What is an Overdraft Interest?

Overdraft interest is the interest a bank charges on an overdraft facility. An overdraft is a facility of extended credit from a bank. This facility allows the current account holder to withdraw money even when the account balance reaches zero. In other words, this facility allows the account holder to use more funds than what is effectively available in their current account with the bank.

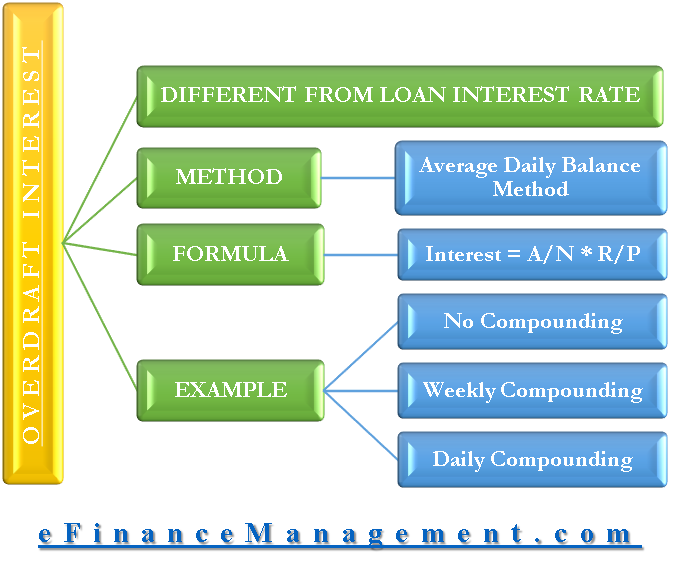

How is the Overdraft Interest Rate Different?

Overdraft interest rate is very different from the interest rate of regular loans in the following way:

- Number of days under consideration: In an overdraft facility, the interest rate is charged only for the number of days for which the current account is overdrawn, whereas in a loan, the interest rate is charged for the entire duration of the

- The amount under consideration: In an overdraft facility, the interest rate is charged only on the amount of cash overdrawn, as opposed to a loan where the interest is calculated on the sanctioned amount regardless of usage.

Read Overdraft Vs. Loan for more details.

How to Calculate Overdraft Interest?

The overdraft interest rate is calculated using the average daily balance method. In the average daily balance method, the interest is calculated by considering the balance of a current account at the end of each day. The interest rate is applied to the balance of the overdraft, and the total interest charged is added to your account at the end of each billing cycle (for example, a month).

Average Daily Balance Method

The formula for overdraft interest rate by average daily balance method is as follows –

| Overdraft Interest = (A*R*N)/365 |

Where –

- A = Amount overdrawn at the end of the day

- R = Annual interest rate

- N = Number of days (for which amount is overdrawn)

Overdraft Interest & Compounding

The interest on an overdraft is calculated on a daily basis and added to the balance of the overdraft at the end of each billing cycle. This billing cycle could be fortnightly, monthly, quarterly, etc. If the interest is not paid in full at the end of the billing cycle, it can be added to the balance of the overdraft, resulting in a higher total balance and higher interest charges in the following billing cycle.

Let us take a detailed example to understand this.

Example of Overdraft Interest Calculation

Suppose XYZ Ltd. holds a current account with Bank of America. It has a current account balance of USD 5000.00 and an overdraft limit of USD 2000.00 at an interest rate of 18% per annum (daily interest rate = 18%/365 = 0.0493%).

Also Read: How does an Overdraft Facility Work?

Following is XYZ Ltd.’s current account activity for 15 days from 1st Jan to 15th Jan-

| Date | Beginning Balance | Withdrawal | Deposit | Ending Balance |

|---|---|---|---|---|

| 1st Jan | 5,000.00 | 5,000.00 | ||

| 2nd Jan | 5,000.00 | 2,000.00 | 3,000.00 | |

| 3rd Jan | 3,000.00 | 3,200.00 | -200.00 | |

| 4th Jan | -200.00 | -200.00 | ||

| 5th Jan | -200.00 | 350.00 | -550.00 | |

| 6th Jan | -550.00 | -550.00 | ||

| 7th Jan | -550.00 | 100.00 | -650.00 | |

| 8th Jan | -650.00 | 50.00 | -600.00 | |

| 9th Jan | -600.00 | 400.00 | -1,000.00 | |

| 10th Jan | -1000.00 | 500.00 | -500.00 | |

| 11th Jan | -500.00 | 100.00 | 50.00 | -550.00 |

| 12th Jan | -550.00 | 1,000.00 | 450.00 | |

| 13th Jan | 450.00 | 450.00 | ||

| 14th Jan | 450.00 | 550.00 | -100.00 | |

| 15th Jan | -100.00 | 300.00 | 200.00 |

We will calculate the interest rate when there is:

