What is the Sunk Cost?

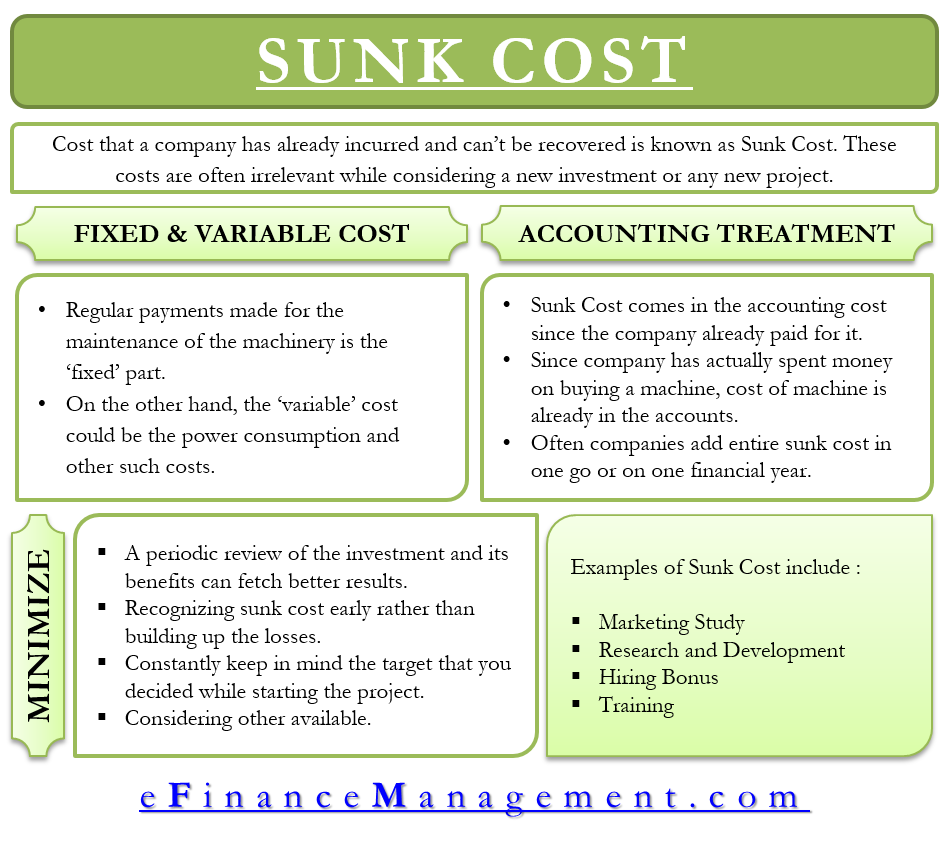

The cost that a company has already incurred and can’t be recovered is known as Sunk Cost. These costs are often irrelevant when considering a new investment or any new project. For example, when a company is replacing an old machine with the new one, it may be able to recover some money by selling the old machine. But, the company may never be able to recover anything close to what it incurred for getting it in the past.

The term sunk cost has its roots in the oil industry. In this particular industry, the decision to continue with the well or abandon it is made on the basis of future cash flows rather than the money spent in drilling the well further. Other popular names for sunk cost are past cost, sunk capital, or retrospective cost.

- What is the Sunk Cost?

- Fixed and Variable Sunk Cost

- How to Calculate Sunk Cost?

- Sunk Cost vs Fixed Cost

- Concorde Effect and Sunk Cost?

- Sunk Cost Fallacy

- Sunk Cost’s Accounting Treatment

- Examples of Sunk Costs

- Importance of Sunk Cost in Decision Making

- How to Minimize Sunk Cost?

- Frequently Asked Questions (FAQs)

Fixed and Variable Sunk Cost

Companies can further classify sunk costs into variable and fixed costs. For instance, if a company spends around $5 million for installing a new machine, it would be a one-time cost that is unrecoverable. And thus, it is sunk cost.

Regular payments made for the maintenance of the machinery are the ‘fixed’ part. On the other hand, the ‘variable’ cost could be power consumption and other such costs, which are dependent and relate to their usage.

How to Calculate Sunk Cost?

There is no particular sunk cost formula, but there is always a need to calculate sunk cost to know whether to continue with the project or to leave it. For such purpose, follow the simple steps:

Firstly, one has to identify the fixed assets for which scrapping or replacement option is being considered. Effectively that machine will be sold and replaced by the purchase of a new machine. And/or the entity will not operate that machine or process and instead buy the semi-finished or raw material directly from the market instead of producing it. For all such decisions, the extra cost still to be incurred by the company is taken into account. Leaving aside the cost which is already incurred and dead. Nothing can be done about that cost.

Then define the assets that cannot be scrapped and calculate their present-day cost (Purchase price – Depreciation till date).

Finally, now calculate the employee cost of the project incurred so far and add it with the cost of assets that cannot be scrapped. The result is the value of the sunk cost of the project.

Sunk Cost vs Fixed Cost

Most of the time, we use the terms fixed and sunk cost synonymously, but there exists some difference between both. It is important to get clarity on how fixed costs are different from sunk costs.

Also Read: Types of Costing

- Sunk costs are only incurred once, but the fixed costs are recurring. Take, for example, the case of a pharmaceutical company. The cost it incurred on R&D is a sunk cost irrespective of the fact that whether the formula it developed will be successful or not. While the rent it pays for the building will get accrue in each period.

- Fixed costs can be recovered from profit, but sunk costs are irrecoverable.

