International Monetary System: Meaning

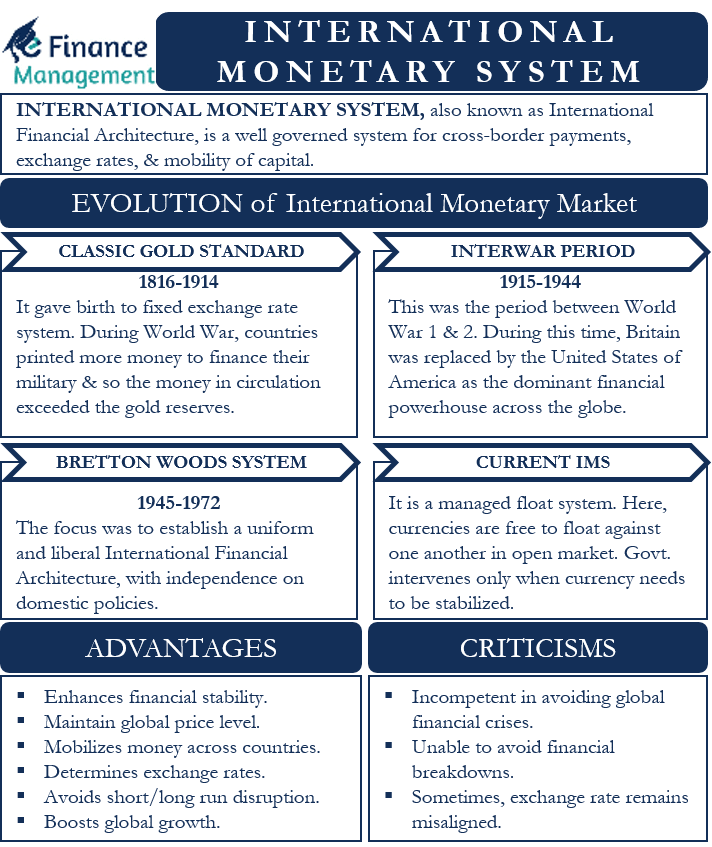

International Monetary System (IMS) is a well-designed system that regulates the valuations and exchange of money across countries. It is a well-governed system looking after the cross-border payments, exchange rates, and mobility of capital. This system has rules and regulations which help in computing the exchange rate and terms of international payments. In other words, International Monetary System mobilizes the capital from one nation to another by felicitating trade. There are many participants like MNCs (Multinational Corporations), Investors, Financial Institutions, etc., in the International Monetary System.

The main purpose of the International Monetary System today is to enhance high growth in the world with stable price levels. Earlier the scope was only up to exchange rates. Now the system has a broader scope by taking financial stability into consideration. International Monetary System has established International Monetary Fund (IMF) and the World Bank in the year 1944.

International Monetary System is also known as “International Monetary and Financial System” and also “International Financial Architecture.”

Evolution of International Monetary System

Over the past 75 years, the International Monetary System has been modified according to the prevailing conditions. The scope has evolved over the years, but the purpose of the system has remained constant. The evolution of the International Financial Architecture is as follows:-

Classic Gold Standard

The first phase of the International Monetary System was the Classic Gold Standard from 1816 to 1914. Only a few countries adopted this standard in the initial years of the Gold Standard. Later almost all countries accepted it. Usually, coins and billions of gold were useful during this standard. This gold standard gave birth to a fixed exchange rate system with minimal fluctuations. Because of the most fixed exchange rate, International trade saw a boost during this time. Gold Standard also made all countries of the world abide by strict monetary policy. This standard was helpful in correcting trade imbalances in the country. The other name of Classic Gold Standard is International Gold Standard.

Also Read: International Money Market

Why Classic Gold Standard Collapsed?

After the end of World War 1, the Classic Gold Standard collapsed. During World War, many countries printed more money in order to finance their military requirements. As a result of this, the money in circulation exceeded the gold reserves of the country, and so those countries have to give up on Classic Gold Standard. The only United States of America didn’t give up on Classic Gold Standards.

Interwar Period

The period between World War 1 and World War 2 is known as the Interwar Period. This was the next episode of the International Monetary System from 1915 to 1944. During this time, Britain was replaced by the United States of America as the dominant financial powerhouse across the globe. During this period, all the economies had gone into a depression with a higher inflation rate. The fixed exchange rate system collapsed with a higher supply of money. Almost all countries started focussing on domestic revamping and not on international trade.

