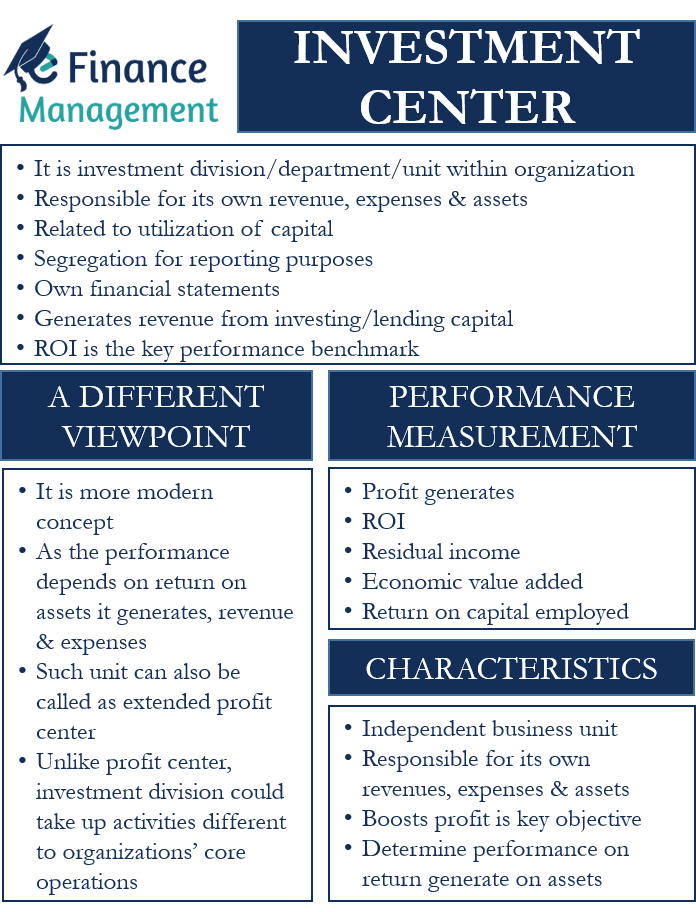

An investment center is an investment division or department or unit, or responsibility center within an organization. Instead of classifying this one as a cost or profit center, the organization classifies this unit as an investment center. And this unit/center remains responsible for its own revenue, expenses, and assets. The activities of such units may be totally different from the organizations’ core operations and mostly relates to the utilization of capital. Hence, usually, it is called an investment division.

All three factors (revenue, expenses, and assets) determine the performance of such a business unit. However, in this case, the key differentiator is that this center’s performance is judged by its use of capital and the return on assets it generates, rather than judging the performance based on its costs and profits like any other cost or profit center.

We can also say that an investment center is any business unit that the management can segregate for reporting purposes. Or a unit that can work as a separate operating entity or a subsidiary. These centers usually prepare their own financial statements. Along with generating income from the core business activities, these units can generate revenue from investing or lending capital.

ROI – Key Performance Benchmark

As we discussed above, return on assets or ROI (return on investment) remains the core yardstick or the core concept of the investment division or center. Because this indicator helps management to judge/evaluate/compare the performance of this division. Such a concept usually suits the organizations with a massive fixed-asset investment. The finance departments of the department store are a good example of investment centers.

For the purpose of accounting, we need to treat these units as separate entity that has their own financial statements. For external reporting, the financial statements of these centers are merged into the organizations’ report cards.

Characteristics

There are three main characteristics of an investment center, and these are:

- Like any other profit center, this division also remains and is treated as an independent business unit. And this division remains responsible for its own revenues, expenses, and assets.

- The core idea or objective of creating such a division is to boost the profit of the organization by using the investments/fixed assets and capital. In other words, maximizing of return on the assets/investments/capital is the key objective.

- Management determines their performance on the basis of the return they generate on their assets.

Measuring Performance of Investment Center

The performance of a profit center depends on the profit it generates. And the performance of a cost center depends on the variation between a department’s actual and budgeted costs.

In the case of an investment center, the performance evaluation considers the assets and resources that the department gets and how well that unit is using those resources and assets to generate revenues in comparison to their total expenses. Such a unit is free to use capital and other funds to buy more assets to boost its revenues.

Looking at the ROI of a department is very helpful in business scaling. So, on the basis of ROI, if a department is not performing well, then the management can either close it or reduce their capital allocation or further allocation. Managers, however, can manipulate ROI to ensure their performance is always above par.

Also Read: Profit Center vs Cost Center

Along with ROI, there are a few more metrics that can help in measuring the performance of these units. These metrics are:

- Residual Income (Earnings less Expected or Target Return)

- EVA or Economic Value Added (Earnings after tax less Cost of Capital)

- ROCE or Return on Capital Employed (Earnings divided by Capital Employed)

Investment Center – A Different Viewpoint?

If you are not already aware, there are primarily two ways in which an organization can categorize its departments. These are profit centers and cost centers. As is evident, the performance of profit centers (manufacturing and sales department) depends on the profits they generate, and the performance of cost centers (human resource or marketing departments) depends upon the cost (versus estimates).

In contrast, an investment center’s performance depends on the return on the assets it generates and its revenue and expenses. It will not be wrong to call such a unit or department an extended profit center.

We can say that an investment center is a more modern concept. Rather than identifying divisions as profit or cost centers, management views those departments as investment centers. So, in a way, it is basically a different way of looking at departments that may also be a profit or cost center.

However, unlike a profit center, an investment division could take up activities that are different from the organization’s core operations. For instance, such a unit could take up investments or acquisitions. Lately, we have seen big companies establishing a venture arm within an organization. Such a unit primarily invests in start-ups. The whole idea is to generate and maximize profits with the available resources.

Final Words

With a focus on the return on capital, the concept of an investment center paints a more accurate image of how a unit is contributing to the overall success of the organization. This assists management in deciding whether to extend or curtail the resources of such units or to close down such units completely. Creating such units or capacities within the organization helps it optimize resource utilization; there remains no idle capital, or there remain no loss-making investments on a continual basis. These activities effectively improve the performance of the business.