- The time factor also helps determine whether a cost is sunk cost or fixed cost. The cost which has been incurred in the past is sunk cost while the cost we are incurring currently is fixed cost.

- All sunk costs are fixed, but all fixed costs are not sunk costs.

Concorde Effect and Sunk Cost?

It is human nature to avoid failure, and as a result, they continue to invest time and money to fix a failure instead of cutting down the losses. Such a tendency is the sunk cost effect or Concorde effect.

Concorde was the name of the plane that the British and French Governments were working on together. The aim of the plane was to fly its passenger from London to New York within four hours. Mid-way, both governments realize that the project is not economically viable.

However, instead of scrapping the project and realizing the loss, they kept building the planes, thinking that they had spent billions, so they must carry on. Eventually, they end the project. The loss, however, was enormous, much more than what they would have incurred if they had stopped the project earlier when they felt that the objective seemed unachievable.

What one learns from this real story is that one must abandon the project after realizing its failure rather than dragging it unnecessarily. Throwing good money after bad is something that describes the Sunk Cost most effectively.

Sunk Cost Fallacy

The quicker companies or even in normal lives, we recognize the sunk cost, the better we would be able to manage further losses. Whether we agree or not, our decisions have a great influence on the sunk cost. It is very difficult for a person or entity to appreciate and realize that the money already spent is no more of any use. And so, particularly when the amount involved is high. For instance, assume you spend $100 to buy two tickets (non-refundable) for movie A, and your spouse also spent $50 to buy two tickets for movie B (non-refundable). The problem is that both the shows are on the same day and simultaneously. The movie reviews are in favor of movie B.

A rational choice would be to go to a movie that will be enjoyable and fun. However, it is the human tendency to avoid losses, so many would opt for movie A as well. Studies reveal that humans have a fear of acknowledging the loss and, therefore, end up making the wrong decision, which leads to more losses.

Sunk Cost Trap is Universal Phenomenon

Sunk cost trap affects not just individuals and inexperienced investors but also big business houses and companies. They keep running a project simply because they fail to acknowledge the loss. Moreover, they believe and continue to remain optimistic that the venture will turn profitable at some point in time.

Similarly, investment decisions can sometimes go bad. But, rather than acknowledging the loss, most companies or individuals put in more money to keep it running. Such situations arise partly because of our inability to make the right decision, appreciate the signals, and also the human tendency to acknowledge the loss.

For example, Microsoft has been in such a situation before when it was unable to infiltrate the portable MP3 player market with the Zune. After realizing the failure, the company ended its production.

Sunk Cost’s Accounting Treatment

Sunk Cost comes in the accounting cost since the company already paid for it. For instance, a company buys a machine that did not turn out to be productive. The first scenario is that the company keeps on using it only to make things worse and slow down the whole process. The second scenario is dropping the machine after realizing and acknowledging that investing in it was the wrong decision. Or the machine has now become redundant in the current changed circumstances.

Though the loss could be less in the second scenario, in both scenarios, the company has actually spent the money on buying the machine. Therefore, the cost of the machine is already in the accounts.

Often companies add entire sunk cost in one go or on one financial year. This might make the books look bad for that financial year, but it is actually is the right practice with a view to reflect the true and fair view of the accounts.

Examples of Sunk Costs

Marketing Study

Suppose a company spends $10,000 on surveying the feasibility of a new type of gadget. If the survey finds that there will not be much demand for it, the company must not invest further in it. In this case, $10,000 spent on the feasibility survey is the sunk cost.

Research and Development

Similar to a marketing study, the amount that a company invests in the R&D of a product or developing a molecule should also be sunk cost irrespective of whether the product fails or not.

Hiring Bonus

Suppose a company hires a new employee and gives $5,000 as a bonus. If the employee leaves the company or proves to be unreliable, then the $5,000 will be the sunk cost.

Training

Suppose a company spends $3000 on training its employees to use new tablets. If the tablets encounter issues midway and are not usable, then training is a sunk cost.

Advertisement

The demand of a product is uncertain. If the advertising strategy didn’t work well, the demand for a product may decrease. The cost incurred for such an advertisement is a sunk cost.

Outdated Goods

Goods that turn outdated after a period are the sunk cost for the company. Suppose a book on taxation is of no use after one year because of amendments in the law.

Visit for a Deal

Suppose you are offered a deal by a foreign entity that could earn millions for your business. Hence, you decide to visit him in his country, but the meeting does not went well. The expenditure for such a visit is a sunk cost.

Importance of Sunk Cost in Decision Making

Sunk costs being irrecoverable in nature, are never considered while one is making decisions for the future. These are irrelevant cost and hence, does not have any relevance with the future.

How to Minimize Sunk Cost?

Understanding a few things and following them might prove helpful in avoiding the sunk cost and its dilemma to a great extent:

- A periodic review of the investment and its benefits can fetch better results.

- Recognize the sunk cost early rather than building up the losses.

- Separating the emotions and subjective influence from the real situation on the ground.

- Constantly keep in mind the target that you decided while starting the project.

- Consider other available alternatives that can help in reducing the loss.

Also, read Types of Costs and their Basis of Classification

Frequently Asked Questions (FAQs)

(a) The costs associated with a massive ad campaign the firm ran last month.

(b) Any future costs associated with future decisions of the firm.

(c) The costs of electricity and utilities the firm use each month.

(d) Costs of ingredients the firm uses to make food it sells to customers.

(a) The costs associated with a massive ad campaign the firm ran last month.

Not all fixed costs are sunk costs

1. Research and Development

2. Marketing

Other popular names for sunk cost are past cost, sunk capital, or retrospective cost.