Diseconomies of Scale-Meaning

Diseconomies of scale happen when the size of the company or firm increases so large that the cost per unit increases. Once the production crosses a particular point in production, the process efficiency reduces. Because of this, the cost increases due to the inefficiency in production. In economics jargon, the diseconomies of scale happen when the average cost starts to increase. The average cost is the cost of production per unit of output. It is computed by dividing the total of fixed costs and variable costs by the number of total units (fixed cost + variable cost / total output).

How Economies of Scale Lead to Diseconomies

It is the objective of every company to achieve economies of scale in its operations. This is with a view to achieve the optimum capacity utilization where the average cost per unit remains the lowest. Therefore, every company tries to achieve it, and it remains a continuous process to reach the economies of scale. Few achieve it, and few remain in the fray to achieve it. It is because of proper estimation of their costs before embarking on growth plans, and they efficiently manage the execution and growth momentum. Proper and efficient management is the mantra for companies to grow without diseconomies of scale. All companies have to maintain proper balance in all areas of the business.

However, sometimes the same objective once crosses the optimum level, or the wrong projection leads to diseconomies of scale. The level of operating costs is the main trigger or indicator to determine whether there is a diseconomies of scale or not. Due to over-production or in order to cut down the production cycle time or due to crash costing, the operating cost for the production increases. And this leads to the breeding of cost and work inefficiency due to the diseconomies of scale. In this phase, the company loose track of operating costs along with other costs, which leads to a subtle hike in costs.

Costs that Create Diseconomies of Scale

In this extra or higher production situation, many of the semi-variable costs turn into fixed costs. Every additional resource can be arranged at a higher than the existing cost, or additional cost allocation per unit increases. All these conditions lead to increased operating costs for the production of additional units beyond the optimum production level. Operational cost consists of two main costs, fixed costs that can be reduced but can not be eliminated altogether. Similarly, variable and semi-variable cost also increases due to increased production cycle, extra shift working, increased costs of repairs and maintenance, quality testing costs, production setup costs, etc. All these puts together increase the average operating cost, which starts seeing an upward trend.

Also Read: Economies of Scale

Therefore, considering the impact of all these costs, it is clear how increased operational costs lead to diseconomy. On the one hand, fixed costs’ elimination is not possible, and on the other hand, variable cost increases with a rise in production. Hence, all associated and overall costs of the company increase.

Graphical Explanation of Diseconomies of Scale

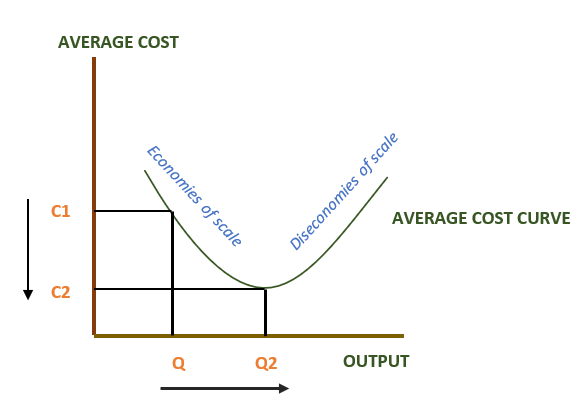

This chart shows the average cost on Y-axis and represents Quantity, Q on X-axis, and the long-run average cost curve. It is the average cost of per unit of output for a long period. The components of the curve are:

Economies of Scale

Here, the firm experiences the highest operational efficiency. The long-run average cost falls with an increase in production up to the optimum level. The left side of the curve shows economies of scale.

Constant Returns to Scale

No change in cost. Cost remains constant. In the graph, it happens at the point Q2. In this state, there is a stagnation of growth in costs, or this is the optimum level of production. At this level, the operating cost is the lowest.

Also Read: Cost Structure

Diseconomies of Scale

Here, the long-run average cost keeps increasing with an increase in production. In the graph, the long-run average cost rises after the point Q2 (where there is stagnation of cost). It shows diseconomies of scale.

Examples

- The growth and production are relative. So, the use of machines increases. It negatively impacts the life of machinery due to damages. So, the installation and procurement of new ones became a prerequisite. Consequently, increasing costs.

