What is the Operating Margin Ratio?

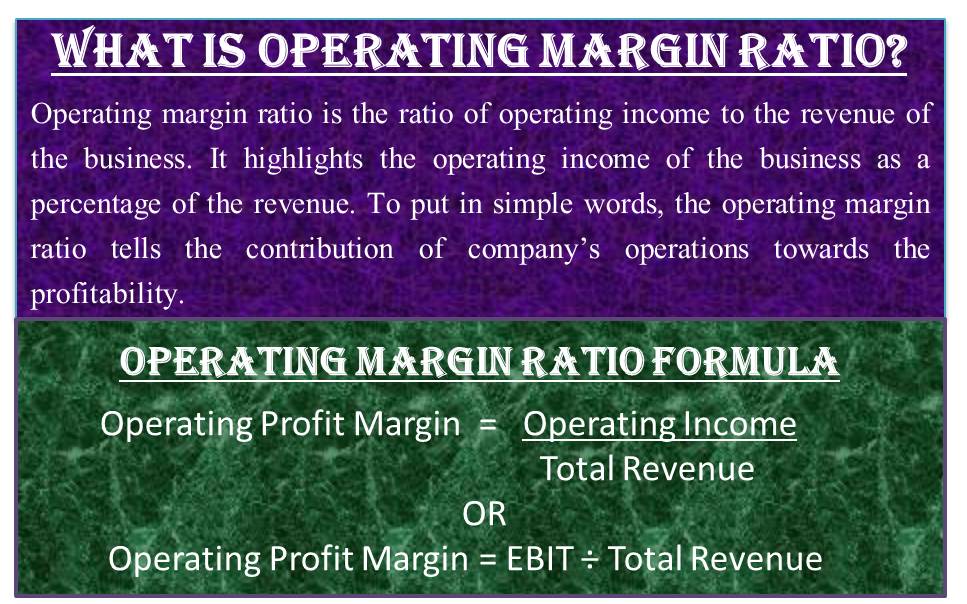

The operating margin ratio is the ratio of operating income to the revenue of the business. It highlights the operating income of the business as a percentage of the revenue. To put it in simple words, this ratio tells the contribution of a company’s operations toward profitability.

The operating profit is the company’s profit after paying the different variable costs of production like raw material purchase, wages, labor cost, etc. The operating ratio displays the efficiency of an organization in controlling its cost. One-time transactions or unique costs do not form part of the operating margin ratio. This ratio is also termed as return on sales ratio.

Before understanding the formula, it is important to know the significance of this ratio.

Significance of Operating Margin Ratio

- A company with a higher ratio is financially sound. It can easily pay its fixed costs and interest on the debt.

- A company with a good operating margin ratio can successfully survive during an economic crisis.

- Only a company with a higher operating margin ratio can successfully compete with the competitors by lowering the price of products to such a level that competitors will not be able to survive.

Refer to PROFITABILITY RATIOS for in-depth understanding.

Let us now have a look at the formula

Operating Margin Ratio Formula

Operating profit margin = Operating income ÷ Total revenue

Or, Operating profit margin = EBIT ÷ Total revenue

Let us understand the above formula with the help of an example.

Example

Suppose the sale of ABC Ltd. is $ 2,000,000. The operating cost is $ 330,000, and the cost of goods sold is $ 750,000. Calculate the operating margin ratio.

Operating margin ratio = 2,000,000 – 330,000 – 750,000 / 2,000,000 = 46%

From the above calculation, it can be concluded that the company earns $ 0.46 before taxes and interest for every dollar of its sales value. A higher operating margin ratio is beneficial for an organization. It signifies that more proportion of the company’s revenue is converted into operating income.

Also Read: Contribution Margin vs Operating Margin

Conclusion

The operating margin ratio is an important indicator of the company’s financial health. Comparison of this ratio with the peer companies helps evaluate a company’s performance within the same industry. The ratio reflects how well the business model of the company is functioning in comparison to its competitors. The investors are also keen on knowing this ratio. It tells the investors about the efficiency and whether the investment can be made in such a company or not.

Read more on CONTRIBUTION MARGIN vs. OPERATING MARGIN.