Contribution Margin Income Statement

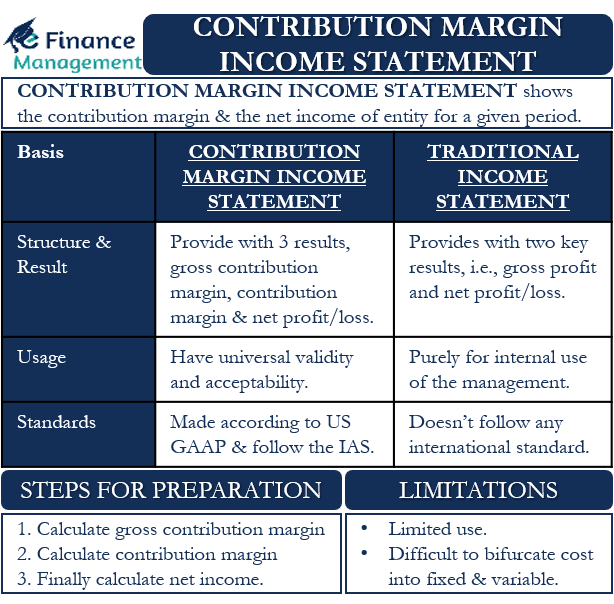

A contribution margin income statement is an income statement that shows the contribution margin as well as the net income of the entity for a given period. As the contribution concept calls for a split of all variable and fixed costs, this statement also shows both these costs separately. It then subtracts variable costs from net sales to calculate the contribution amount. In addition, we subtract fixed costs from that amount to arrive at the net profit/loss figure. And the format of this statement is different from the income and expenditure statement, but the end result and objective are the same to arrive at the net income.

The contribution margin income statement simplifies the cost structure by dividing it into fixed and variable. It helps us understand how much contribution margin any organization has to meet its fixed costs and what is left over as a profit share. Further, this statement also helps management analyze how the variable costs change as production volumes change. Moreover, since the fixed costs do not change with an increase in production levels, only a portion of the additional revenue that the company generates by selling extra will go towards covering its variable costs. The balance portion of the additional revenue will thus result in an increase in profits once the fixed costs are fully covered.

How do we make the Contribution Margin Income Statement?

An income and expenditure statement first gives us the gross profit figure by deducting the cost of goods sold from the net revenue. The cost of goods sold comprises the direct costs of manufacturing a product or rendering a service and includes both fixed and variable costs. And the cost of goods sold may include the cost of direct labor, material, etc., and some direct fixed costs like salaries of personnel involved in the production facility. Further, we deduct the selling, general, and administrative expenses from the gross profit, so we arrived at the pre-tax income. After that, subtracting income tax from this amount gives us the net income. However, this figure can be negative, also, i.e.net loss, if the total expenditure exceeds the net revenue figure.

Steps to Prepare the Contribution Margin Income Statement

First Step – Gross Contribution Margin

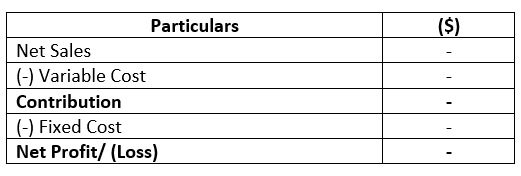

However, a contribution margin income statement format and process are slightly different than the usual Income Statement. which has a different format. Instead of calculating the gross profit here, we attempt to derive the gross contribution margin, and for that, we need to first subtract the variable portion of the cost of goods sold from the net revenue. Further, the Net revenue or sales figure is the final sales figure after all the sales returns, discounts, etc., have been deducted from this amount. And thus, this first step gives us the gross contribution margin.

Also Read: How to Calculate Contribution Margin?

Second Step – Contribution Margin

As we know, the contribution margin is the figure after the deduction of all the variable costs. Therefore, now we need to deduct all the variable selling, general, and administrative expenses. This deduction will happen from the gross contribution margin calculated under the first step. We will thus get the final contribution margin as the answer.