- No compounding,

- Weekly compounding

No Compounding

Let us calculate the total interest amount when there is no compounding. We must note that interest will be calculated only on the ending balances for days when the current account is overdrawn. This can be done in the following manner –

| Date | Overdrawn Ending Balances | Interest Amount @ 0.049% (Daily) |

|---|---|---|

| 3rd Jan | -200.00 | 0.0986 |

| 4th Jan | -200.00 | 0.0986 |

| 5th Jan | -550.00 | 0.2712 |

| 6th Jan | -550.00 | 0.2712 |

| 7th Jan | -650.00 | 0.3205 |

| 8th Jan | -600.00 | 0.2959 |

| 9th Jan | -1,000.00 | 0.4932 |

| 10th Jan | -500.00 | 0.2466 |

| 11th Jan | -550.00 | 0.2712 |

| 14th Jan | -100.00 | 0.0493 |

| Total | -4,900.00 | 2.4163 |

Therefore, the total interest amount at the end of 15 days (when there is no compounding) is $2.42. And, the total balance at the end of 15 days is $197.58 (i.e., 200-2.42).

Weekly Compounding

Following is the table in which the overdraft interest rate is compounded weekly. As per the previous calculation, when finding the sum of balances, interest will be calculated only on ending balances of the days on which the current account is overdrawn –

| Date | Beginning Balance | Withdrawal | Deposit | Ending Balance | Interest |

|---|---|---|---|---|---|

| 1st Jan | 5,000.00 | 5,000.00 | – | ||

| 2nd Jan | 5,000.00 | 2,000.00 | 3,000.00 | – | |

| 3rd Jan | 3,000.00 | 3,200.00 | -200.00 | 0.0986 | |

| 4th Jan | -200.00 | -200.00 | 0.0986 | ||

| 5th Jan | -200.00 | 350.00 | -550.00 | 0.2712 | |

| 6th Jan | -550.00 | -550.00 | 0.2712 | ||

| 7th Jan | -550.00 | 100.00 | -650.00 | 0.3205 | |

| Total | -650.00 | 1.0601 | |||

| 8th Jan | -651.06 | 50.00 | -601.06 | 0.2964 | |

| 9th Jan | -601.06 | 400.00 | -1,001.06 | 0.4937 | |

| 10th Jan | -1,001.06 | 500.00 | -501.06 | 0.2471 | |

| 11th Jan | -501.06 | 100.00 | 50.00 | -551.06 | 0.2718 |

| 12th Jan | -551.06 | 1,000.00 | 448.94 | – | |

| 13th Jan | 448.94 | 448.94 | – | ||

| 14th Jan | 448.94 | 550.00 | -101.06 | 0.0498 | |

| Total | -101.06 | 1.3588 | |||

| 15th Jan | -102.42 | 300.00 | 197.58 | – |

In the above case, the interest is calculated daily but it is charged to the balance weekly. Therefore, the total interest amount at the end of 15 days (when interest is weekly compounded) is $2.42. And, the total balance at the end of 15 days is $197.58.

Also Read: Bank Overdraft Facility

Thus, we can easily see the difference between weekly compounding interest rates against no compounding interest rates. The difference in interest amount may not be visible given the small value, but the difference will be huge for bigger firms where transactions may be in hundreds or thousands of dollars. The farther the compounding cycle, the cheaper it is for the borrower. In other words, weekly compounding is better than daily compounding, and monthly compounding is better than weekly compounding.

Quiz on Overdraft Interest

Let’s take a quick test on the topic you have read here.

if i had the option of an auto loan at 8.90% for 5 years for an amount of 10 lakhs vs an FD at current rate of interest 6.7% for 12 months( or even for 5 years) – will going in for an OD on FD be better?

Great ideas