What is a Performance Budget?

Performance budget, also referred to as performance-based budgeting, is a practice of preparing the budget based on the evaluation of the productivity of the different operations in an organization. In operations that contribute the most to the profitability, the larger share of the budget is allocated to that division. It leads to optimum utilization of resources such as finance, skills of the staff, use of productive time, etc.

A performance budget requires an evaluation of the performance and productivity from one budget period to another budget period. Hence, it is the process of identifying the results achieved by each division of the organization.

Furthermore, this budget does not focus on the individual activities necessary for developing strategies. Instead, the core focus is the achievement of the overall goal of the division. This helps the managers to frame the strategy of the division. Hence, this budgeting is based on the concept of zero-based budgeting.

Generally, not-for-profit organizations and government departments use performance budgets. It is used to justify the application of money. Not for profit and government earns through taxes levied on the citizens, and lack of correct information may result in an ineffective performance budget which affects the entire project.

Also Read: Why is Budgeting Important?

Approach

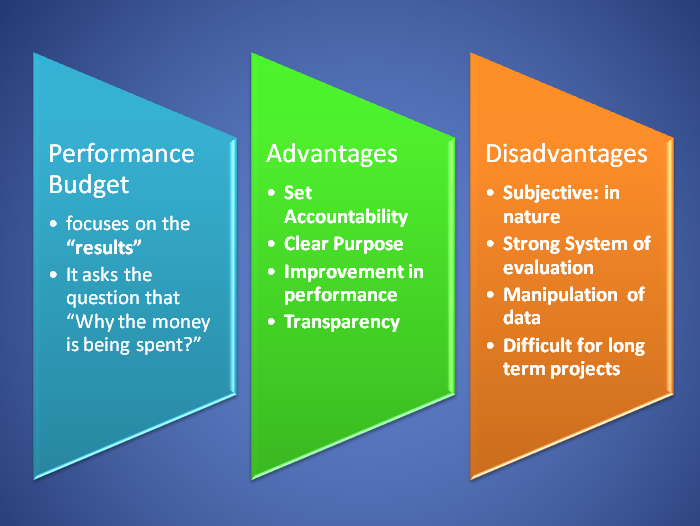

The performance Budget focuses on the “results.” The final outcome is analyzed. It is a motivating tool for the staff.

It asks the question that “Why the money is being spent?”

Process of Performance-based Budgeting

Set Goals

The organization shall make a list of the goals. The goal here indicates the end result. The goals should be clear to each employee of the organization—clear goals and communication of the same results in the successful implementation of performance-based budgeting.

Thus, this step is planning and budgeting.

Periodic Evaluations

The next step is the periodic evaluation of the performance to achieve the desired goals of the organization. The organization shall develop a systematic step by step approach for evaluation. Performance measurement is subjective which differs from person to person. Hence, the organization shall try to quantify the result based on the outcomes.

Thus, this step is a measurement of results.

Performance Indicators

Performance indicators help in evaluating the effectiveness and efficiency of the program. A performance indicator is a standard for measurement. The selection is based on the extent of the following:

- It’s relevance

- Cost-effectiveness

- Comparability

- Representative

Accountability

The organization is going to be accountable for the result or outcomes. The primary focus of the performance budget is the outcome and not the inputs. Likewise, the staff is accountable for organizational goals. Besides, performance-based budgeting expects to achieve a level of results based on the given level of resources.

Also Read: Budget Models

Thus, this step is called evaluation and communication of results.

Performance-based Vs. Traditional Budget

The amount of money to be spent for a particular purpose for example on staff salary, office supplies, equipment, etc. is included in the traditional budget. However, what is to be accomplished by each dollar spent is indicated by the performance budget. Previously, the organizations were not following the performance-based approach. However, currently, organizations follow the performance-based approach.

Example of Performance Budgeting

- 30% reduction in death ratio of HIV-Positive patients by the end of 2020.

- 20% increase in production in 2018 by staff training on a monthly basis.

- 50% reduction in infant mortality rate by implementing robust vaccination centers in all different parts of the country by 2022.

Advantages of Performance Budget

In the advanced world, the management of money becomes one of the important factors for any organization. This budget plays an important role to achieve efficiency.

Set Accountability

In the public sector organization and not-for-profit organization, a performance budget helps to increase accountability. The employees have to quantify a particular goal based on the priority and the taxpayer’s money. Unquestionably, taxpayers and donors have an interest in knowing where the money is spent. It evaluates the benefit accruing to the citizens and society.

Clear Purpose

Performance budgeting clearly indicates the objective on which the money will be spent. Making the purpose clear makes it easier to assess the performance and correct the deviations.

Improvement in Performance

The performance budget improves the performance of the programs on a continuous basis. In addition, it leads to the overall operational efficiency of the organization. Also, it overcomes the limitations of traditional budgeting.

Transparency

Performance-based budgeting helps in bringing transparency in budget preparation. It also helps in making better financial decisions for the allocation of resources. It reviews the operational efficiency of the projects. Hence, one can say, it links the entire process of planning, implanting and evaluating the results.

Disadvantages of Performance Budget

Subjective

Since the performance budget is subjective in nature, it creates disagreement amongst the management. Also, social projects are with a long-term vision. It isn’t easy to quantify in money terms. The costs may differ from one government body to another government body.

Therefore, The more use of result-based approach helps in the improvement of the budgetary process, accountability, and administration of the organization.

Strong System of Evaluation

The performance budget requires a strong system of accounting. Therefore, the reporting system has to be strong for its successful implementation.

Manipulation of Data

Staff may manipulate the data. Further, the calculation of the financial information is not reliable because of the errors in preparation.

Therefore, a proper internal control system helps in maintaining the accuracy of the data.

Difficult for Long-term

The time period between the allocation of resources in the project and the achievement of the result might be more than a year. Undoubtedly, it makes it difficult to measure the results of the projects in long term.

Therefore, Dividing the project into small parts may help in simplifying the evaluation process.

Without a doubt, over a period of time Performance Budget became popular overall in the industry.

Read more about other Types of Budgets.

Quiz on Performance Budget

This quiz will help you to take a quick test of what you have read here.

Thank you, Sanjay. This was really helpful.

I am from Africa

Informative…..?

Excellent article. Especially the relationship with zero budgeting.