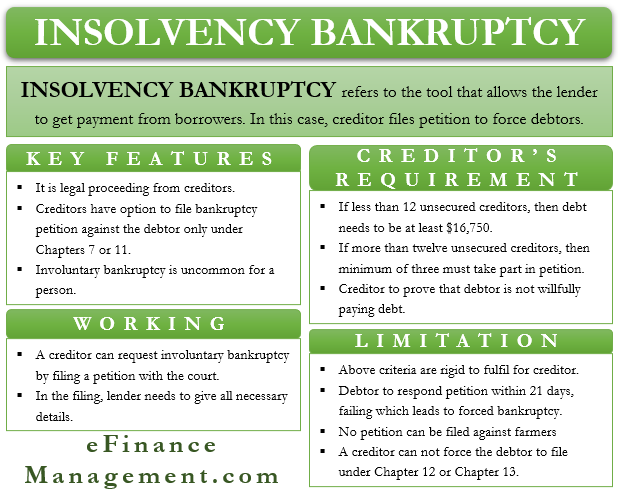

Involuntary Bankruptcy is a tool available to lenders or borrowers, or creditors. It allows them to get their payment (maybe partly) from a debtor or a borrower by forcing them to file bankruptcy. In this, a creditor files a petition to force a debtor into bankruptcy.

Creditors primarily go for this route if they believe the debtor has meaningful assets. Or, they feel that they won’t be able to get their payment unless they make the debtor file for bankruptcy. The final verdict on the application moved by the creditor rests with the court – (i) whether or not to accept the creditor’s application and (ii) whether or not to declare the debtor bankrupt.

Such a bankruptcy application moved by the creditors may prove ineffective if the debtor is not well off and does not have unprotected assets. Such bankruptcy is more common among companies. If the debtor lacks substantial assets, they will get protection from the automatic stay. So, in such a case, creditors will have to look for other ways to collect their debt.

Key Features of Involuntary Bankruptcy

Following are the key features of involuntary bankruptcy:

- It is a legal proceeding from a creditor against the debtor to force them or the business into bankruptcy.

- A primary reason why a court may grant permission for such bankruptcy proceedings is that a debtor has the capability to pay the debt but is not doing so—or stretching and delaying the payment to the creditors on flimsy grounds.

- Another important point to note is that the Creditors have the option to file a bankruptcy petition against the debtor only under Chapters 7 or 11 of the Bankruptcy Code.

- Involuntary bankruptcy is uncommon for a person. However, it is a common practice for a business. But, such bankruptcy is still rare in comparison to voluntary bankruptcy.

Involuntary Bankruptcy – How it Works?

A creditor can request involuntary bankruptcy by filing a petition with the court. A creditor can only file a petition under Chapter 7 or Chapter 11 and not Chapter 13 or Chapter 12.

In the filing, the lender needs to give all the necessary details. For instance, a creditor needs to detail that they are moving with such a bankruptcy against the debtor, who is unable to pay the debt. Also, a creditor may pursue such bankruptcy if a custodian or an agent took control of the debtor’s property to enforce a lien.

What Options Do Debtors Have?

After a creditor files a petition, a debtor can object to it on the grounds that the claims made by the creditors are baseless. If a judge finds that the arguments put forth by the debtor are reasonable, then the judge may dismiss the creditor’s bankruptcy petition. In such a case, the debtor may also get compensation from the creditor.

If the arguments put forth by the debtor are not found satisfactory, then the judge would move ahead with the petition.

If a debtor does not object to the creditors’ petition, then the bankruptcy is treated as voluntary bankruptcy. A debtor also gets the option to convert an involuntary bankruptcy into a voluntary one. The debtor can also re-negotiate the credit terms with the creditors.

Requirements for Creditors

Not all creditors can go ahead with the petition. Instead, they need to meet certain requirements to be able to file a bankruptcy petition against the debtor.

A single creditor can move with the petition if the amount they owe meets a specific threshold amount. And there are less than twelve unsecured creditors. Debt needs to be at least $16,750.

If a debtor has more than twelve unsecured creditors, then a minimum of three must take part in the petition. Also, they need to meet the threshold amount as a group. They also need to meet the above requirement regarding debt amount.

In both cases, a creditor (creditors) must prove that the debtor is not willfully paying the debt. The creditor or creditors also need to prove that the debt claim is not subject to any “bona fide dispute.”

If you are thinking about why there is no mention of a secured creditor, then the answer is that such creditors do not need to file a bankruptcy petition. Since their debt is secured, they can move ahead to take over the asset.

A Creditor (or creditors) can not move with the petition if there is a dispute over the debt. Also, a creditor can not move forward with the petition if the debt is contingent or dependent on an event that is still to occur.

What If Creditors’ Petition Fails?

If a creditor files a petition for bankruptcy and the court dismisses it, then it has certain consequences for the creditors. These are:

- If the court dismisses the petition, then creditors could be liable to pay costs and attorney’s fees.

- In case a court decides the petition was in bad faith, then the creditors could be liable for the damages due to the filing and maybe punitive damages as well.

Limitations of Involuntary Bankruptcy

Following are the limitations of involuntary bankruptcy:

- A creditor needs to fulfill the requirements (mentioned above) so as to move against the debtor with the petition.

- The debtor needs to respond to the petition in 21 days. If the debtor is unable to respond in that period, then they are placed into bankruptcy.

- Creditors can not file an involuntary bankruptcy petition against farmers. They can not also file a petition against some types of organizations, including banks, insurance firms, non-profit organizations, and credit unions.

- A creditor can not force the debtor to file under Chapter 12 or Chapter 13 of the Bankruptcy Code. They can only ask the debtor or force the debtor to file the bankruptcy application under Chapter 7 or Chapter 11 only.

Final Words

Involuntary bankruptcy helps to protect creditors from debtors who do not intend to pay the dues. However, such a bankruptcy could backfire if the creditor is not acting in good faith. Or if actually, the debtor does not have enough assets to pay off the debts. Moreover, even after a debtor is declared bankrupt, there is no assurance that creditors will get all their dues.