A relevant range is a level of volume or activity within which a company is expected to operate. All the budgeting and costing exercises are conducted with the relevant range as the fundamental assumption. In other words, it is the underlying assumption when we comment on certain costs to be fixed or variable. Fixed costs may not be fixed, and per-unit variable costs may not be variable outside the relevant range of activity or volume.

A relevant range in managerial accounting and cost accounting discipline is crucial for managers. All the fundamentals of planning and control are based on a company’s relevant range of operating activities. Therefore, it is of utmost importance to estimate the relevant range as close to actual as possible so that the planning and actions of the management are proved fruitful.

Relevant Range and Budgeting

A relevant range is a very important concept from various angles. It is the foundation for any budgeting exercise. Without defining such a range, it is impossible to complete the budgeting process effectively. Let us see how, with the help of an example.

Relevant Steel Ltd, a steel ingot manufacturing company. Following is the activity level of the last 5 years of the company.

| Financial Year | Production in MT Tons |

| 2009 | 250 |

| 2010 | 312.5 |

| 2011 | 390.63 |

| 2012 | 488.28 |

| 2013 | 610.35 |

While making cost budgets for the year 2014, one would need to forecast the various cost elements such as material cost, labor cost, utility cost, factory cost, administration cost, finance cost, selling and distribution cost, etc. All these costs are directly or indirectly dependent upon the level of activity of the business. Therefore, the budgeting manager should know the expected activity level in the year 2014. Can that activity be 10000 MT? It looks illogical, right?

How to Calculate Relevant Range?

The growth rate of the company, i.e., roughly 25% year on year, can be taken as the base for defining the relevant range of activity in 2014. Other factors such as industry growth, competitor’s position, etc., would play a role in defining the relevant range.

Relevant Range and Behavior of Costs

Example of Fixed Cost

‘Fixed cost is fixed only in the relevant range.’ We normally understand a supervisor’s salary as a fixed cost because that does not vary with the production. Now, look at the example below:

