Return on Capital Employed

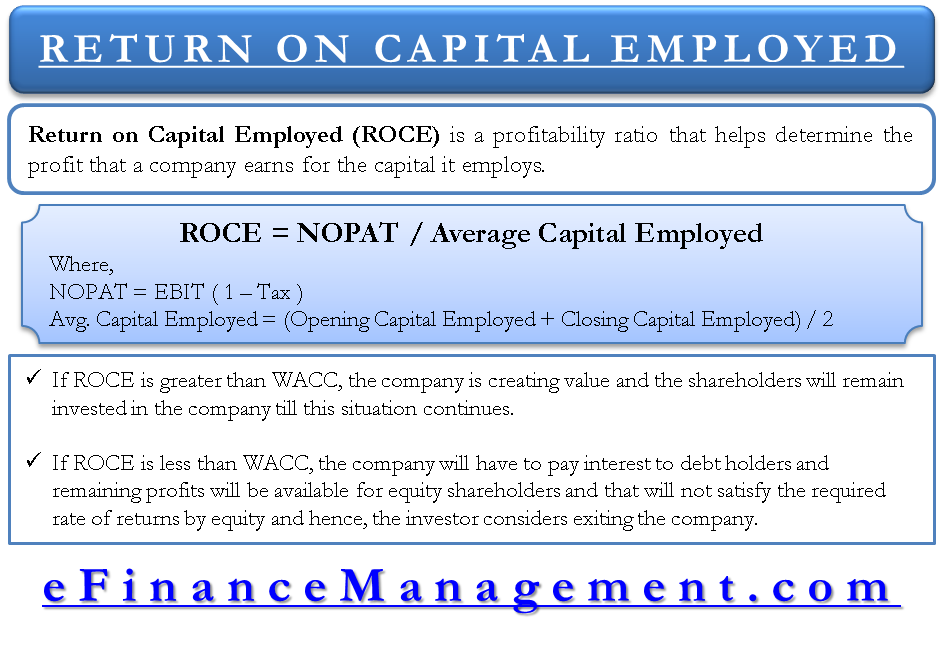

Return on Capital Employed (ROCE) is a profitability ratio that helps determine the profit that a company earns for the capital it employs. ROCE is measured by expressing net operating profit after taxes (NOPAT) as a percentage of the total long-term capital employed. In other words, ROCE can be defined as a rate of return earned by the business as a whole. Like ROE (equity), which calculates the % return of equity shareholders, ROCE calculates the % return of all the capital providers together. If a company has no debt, its ROE and ROCE will be the same.

Return on Capital Employed (ROCE) Formula & Calculation

The calculation of ROCE is simple and can be easily calculated using the company’s financial statements, i.e., profit and loss account and balance sheet. The NOPAT can be worked out from P/L a/c and the average capital employed from the balance sheet.

| Return on Capital Employed = NOPAT / Average Capital Employed |

Average Capital Employed

Return on capital employed takes into consideration only the long-term borrowed funds. Thus, we do not consider current liabilities while calculating capital employed. Capital employed is calculated as follows.

Capital Employed = Share Capital + Reserves and Surplus + Long Term Loans (Secured + Unsecured) – Capital Work in Progress – Investment Outside Business – Preliminary Expenses – Debit Balance of Profit and Loss A/c.

Also Read: Return on Capital Employed Calculator

Average Capital Employed = (Opening Capital Employed + Closing Capital Employed) /2

Refer to Capital Employed for a more detailed understanding.

A company raises capital for investing it in its assets, eventually generating revenues. But this does not mean that capital employed is equal to assets (net assets).

Refer to Net Assets vs. Capital Employed to learn about the differences.

Net Operating Profit After Taxes (NOPAT)

The operating profit of the business activities is financed by the capital employed as calculated above. Since we have deducted ‘Investment outside Business’ from the capital employed, we should deduct the profits or returns received due to those investments if included in the profits. In essence, the numerator and denominator should be comparable and consistent with each other.

NOPAT = PAT + Interest – Tax Shield

Or

NOPAT = EBIT (1-Tax)

ROCE Calculation Using Example

XYZ Co. All figures in USD.

| Share Capital | 60,000 | EBIT | 50,000 |

| Reserves and Surplus | 1,00,000 | Interest | 10,000 |

| Long Term Loans | 40,000 | EBT | 40,000 |

| Current Liabilities | 10,000 | Tax (40%) | 16,000 |

| Total Liabilities | 2,10,000 | EAT | 24,000 |

| Total Assets | 2,10,000 |

NOPAT = EAT + Interest – Tax Shield

= 24,000 + 10000 – 10,000 (40%)

= 34,000 – 4000

NOPAT = 30,000

Capital Employed = Share Capital + Reserves & Surplus + Long Term Loans

Capital Employed = 60,000+100,000+40,000 = 200,000

Therefore, Return on Capital Employed (ROCE) = NOPAT / Capital Employed

ROCE = 30,000 / 200,000

ROCE = 0.15 = 15%

Thus, from the above illustration, we can conclude that for every dollar of the capital company employs, 15% of it is from operating profits. To put it in other words, to earn every dollar, the company needs to employ 6.67 (100/15) dollars worth of capital.

You can also use our calculator for a quick calculation – Return on Capital Employed Calculator.

Interpretation of ROCE

In our example, we have a ROCE of 15%. Is it good or bad? To answer this question, we have to compare this 15% with the company’s Post Tax Weighted Average Cost of Capital (WACC). Why and how these two metrics are comparable? On the one hand, the ROCE works out a return earned by the company’s total capital employed, which includes both equity shareholder funds and long-term debt. On the other hand, WACC talks about the company’s combined required rate of return, i.e., both the required rate of returns by equity holders and the interest rate expected by debt holders are considered. Thus, ROCE is the return that the company earns, and WACC is the return that stockholders expect.

Also Read: Return on Equity (ROE)

If ROCE is greater than WACC, the company is creating value, and the shareholders will remain invested in the company until this situation continues. If ROCE is less than WACC, it is destroying shareholders’ value. The company will have to pay interest to the debt holders as they have first right on profits. The remaining profits will be available for equity shareholders, which will not satisfy the required rate of returns by equity. Hence, the investor considers exiting the company.

Investors can also use the ROCE figure to analyze a company’s performance or compare the performances of different companies within the same sector. If 2 companies in the same sectors have more or less the same amount of capital employed, the company with better ROCE would, without a doubt, have made better use of the employed funds. We can safely assume that such a company would have made better use of its resources.

Refer to Profitability Ratios for other types.

please am stuck with this question and i need help on the solution

Suppose a company wishes to increase their return of capital employed (ROCE) to 15%. Currently, their ROCE is 10% and their working capital turnover rate is 1,5. However, they believe it would be difficult do much about their yearly turnover and average-tied up capital (assets).

1)What is the company’s current profit margin?

Enter the figure here, with two correct decimals:

2) what profit margin is the company aiming for?

Enter the figure here, with two correct decimals:

1. 0.07

2. 0.10

I like these financial management topics.