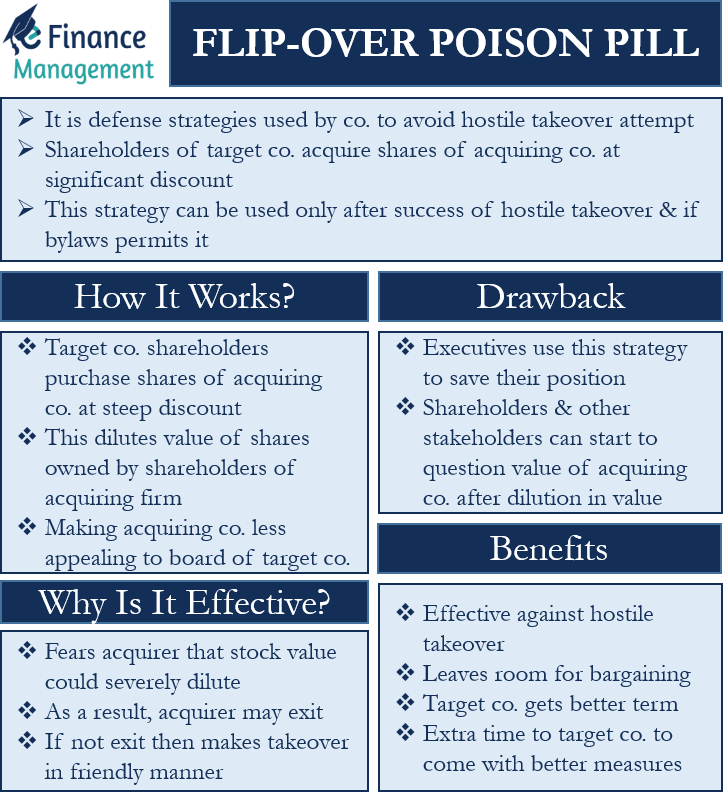

Poison Pill refers to the defense strategies that companies use to avoid a hostile takeover attempt. There are two main types of poison pill strategies. These are Flip-in Poison Pill and Flip-over Poison Pill. In this article, we will be discussing the Flip-over Poison Pill strategy.

Flip-over Poison Pill – What it is?

In this strategy, the shareholders of the target firm acquire the shares of the acquiring company at a significant discount. However, such a strategy only comes into play when the takeover is successful. Like Flip-in Poison Pill, a company can only use the flip-over poison pill strategy if its bylaws permit it.

The motive behind using such a strategy is to devalue and dilute the acquiring company’s share price as well as shareholding. Doing this would make the transaction unattractive to the acquiring company and its shareholders, who may eventually decide to end the deal.

Flip-over Poison Pill – How it Works?

As said above, under this strategy, the target firm shareholders purchase the shares of the acquiring company at a steep discount. The right to buy shares of the acquiring company comes attached with the shares. And this right is automatically triggered at the time of the acquisition.

This strategy comes into play when the acquirer has made its offer, the target company’s board has not rejected it outright, or when the hostile bid is successful. Another pre-requisite is that the bylaws must carry a provision and details for the shareholders to buy the shares at a discount.

Such an action dilutes the value of the shares owned by the shareholders of the acquiring firm. Additionally, the dilution puts downward pressure on the acquiring company’s share price as each stock now represents a smaller ownership interest in the acquiring company.

This makes the acquiring firm less appealing to the board of the target company. Thus, both companies enter into further negotiations. The right to buy the shares at a discount would apply either to common shares or preference shares.

For example, shareholders of the target firm may acquire rights to purchase the stock of the acquiring firm at a two-for-one rate. This would dilute the value of the equity of the acquiring company. So, the acquiring company may quit the acquisition if it believes the deal would dilute its value.

A point to note is that the shareholders of the acquiring company lose the most because of the use of such a strategy. They do not get the option to buy the shares at a discount. But the action by the target company shareholders reduces the value of their shareholding.

Flip-over Poison Pill – Why is it Effective?

Such a strategy works because the acquirer fears that its stock value could severely dilute due to the action of the target company shareholders. As a result, the acquirer may exit the deal altogether or re-negotiate the deal to offer better terms to the target company.

Generally, the use of this poison pill strategy doesn’t force the acquirer to exit the deal completely. But in most cases, using this strategy does force the acquirer to abandon a hostile takeover and approach the deal in a friendly way. A friendly way here means offering better terms to the target company.

Benefits and Drawbacks

Now let us discuss the pros and cons of this strategy:

- It is an effective strategy against a hostile takeover.

- Such a strategy leaves room for further bargaining.

- The target company can get better terms after using such a poison pill strategy.

- The use of this strategy also gives some extra time to the target company to come up with measures benefiting the target company.

Following are the drawbacks of the Flip-over Poison Pill strategy:

- Some executives could use this strategy to save their positions. They generally do this when they believe the new management would not take them in.

- Shareholders and other stakeholders can start to question the value of the acquiring firm after the dilution in value.

Final Words

Flip-over Poison Pill is an effective strategy against a hostile takeover bid. It makes the acquirer re-think their decision to offer a better deal or abandon the deal completely.