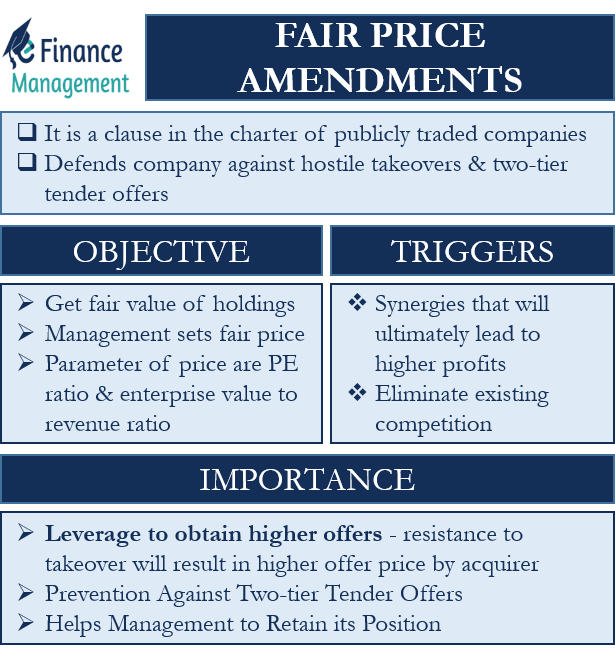

What is Fair Price Amendments?

The fair price Amendment is a clause in the charter of publicly traded companies. Such a provision defends a company against hostile takeovers and two-tier tender offers that do not have the approval of the target company’s board. This will also take care of the interests of the minority shareholders. A company may try to acquire the majority of shares that have voting rights of the target company in direct and indirect ways to gain control over its management. And such acquisitions are, of course, without the consent of the board of the target company. Hence, they are forceful too. Fair Price Amendment is one of the several measures companies incorporate to dissuade other companies from taking them over in a hostile manner.

Objective of Fair Price Amendments

The main objective of the Fair Price Amendments clause is that the shareholders should get a fair value of their holdings at the time of a hostile takeover. The management sets a fair price for its stock that the acquirer should pay to gain control of the company. For deciding the fair price, a reference is usually made to the key financial ratios like the Price to earnings (P/E) ratio or the Enterprise value to revenue ratio. The management uses the historical earnings figure to calculate the correct current market price of the stock. If the acquiring company finds this fair market value of the share too high, it can give up the hostile takeover bid. It can also try to persuade the management to lower the price.

Triggers of a Hostile Takeover Bid

A company can make a hostile takeover bid over another company due to many reasons. It may be looking for synergies by taking over a company and using its already set production, marketing, and logistics channels. The business model of the target company may complement its own business. A merger would result in various types of synergies – benefit of economies of scale, cost savings and thus lower cost of production, lower admin and marketing expenses. All this will result in higher revenues and higher profits for the merged entity. And in turn, it would lead to a higher market price for its shares.

Sometimes a company may try to acquire another company to eliminate existing competition from the market. This is the case in monopolistic situations where only two or three market players exist. It may also feel that it can run that company better and bring in more business and revenue. Clauses such as the Fair Price Amendments come in handy under such circumstances. It protects the company from hostile takeover attempts.

Importance of Fair Price Amendments

Leverage to obtain Higher Offers

Fair Price Amendments act as a leverage tool to increase the offer price for a company’s shares in case of a hostile takeover bid. It is believed that any kind of resistance to the takeover will result in a higher offer price by the acquirer. Also, the board can ensure that the acquirer pays at least the fair price they have set as per the company’s bylaws. The historical prices of the company’s shares can act as a basis to decide the fair price of the shares at present. This will ensure that all the shareholders get a fair value for their investments in the company.

Prevention Against Two-tier Tender Offers

The acquirer often makes a first-tier tender offer to buy some percentage of the target company’s shares at a specific price. The tender offer also states the second-tier tender offer price for the takeover or merger. This price is quite low than the first-tier tender price. The stockholders may rush to dispose of their holdings at the first-tier tender price, which is higher. However, the balance stockholders will suffer a financial setback due to the substantially lower second-tier tender price.

Fair Price Amendments clause prevents the shareholders from the two-tier tender offers. It ensures that all the shareholders receive one common price per share. It makes sure that there is no discrimination between any category of shareholders. The idea is to ensure fair and equal treatment for all, especially the minority shareholder group.

Helps Management to Retain its Position

Managers always keep in mind the fact that the acquirer can displace them from their positions once the takeover bid is complete. Hence, clauses like the Fair Price Amendments ensure that the takeover bid is delayed. Sometimes the acquirer may find the fair price of the shares set by them to be too high. In that case, he may give up the takeover bid. This will help the management ward off the takeover attempt and retain all its positions.