Activity-Based Management or ABM helps a business to analyze or evaluate the cost of business activity (or activities) based on the value addition that the activity brings. In simple words, ABM helps a company to know its strengths and weaknesses, including the activities where the company is wasting time, money, and effort.

ABM takes into account every cost, including costs of the equipment, overhead costs, costs of employees, facilities, and distribution costs. Such an evaluation helps a business to decide whether to upgrade the activity or eliminate it. The main objective of using AMB is to improve the overall profitability and efficiency of the company.

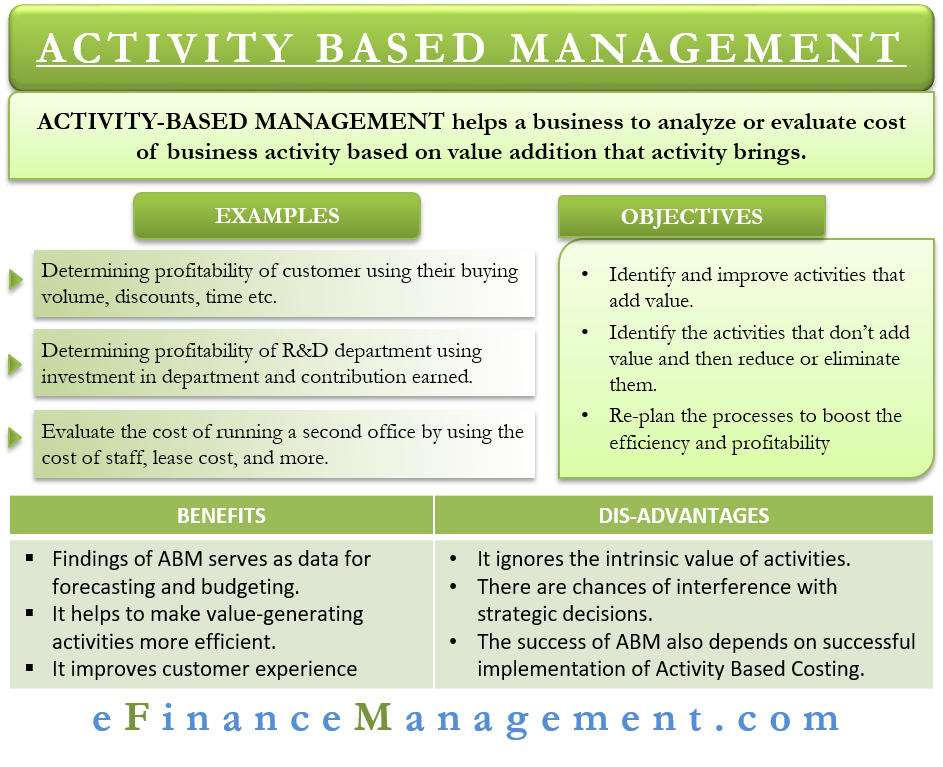

Activity-Based Management – Examples

- An example of AMB can be determining the profitability of a customer using their buying volume, returns (if any), discounts, and time that the customer service department spent.

- Another example is determining the profitability of the R&D department using investment in the department and their contribution to developing new and improving existing products.

- One can also use ABM to determine the profitability of a new product. For this, it would use costs of warranty claims, sales, production costs, marketing costs, cost of the return, and more.

- ABM can also help a company evaluate the cost of running a second office by using the cost of staff, lease cost, and more.

Objective

Activity-based management primarily tries to address the three objectives. These are:

- Identify and improve the activities that add value.

- Identify the activities that don’t add value and then reduce or eliminate them.

- Replan the processes to boost the efficiency and profitability by maximizing value-added activities and cutting costs on non-value activities

Process and Implementation

ABM is a method of internal analysis that looks at crucial business activities. Then, it evaluates those activities based on their cost to the company and the amount of value addition they do. ABM analysis uses cost information from activity-based costing (ABC). Under ABC, an accountant assigns general overhead costs to the cost objects based on the activity drivers.

ABM analysis helps a precise segmentation of business activities into two primary categories. First, activities that add value, and secondly, activities that don’t add any value. Actions adding value also improve the value of the company or the product in the eyes of the customer. On the other hand, non-value-added activities don’t raise the value but rather incur costs.

After a business identifies the activities that add value and those that don’t, the company then focuses on making activities that add value more efficiently. The management may reduce or eliminate the activities that don’t add any value. A company may also use ABM analysis to rank the value-added activities by the level of contribution they make.

ABM and ABC

Many data and information that ABM uses is the output of activity-based costing (ABC). While ABM focuses on business processes and managerial activities, ABC helps to optimize the resources by identifying and reducing cost drivers.

It won’t be wrong to say that activity-based costing is part of the ABM. ABC helps map the different costs to different business processes, which, in turn, serves as a crucial input for ABM analysis.

Activity-Based Management – Benefits

The following points reflect the importance of the ABM:

- The findings of the ABM analysis can serve as the data for forecasting models and budgets. Thus, we can say that ABM can assist the management in getting a better idea of future business prospects.

- Since ABM helps to make value-generating activities more efficient, this, in turn, improves the customer experience.

Drawbacks

Following are the drawbacks of ABM:

- ABM assumes that all the benefits and costs of conversion to monetary units are possible. Or, we can say, it ignores the intrinsic value of the activities. For example, an ABM analysis may recommend renting a less fancy office to save costs. However, a company needs a modern workplace to attract new talent.

- ABM can also interfere with strategic decisions if such decisions are expected to prove costly in the near term but offer a long-term payoff.

- The success of ABM also depends on the successful implementation of the ABC (activity-based costing). It means that if a company fails to implement ABC properly, then it may fail to reap the benefits of ABM.

Final Words

We can apply ABM to almost any type of organization, including non-profits, government departments, manufacturers, schools, and service companies. Moreover, it can give cost information on any business activity.

Also Read: Activity Based Budgeting

However, implementing both ABC and ABM could prove very costly both in terms of time and resources. Thus, many recommend using activity-based management if a company faces intense price competition. Also, it is more suitable for a company with several complex products and processes.