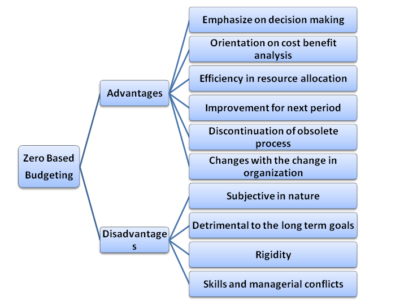

Zero-based budgeting is a method of budgeting wherein no base is considered in the preparation of the budget. Having learned zero-based budgeting in the past, we shall, in this article, discuss the advantages and disadvantages of zero-based budgeting.

Zero-Based Budgeting – Meaning

As the name indicates, zero-based budgeting is a budgeting method with zero base consideration while preparing the budget. It justifies all the expenses each time we prepare a new budget. Zero-based budgeting does not aim to consider any base. Each expense has to be drilled down and analyzed well before the actual allocation of the budget. It is known as need analysis. The preparation of the budget is on the basis of the actual need for the expenses for the forecasted period. It does not consider the fact that the previous budget was lower or higher than the current budget.

Zero-based budgeting targets identifying efficient and alternative methods for organizations that opt for optimum utilization of resources. This will not only ensure efficiency and effectiveness but also wealth and profitability.

Any process will have advantages and disadvantages. However, we can call a process to be a feasible one only when its advantages exceed its disadvantages.

Also Read: Zero Based Vs. Traditional Budgeting

Advantages of Zero-Based Budgeting

Emphasize on Decision Making

Traditional budgeting considers the fact that “how much” expense shall be incurred. However, zero-based budgeting is on the “why” approach. It goes to the root of the expense. Zero-based budgeting aims toward achieving the objectives of the organization. For better decisions, zero-based budgeting completely ignores the past year’s figures.

Orientation toward Cost-benefit Analysis

Zero-based budgeting aims at cost-benefit analysis. It does not focus on studying the changes in expenses and preparing a variance analysis (such as why the expenses increased or reduced). However, it considers the necessity of the expense and the benefit which will derive from the expense. To prepare an effective zero-based budget, more accurate information is a must. Zero-based budgeting operates vertically as well as horizontally. And hence it enables all levels of management to participate in the organization’s decision-making process.

Budget Inflation

Since every line item is to be justified, a zero-based budget overcomes the weakness of incremental budgeting of budget inflation.

Efficiency in Resource Allocation

The ultimate objective of any organization is to maximize profitability of the organization and enhance the wealth of the shareholders. The zero-based budget helps in achieving this objective. Zero-based budgeting ensures that the resources of the organizations are allocated economically and efficiently.

Improvement for the Next Period

For each year, the preparation of the zero-based budgeting is with the same assumption of not taking a base for any previous period. Each department of the organization analyzes the expenses every year. They make sure that there is an inclusion of only those expenses in ZBB that are necessary and derive benefits.

Also Read: Steps in Zero Based Budgeting

Discontinuation of an Obsolete Process

At first, the zero-based budget identifies all the obsolete processes of the manufacturing unit or other departments of the organization. If the process is not essential for the organization, management should analyze and scrap the same. Discontinuation of obsolete operations results in better costing, better pricing, and better profitability of the organization. Zero-based budgeting helps in enhancing the interpretation and knowledge of different cost patterns.

Changes with the Change in an Organization

Due to technological changes, with the new and advanced processes, the organization has to change underlying assumptions and expenses. Hence, zero-based budgeting responds to changes in the organization.

Coordination and Communication

It also improves coordination and communication within the department and motivates employees by involving them in decision-making.

Disadvantages of Zero-Based Budgeting

Time-Consuming

It is a very time-intensive exercise for a company or government-funded entities to do every year as against incremental budgeting, which is a far easier method.

Subjective in Nature

Some of the expenses in the organization are difficult to judge whether the same is essential or not. The reason is the benefits are qualitative in nature, and one cannot measure them in numbers.

Well, the organization can overcome this disadvantage through a thorough analysis of the expenses and with the help of management consultants.

Detrimental to the Long-term Goals

Zero-based budgeting is based on a cost-and-benefit analysis of a particular period. In the short run, the company may not get benefits in the same year of incurring the expenses. However, an organization incurs some expenses for achieving its long-term goals.

The top management shall list all the expenses that have long-term benefits and exclude the same while preparing the budget.

Rigidity

The organization should not always stick to the budget in every situation. Sometimes circumstances may arise, leading the management to incur the expense of the unexpected opportunity or mitigate the possible threat.

The company can make a provision of the same in zero-based budgeting and overcome the same.

Skills and Managerial Conflicts

Management conflicts may arise since zero-based budgeting requires a large amount of time and effort of the managerial and executive staff. Sometimes, the required skills are also not present in the staff to prepare zero-based budgets.

The management shall properly plan and involve qualified and experienced staff to participate in the zero-based budgeting process.

Interesting article. I would contend that BAU operations could carry on with traditional variance accounting whilst supposed value-add discretionary projects are reviewed during their business case phase on a zero-based basis. Consulting engagements aiming to increase efficiency and effectiveness thereby live or die based on a zero-based analysis – no ROI, no-go…

This still means that such projects will inevitably incur costs one year and benefits the next but the disadvantages inherent in the zero-based approach, if only applied to discretionary spend, is surely a good investment and likely a smaller one than the projects under scrutiny…

I’m a Programme Manager, not a Business Consultant (maybe you already surmised that much…)