- Increased operation relatively increases production. As a result, it increases work. This leads to the employment of more workers to match increasing size requirements. Recruitment, selection, and training incur huge costs for the company.

- Due to higher usage of the equipment, the repairs and maintenance costs also increase disproportionately.

- Higher storage and carrying costs.

- Various costs increase from point to point or in a level framework like electricity consumption, workers welfare costs, etc. Therefore, such costs lead to a disproportionate increase in the cost per unit.

Reasons for Diseconomies of Scale

As we discussed above, diseconomies of scale are mostly company-specific internal reasons. It is the operational inefficiency, defective management planning, wrong estimation of the costs and production levels, etc., are the main reasons for such diseconomies of scale.

The external factors are very, very limited ones.

Those can be when similar kinds of units at the same place start operating. Thus the demand for workers, support services, rental and land costs, warehousing and transportation costs, etc., see a sudden hike due to increased demand and supply shortage. Moreover, due to environmental issues, all such polluting industries are put in a specific zone so that the distant location may increase the infrastructural costs beyond a point.

In simple terms, the growing operational inefficiency of the company leads to diseconomies of scale. It comes after the economies of scale are experienced.

Now, let us look into deep, internal, and external diseconomies.

Internal Diseconomies of Scale

Technical

Diseconomies due to stress on the production process asking for increased production by cutting cycle down average cycle time. It happens due to the quick growth of the company, adaptation of which has not been planned well. Therefore, it results in more cost to produce additional goods or services.

Organizational

When the workforce becomes larger and more difficult to manage, organizational diseconomies occur. A higher or additional workforce may be needing a proper place, training, and various welfare activities, their proper time scheduling. In a short time, all this is very difficult to arrange, leading to lower output per worker or per hour. These are inefficiencies that arise due to a poorly managed increased workforce.

Purchasing

In order to avoid production disruption or loss of any business opportunity, it is essential for the company to keep inventory at a sufficient level. For increased production, the demand for such inventory items increases, and to maintain a smooth availability, at times, the company needs to pay the higher cost for those items or that may be arranged from a different and distant location. It all leads to increased effective cost of purchasing. Moreover, this fluctuating availability also increases the carrying costs.

Financial

With the increase in the size of the firm, the need for a financial resources also rises. And such short-term or beyond a reasonable level of funds arrangement increases the cost of funds in terms of higher interest charges leading to increased production costs for the company.

Marketing

Marketing diseconomies are also rises. Because the company is growing, they have to spend huge sums on marketing activities. Planning of marketing activities, hiring of new marketing staff, increase in marketing campaigns, entering into new territory are the reasons for the increasing cost.

External Diseconomies of Scale

Limited Natural Resources

As the company grows large, the need for resources also rises. They require natural resources, labor, land, physical resources, etc. In turn, the availability of the resources reduces, and the firm has to incur higher costs for procuring the same resources. Skilled labor becomes short in supply. As a result, a high salary is offered to attract skilled labor. This induces additional costs.

Infrastructure Diseconomies

Sometimes local infrastructure has to bear the brunt of a growing company. As the company grows, it attracts more suppliers, employees, customers, and other stakeholders. The place converts into an industrial center. It puts a lot of pressure on the transportation facilities, roads, and other public infrastructures and services—for example, congested roads, traffic, overcrowding, and delayed supply of raw materials, etc.

Diseconomies of Pollution

Moreover, due to environmental issues, all such polluting industries are put in a specific zone so that the distant location may increase the infrastructural costs beyond a point. Consequently, it increases water pollution, noise pollution, and soil pollution.

Solutions for Diseconomies of Scale

Yes, diseconomies of scale are an integral part of growing industrial production. To address such an issue following are a few ways that the Management may consider to reduce its impact:

- Relocation of operations means to change the location of operations to reduce cost and increase operational efficiency.

- Sub-Contracting or job-contracting a part of the job.

- Cut down and outsource part of the production process that is possible at a lesser cost outside as compared to the cost when it is done in-house. Sometimes, it reduces pressure on the man and machines and also has several secondary benefits.

- Revamping the existing Organization structure. This is to address the increased and decentralized requirements as the overall size of the operation has increased.

- The introduction of new and improved technology to improve the production process.

- Outsourcing of some of the support services so that the firm can concentrate on its core operations.