Treasury Stock vs Common Stock: Meaning

Treasury Stocks Vs Common Stock is the biggest question and confusion faced by many people in the financial and investment world. Both these terms have different meanings and significance. Therefore before knowing the difference, we need to understand and appreciate their meaning very clearly.

Treasury Stock

Treasury Stocks are shares that the company buys back from the general public. And these are shares that were previously held by the shareholders of the company and are now being repurchased by the company. Because of the buyback, Treasury stocks increase the ownership stake of the issuing company and decrease the ownership stake of the general public. Further, there are many reasons that lead to the issuance of Treasury stocks like the company wants to increase the ownership share, the issuing company has additional finances, the company wants to increase the Current Market Price (CMP) of the share, defensive strategy against hostile takeovers, to correct the prevailing undervaluation, etc.

However, it is not unregulated. The country’s regulatory authority, such as the Securities Exchange Of Commission (SEC) of the United States, manages and keeps a constant check on the number of repurchases by the issuing companies. The other name of Treasury Stock is Treasury Shares or Reacquired Stocks.

Common Stocks

Common Stocks are outstanding shares held by the general public at large. This general public has an ownership stake in the Company and has a name as a shareholder in the Company. These shareholders receive regular dividends and have voting rights. At the time of liquidation, common stockholders get the least preference for repayment of their investment or surplus left over. However, Common Shares are the most popular and the most important source of finance for companies in terms of equity capital.

Also Read: Equity Share and its Types

We must note that this differentiation is not a permanent one. Today’s treasury stock can become tomorrow’s common stock. And today’s common stock can become tomorrow’s treasury stock. Because the share certificate is the same.r4aqe

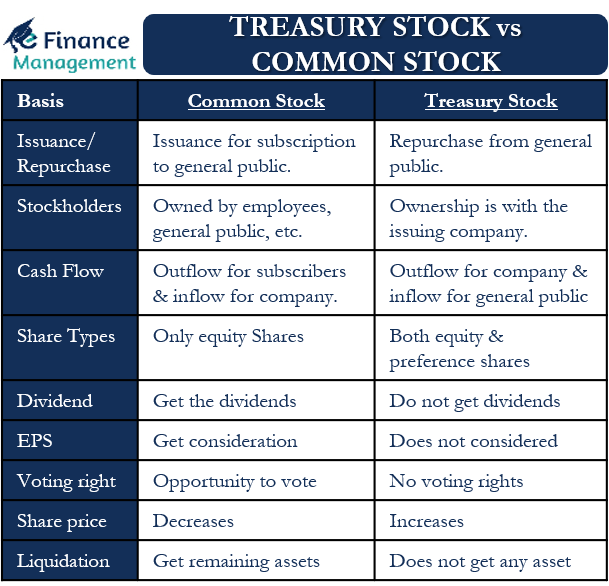

Treasury Stock Vs Common Stock: Differences

There are many differences between the Treasury Stock and Common Stock. They are as follows: –

Issuance Or Repurchase

Issuance of Common Stock takes place for subscription by the general public. And this is an issuance of the security by the company through dilution of its ownership. At the same time, Treasury stocks are repurchases of securities from the general public. Further, in Treasury stocks, the balance of the outstanding share in the market/ holding with the public decreases, and the ownership stake of the company increases.

Thus, in Common Stocks, issuance of securities occurs, and in Treasury Stocks, buyback of securities occurs.

Holders of the Stocks

Common shares are mainly owned by employees, senior management, financial institutions, the general public, promoters, etc. On the other hand, mostly the ownership of Treasury Stocks is with the issuing company.

Cash Flow

Treasury Stocks have a cash outflow for the issuing company and a cash inflow for the general public. As the issuing company buys back the shares from the open market, they have to pay the money for it to the existing public shareholders. Common Stocks have the shares for sale/subscription in the open market. Consequently, there is a cash outflow for the subscribers and a cash inflow for the issuing company.

Also Read: Stocks vs Shares – All You Need To Know

Types of Shares

Common shares represent only the equity holding of the Company. Common shares are Equity Shares of the Company and not the preferred stock of the Company. They only represent the equity shareholding of the Company. In comparison, Treasury shares may be a repurchase of equity shares or preference shares. Hence, it is possible that treasury shares may have a preference share component. However, the Common stock cannot have a preference share component.

Total number of Outstanding Shares

The total number of shares outstanding on the open market increases with the Common Stock issuance. The issuing company dilutes its ownership and releases its ownership stake in the form of shares. Since commons stocks are repurchased in the case of treasury shares, the total number of shares outstanding/available in the open market decreases. The issuing company acquires an ownership stake from the general public, reduces the number of outstanding shares, and increases its ownership stake.

Distribution of Dividends and Calculations of EPS

Common Stockholders get the dividends of the company as a part of the share in the profit. In contrast, the Treasury Stockholders do not get any dividends.

Earnings Per Share (EPS) is a matrix that tells the earnings earned by one share of the company. In calculating EPS, consideration of Common Stock (total number of outstanding shares) takes place. In the calculation of EPS, consideration of the Treasury Stocks does not take place.

Voting Rights

As we all know, the biggest attraction and right of subscribing or purchasing common stock is to have unfettered voting rights for all the matters of the company. Therefore, all the common stockholders will have a right to vote in every Annual and Extra-Ordinary General Meetings (AGM/EOGM) of the company. They have indirect involvement in the decisions making of the company. However, such an opportunity and right to vote in the AGM/EOGM of the company is not available to Treasury Stockholders. They are mostly the owners of the company and have direct involvement in the decision-making of the company.

Share Price

In Treasury Stocks, the value of the shareholders of the company increases. Generally, the share prices of the stock increase after the repurchase of stocks take place. As a result, there is an increase in the Current Market Price (CMP) of the stock, with a reduction in the total number of outstanding shares. While through the issuance of Common Stocks, the Current Market Price (CMP) of the stock decreases with the increase in the total number of outstanding shares.

Accounting

The accounting entry at the time of issuance of Common Shares is that the cash account is debited, and the common stock account is credited. The accounting entry at the time of the treasury stock is that the treasury stock account is debited, and the cash account is credited.

Effects on Balance Sheet

Common shares are recorded in the liability section of the Balance Sheet under the head of share capital. Additional issuances of common stocks are added to the share capital of the Company. Treasury shares are deducted from the share capital of the Company under the liabilities side of the balance sheet.

Liquidation

At the time of the liquidation of the Company, the common stockholders get the remaining assets after payment to creditors and preference shareholders. Treasury stockholders do not get any assets at the time of the liquidation of the Company.

These differences are non-exhaustive in nature.

Conclusion

It is important to understand the distinction between Treasury Stocks and Common Stocks. The Treasury Stock and the Common Stock both represent the holding in the company. According to the requirements, the issuing company decides on issuing common stocks or repurchasing common stocks or preferred stocks. The issuing company effectively uses Treasury Stocks and Common Stocks according to the business requirements. The issuing company tries to take full advantage by effectively managing and monitoring the movements of its stock price through the quantum of Treasury Stocks and Common Stocks.

Frequently Asked Questions (FAQs)

The reasons for the issuance of treasury stock include:

1. Company wants to increase the ownership stake.

2. Issuing company has additional unutilized finances.

3. Company wants to increase the Current Market Price (CMP) of the shares.

4. Defensive strategy against hostile takeovers.

5. Undervaluation due to excess liquidity in the market, etc.

Treasury stock increases the ownership stake of the issuing company and decreases the ownership stake of the general public.

No, common stocks represent only equity stocks of the company and not the preferred stock of the company.