Bretton Woods System

The period after World War 2 gave birth to Bretton Woods System. This monetary system was in existence from 1945 to 1972. Representatives from 44 countries, in the year 1944, met at Bretton Woods of the United States and came up with a new International Monetary System. The focus of the Bretton Woods Agreement was to establish a uniform and liberal International Financial Architecture with independence on domestic policies. This agreement gave birth to the US Dollar-based Monetary System or Gold-Exchange Standard. This system gave birth to the pegging of domestic currency in terms of US Dollars. A price of $35 was set for 1 ounce of gold—the countries, rather than linking their currency to the gold-linked it to US Dollars.

All the member countries of Bretton Woods had to maintain their currencies value within 1% upward or downward variations in comparison to Fixed Exchange Rate. This agreement also allowed the Governments of the country to convert their gold into the US Dollar at any point in time. Eventually, countries and businesses have started ignoring the link between US Dollar and Gold and have started considering exchange rates directly.

If the situation prevailed, then Bretton Woods Agreement allowed the country to devalue its currency by more than 10% straight. Although, it didn’t allow countries to use this mechanism to benefit from imports and exports of the country.

Downfall of the Bretton Woods System

Post-World War situation, the supply of US Dollars suddenly increased in the world economy. As a result of it, many countries started questioning the quantum of gold reserves of the US Government with the supply of the US Dollar. By 1973, many countries started losing confidence in the US Dollar and started searching for some other reliable sources.

Current International Monetary System

After the downfall of the Bretton Woods System, there has not been any formal International Monetary System in place. The present-day International Financial Architecture is a managed float system. All the currencies of all the countries can freely float against one another in an open market under the managed float system. The government intervenes only when the currency needs to be stabilized. Managed Float System has been in place since 1976 with the Jamaica Agreement. Later in 1980, the International Financial Architecture was regulated by G-5 countries. This G-5 group has currently turned into G-20, with a group of 20 countries managing the exchange rate on managed float system.

Advantages of Current International Monetary System

Following are a few advantages of the International Monetary Market

- IMS enhances financial stability and maintains the price level on a global scale. It also boosts global growth.

- International Monetary System mobilizes money across countries and determines the exchange rate.

- This system encourages the governments of respective countries to manage their Balance of Payment by reducing the trade deficit.

- IMS is a well-regulated system that makes the whole process of international trading smooth.

- This system relocates the capital from one country to another by enhancing cross-border investments.

- International Financial Architecture provides liquidity to the countries of the world.

- This system tries and avoids any short or long-run disruptions in the world economy.

These advantages are non-exhaustive in nature.

Criticisms of Current International Monetary System

The biggest criticism of the present International Monetary System is that it is incompetent in avoiding global financial crises. There have been four serious financial crises over the past few years. Mexico, in the years 1994 and 1995, has suffered from a major economic and financial downfall. These crises came to an end in December 1996. Similarly, in the year 1997, Southeast Asia had suffered from a major economic breakdown. Russia and Brazil also had to go through serious financial crises in the year 1998 and 1999, respectively. In 2007-2009, the Global Economic Crisis questioned the current International Financial Architecture. There have been many such major financial breakdowns over the past few years, which the International Financial Architecture was unable to avoid.

The second criticism with respect to the current International Financial Architecture is that sometimes the exchange rate remains misaligned. Managed Float System sometimes gets misaligned due to either internal or external factors.

Conclusions

International Monetary System has evolved over the years and has adjusted according to the prevailing conditions. There have been many criticisms of the prevailing International Monetary System. Sometimes it becomes difficult to manage Exchange Rate Stability, Monetary Policy Independence, and Free Capital Mobility altogether. According to experts, these criticisms can be overcome by filling the gaps in the national monetary system of each country and the International Financial Architecture at large. Rather than completely replacing the current system, a little modification in the regulations would make the current International Financial Architecture foolproof.

RELATED POSTS

- International Monetary Market: Meaning, IMM Index, IMM Date, Criticisms and More

- Fixed Exchange Rate – Meaning, Pros, Cons Examples, and More

- Official Reserve Assets – Meaning, Types, Uses, and More

- International Financial Markets

- Bank for International Settlement BIS – All You Need To Know

- Monetary Policy: Meaning, Objectives, Types, Tools, and FAQs