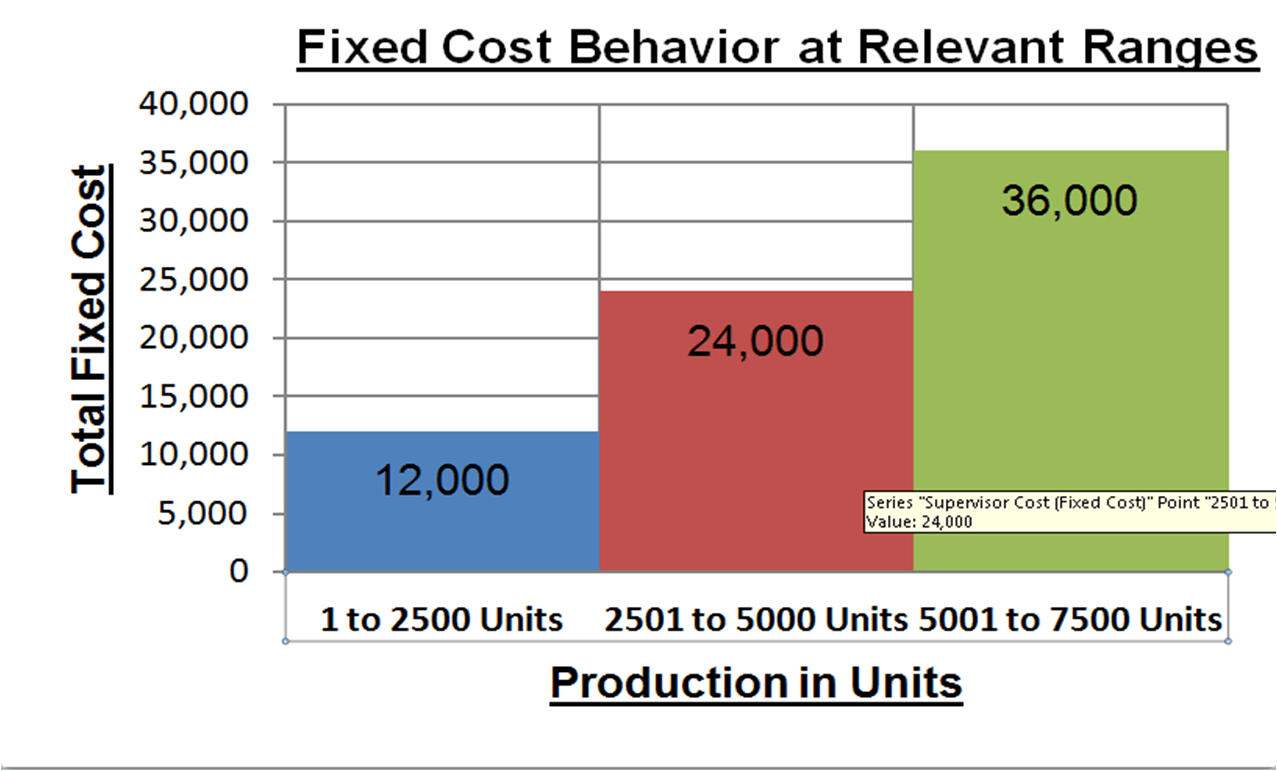

Suppose 2 machines are producing 500 units each per year and are supervised by one supervisor. He can supervise another 3 machines if installed nearby them. So, till the requirement of the company is 2500 (500*5) units per year, the same supervisor will handle it, and the cost of the supervisor will remain fixed to say $12,000. Over and above the production of 2500 units, the company will have to appoint another manager to supervise 6th machines onwards. In the example, it is clearly evident that the supervisor cost, which is a fixed cost, is only fixed till the production is 2500 units. Here, the relevant range and fixed cost relation are as follows:

| Fixed Cost Behavior at Relevant Ranges | |

| Production (In Units) | Supervisor Cost (Total Fixed Cost) |

| 1 to 2500 Units | $12,000 |

| 2501 to 5000 Units | $24,000 |

| 5001 to 7500 Units | $36,000 |

From the above table and graph, we can make out another exciting thing about the behavior of costs with respect to the relevant range. The fixed costs increase like stair steps.

Also Read: Production Budget

Example of Variable Cost

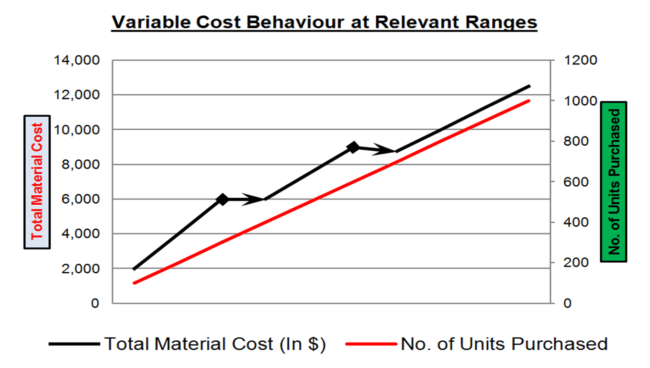

We have learned a phrase from our school days – ‘Variable costs change proportionately with the change in production.’ NO, the variable cost, such as material cost, does not change in the same proportion of the increase in production.

Undoubtedly, the variable cost will increase with production, but the rate of increase will slow down. The reasons could be price discounts due to bulk purchases etc.

We can understand the same from the following table and graph that the rate of increase of total variable cost is not throughout. After a range, it changes. After 300 units and 600 units, it changes in the following example.

| No. of Units Purchased | Total Material Cost (In $) | Rate |

| 100 | $2,000 | 20 |

| 200 | $4,000 | 20 |

| 300 | $6,000 | 20 |

| 400 | $6,000 | 15 |

| 500 | $7,500 | 15 |

| 600 | $9,000 | 15 |

| 700 | $8,750 | 12.5 |

| 800 | $10,000 | 12.5 |

| 900 | $11,250 | 12.5 |

| 1000 | $12,500 | 12.5 |

Read Costing Terms to learn about various other basic terms related to costing.

Good content which is worth reading it .Thanks