Final Step – Net Income

In the final and third steps, we need to deduct all the fixed costs by clubbing them together or showing them separate head-wise from the net contribution margin derived from the second step. And the final amount so arrived is our Net Income or Net Loss, as the case may be.

Difference between Traditional vs. Contribution Margin Income Statement

Structure and Results

A traditional income and expense statement provides us with two key results, i.e., gross profit and net profit. Moreover, it divides the costs as per the functions in an organization into manufacturing and non-manufacturing or operating expenses. The gross profit is an assurance that the non-manufacturing expenses will be taken care of and something is still available for meeting the operating expenses, other fixed costs, etc.

On the other hand, a contribution margin income statement provides us with three key results, i.e., the gross contribution margin, the contribution margin, and finally, the net profit/loss. It divides the total costs according to their type into fixed costs and variable costs. The contribution margin availability, like gross profit, assures that adequate cover for the fixed costs of the organization may be available.

Also Read: Contribution Margin vs Gross Margin

Usage

Traditional income and expenditure statement is made according to the U.S.GAAP. They also follow the International Accounting Standards (IAS). Therefore, they have universal validity and acceptability. These statements are of use both for the internal management and the external third parties, and other stakeholders.

A contribution margin account statement does not follow any of the international standards and techniques of accounting. It is purely for the management’s internal use for effective planning, decision-making, and performing the control functions. It simplifies the division of total costs into fixed and variable costs. Thus, the management gets to know where the company stands financially. After meeting the variable costs, the cost break-up tells what is leftover from net revenue. Hence, it can decide which costs need to be trimmed or controlled. Also, it gives a basis for doing the break-even analysis, which can help decide how much to produce. However, there is no such standard or mandatory format for such a statement. Hence, as per the need of the management, they can tweak the format of the contribution margin statement.

Example

Let us discuss the concept through an example. XY company generates sales revenue of US $ 10000 in the financial year ending December 2020. It had a sales return of US $500. The variable cost of goods sold amounts to US$ 2000 for the period. The variable selling, general, and administrative costs for the same period amount to US$ 500. The fixed manufacturing costs are US$ 3500, and fixed administrative, and other expenses amount to US$ 1500 for the period. Let us prepare the contribution margin account statement for XY Pvt. Ltd for the year ending December 2020.

| Particulars | ($) |

| Sales Revenue | 10000 |

| Less: Sales return | 500 |

| Net Revenue | 9500 |

| Less: Variable cost of goods sold | 2000 |

| Gross Contribution margin | 7500 |

| Less: Variable Selling, general and administrative costs | 500 |

| Contribution margin | 7000 |

| Less: Fixed manufacturing costs | 3500 |

| Less: Fixed administrative and other expenses | 1500 |

| Net Profit | 2000 |

Limitations of the Contribution Margin Income Statement

The following are some of the limitations of the contribution margin income statement:

Limited use

The contribution margin income statement has a very limited scope and usage. It is restricted to internal use within the organization because U.S.GAAP neither recognizes it nor follows international accounting standards.

Moreover, it is tailor-made according to the needs of any organization and is not universally accepted. Due to these reasons, it might be inappropriate to use it to match and compare different companies and industries.

Difference between Fixed and Variable Costs

There are many costs that are difficult to bifurcate into fixed and variable, and their treatment becomes confusing. For example, rent is a fixed cost. But a company may decide to ramp up its production and take additional space on rent temporarily. Hence, this additional rent is variable in nature and hence, should be included in variable costs.

However, it remains up to the management to decide the treatment of such costs as fixed or variable. Accordingly, this subjective treatment may vary the contribution margin figure substantially. This makes the entire exercise of dividing the total costs into fixed and variable a waste or inaccurate. Therefore, the contribution margin income statement may not prove very beneficial until there is a rational clarity about the division of various costs.

Frequently Asked Questions

The contribution margin income statement is represented as:

The contribution margin income statement is purely for the management’s internal use for effective planning, decision-making, and performing the control functions.