Staggered Board: Meaning

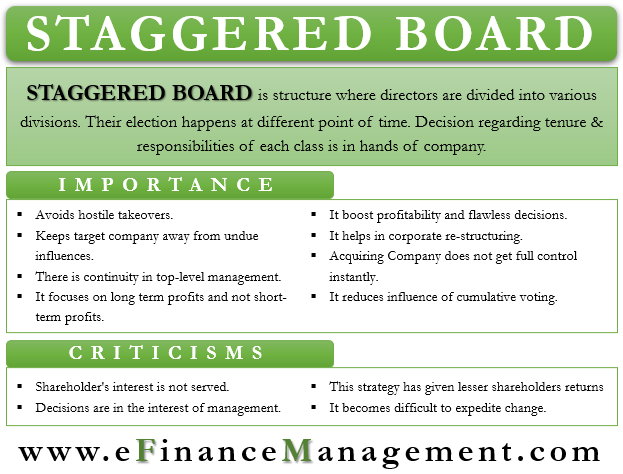

Staggered Board is a structure where the directors are divided into various divisions. And their election happens at different points in time. Hence, they serve for different time lengths. Under this strategy, all the Board of directors of the company is divided into various classes. And each class of directors serves for a different overlapping time length. At any point in time, only one class is open for the election. The company is responsible for making classifications or divisions.

Generally, there are 3 classes with 1/3rd seats in each class, i.e., mostly equal divisions of seats. The decision regarding the tenure and responsibilities of each class is in the hands of the company. At the same time, the voting rights for each election lie in the hands of the shareholders. The prospectus and the proxy statement of the company provide all the details regarding the elements and types of the Board of Directors.

The other name of the Staggered Board is Classified Board.

Understanding the Term Staggered Board

It is an anti-hostile takeover strategy. Generally, all the directors of the company are elected together and serve for the same tenure. But under the Staggered Board structure, the election of directors takes place in various classes, and as a result, various classes serve for different time periods.

Example of Classified Board

For example, Company XYZ is having three classes on the board, Class A would serve for 1 year, Class B would serve for 3 years, and Class C would serve for 5 years. Moreover, there will be a pre-decided number of seats allocated for each class of directors out of the total number of Board positions. In such a situation, a particular class is up for the election at any point in time, so it avoids hostile takeovers. The Acquiring Company will not get 100% decision-making power instantly. And the dilution of power would take place gradually in accordance with the remaining tenure of each class of board members.

Also Read: Takeovers

To get decision-making authority, the target company has to have enough seats in each class and the total majority on the board. As a result, the Acquiring Company has to wait for a year at least for the Annual General Meeting (AGM) and conduct voting from the shareholders and get the board position of the class falling due for election.

In the above example, let’s say Class A has 3 seats, Class B has 3 seats, and Class C has 3 seats. The Acquiring Company will not get 100% decision-making power instantly because the tenure of Class A is 1 year for Class B is 3 years, and Class C is 5 years. After the election of Class A, they have to wait for Class B’s election and later Class C’s election. And as a result, they have to wait for at least another 2-3 years before getting the majority on the Board of Directors under this structure. This makes it unattractive for a takeover.

Apart from being anti-hostile, this strategy also helps the target company to boost its profitability by avoiding any undue influences and frequent changes in key operating policies.

Importance of Staggered Board

- It avoids any hostile takeovers and keeps the target company away from any undue influences. It takes at least a year plus to completely acquire the target company under this structure. Depending upon the number of seats of each class and the remaining tenure thereof.

- As the authority does not keep on changing continuously, there is continuity in top-level management. Every time at the time of the election, there is some veteran member on the board. And so this avoids additional training costs to the new members on board.

- One of the biggest advantages is that the Staggered Board focuses on long term profits and not short term profits. This focus enhances growth.

- It gives a boost to profitability and flawless decisions. And thus enhances the Corporate Governance of the company.

- This structure helps in the corporate re-structuring of the company from time to time. The Company can keep important and/or experienced people for the long term and so on.

- Even if a hostile takeover is taking place, the Acquiring Company will not get full control instantly. In the 1st year, only one class would be open for election. And later on, other classes will be opening up over the years.

- The managers of the company can give their best without any fear of takeovers under this board structure. And so this structure increases productivity at the managerial level.

- This structure reduces the influence of cumulative voting. All shareholders, including minority shareholders, get enough weight.

All these advantages are non-exhaustive in nature.

Criticism of Staggered Board

One of the biggest limitations of the Staggered Board is that shareholder’s interest is not served. Mostly the decisions are taken in the best interest of management and not shareholders. According to the past few data, Staggered Board has given lesser shareholders returns than a company led by a normal Board of Directors. In the case of hostile takeovers, the Acquiring Company has enough capacity to provide existing shareholders a premium over their shares. This structure, however, well avoids such premium advantage to the existing shareholders.

The second criticism is that since few directors are for a longer tenure in the company, it becomes difficult to expedite change. The veteran Board of Directors may not be flexible enough. This situation, many times reduces the value of the company. All these criticisms are non-exhaustive in nature.

Conclusion

Staggered Board generally does not serve in the best interest of shareholders and keep them away from additional premiums. It also is less flexible in nature. Irrespective of all these, many companies adopt this structure to avoid hostile takeovers. Since decision-making criteria and leadership is the most important thing for a company to grow, this structure plays a very important role in keeping it safe, moving without too many hick-ups, and does provide stability to the operations. As a result, it is one of the best anti-hostile strategies.