the underlying asset at the time of expiry. We calculate the payoff for both parties to the contract.

The parties to the contract agree on a strike price when entering into the contract. It is the price at which the buyer can sell his asset if he wishes to when the contract expires. The writer will have an obligation to fulfill the contract and complete the purchase at this strike price. Then we have a premium amount that the writer charges instead of the risk he assumes.

How to Calculate Payoff for Put Option – Buyer and Seller?

The formula to calculate the payoff for the put option is:

{(Strike Price – Market Price at the Expiry of the Contract) – Premium} * Lot Size

Example

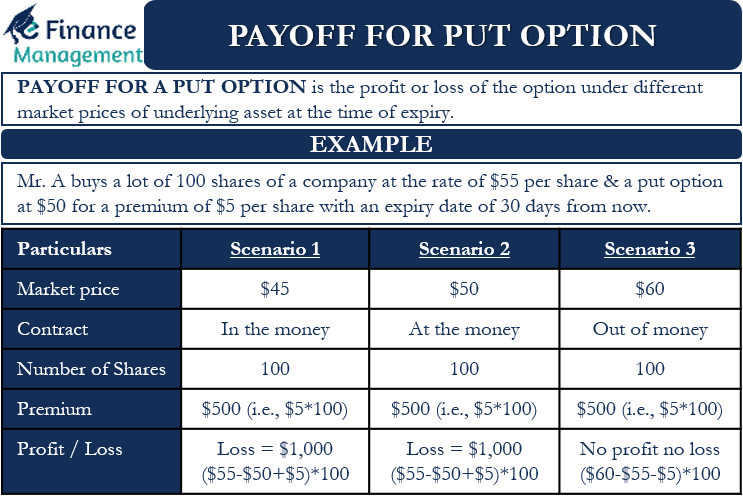

Let us understand the payoff for the put option with the help of an example. Mr.A buys a put option of Exxon Mobil Corporation at a strike price of $50 per share for a premium of $5 per share from Mr. B with an expiry date of 30 days from now. The lot size of the contract is 100 shares.

Scenario 1: When the Market Price is $45

Let us assume that the market price of Exxon Mobil Corp. is $45 at the time of expiry of the contract. This will mean that the contract is “in the money.” Hence, Mr.A will exercise his put option, and Mr.B will have to oblige and fulfill the contract.

Also Read: Payoff for Call Option

Here, Mr. A can buy these shares from the market at $45 and sell them to Mr. B for $50. In this scenario, Mr. A will be at breakeven, {($50 – $45) – $5}*100 = 0

And, the payoff of Mr. B will also be the same, that is, {($45 – $50) + $5}*100 = 0

Therefore, Mr.B is in a no-profit-no-loss situation in this case. It is his break-even point. Any market price of the share above the current market price of $45 will mean a profit for him. He will suffer a loss when the market price of the share goes down further.

Scenario 2: When the Market Price is $50

Now let us assume that the market price of the share is $50 at the end of the expiry of the contract. The closing price is equal to the strike price. This is the case of the option being “at the money.” It will be of no benefit for Mr.A to exercise his put option as the market price is the same as the strike price at the end of the contract term.

In such a situation, Mr. A’s payoff from the put option will be a loss equal to the premium he pays for the option. We can calculate Mr.A’s net loss as:

($5 x 100 shares) = $500.

The payoff for the writer or Mr.B will be equal to the amount of premium he charged. In our example, it is equal to $500 ($5 x 100 shares).

Scenario 3: When the Market Price is $60

In the third scenario, let us assume that the contract ends with the share being at $60. The option will be “out of money” in such a case. It will be useless for the buyer to exercise his option as the strike price is less than the market price.

Therefore, Mr.A’s payoff from the put option will be again a loss equal to the premium he paid for buying the option. This is equal to $500 ($5 x 100 shares) in our case.

Similarly, Mr.B’s payoff from the put option will again be the premium amount of $500, which he had charged for providing his services.

Summary

It is very important to understand the payoff from put options so as to make correct decisions while trading in such options. Put options are an important tool to hedge risks while investing in the markets.

A writer of put options should be very experienced and have good knowledge, instincts, and judgment. His upside potential in a put option has a limit to the amount just equal to the premium he charges. But his downside risk is significant. At max, he can lose an amount equal to the strike price of the asset in case the asset loses its entire value with time and its market value falls to zero. Therefore, he needs to be very cautious as his risks are significant. He needs to study his payoffs from his put position in detail. He should evaluate multiple scenarios with different asset price movements so as to justify his position and the amount of risk he is willing to undertake.

A buyer of the put option has very limited risk. The maximum he can lose is the amount of premium he has to pay to the writer of the put option. His gains can be significant if the share price has a free downward flow. Therefore investors too should study their investments and the market conditions thoroughly, evaluate their payoff from the put option and then go for it.

Please note that we have used such an example for the sake of understanding and simplicity. Otherwise, these transactions occur in exchanges where the buyer and seller do not know each other, and there are no negotiations about the strike price, etc. These things are standard and fixed by the exchanges.

RELATED POSTS

- Call Options – Meaning, How it Works, Uses, and More

- American vs European Option – All You Need to Know

- Buying Call vs Selling Put – Meaning, Example, and Differences

- What are Options in Trading – Types, Pros, Cons, and More

- What are the Factors Affecting Option Pricing? How and Why?

- Option Pricing Model