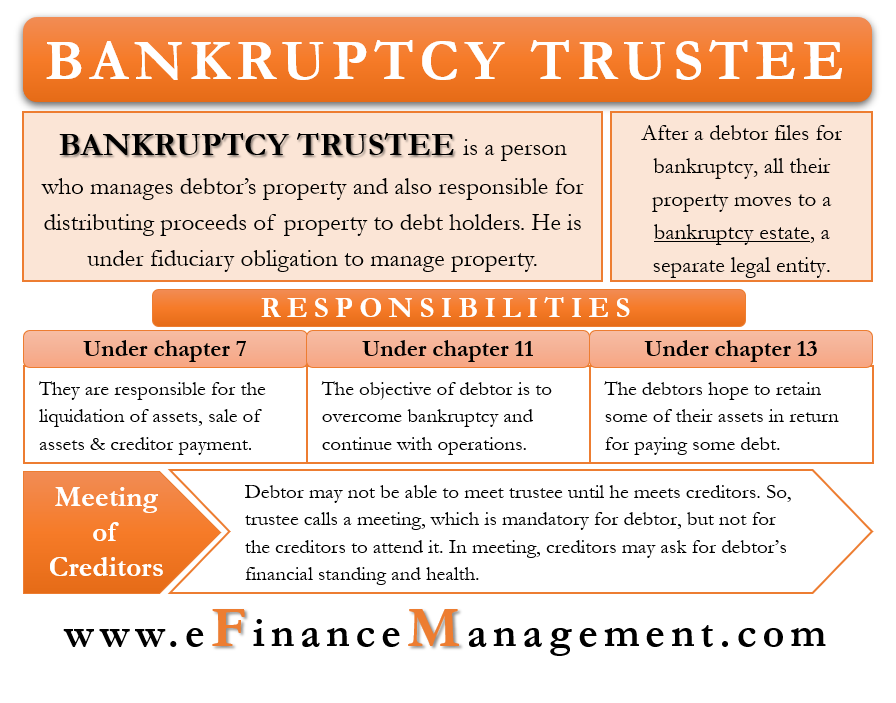

A bankruptcy trustee is the second most important person after the debtor in the bankruptcy. This trustee manages the debtor’s property and is also responsible for distributing the proceeds of the property to the debt holders. Such appointed or assigned trustees to get complete administrative control or work as administrators of the debtor’s property. A trustee is under a fiduciary obligation to manage the debtor’s property impartially.

This trustee represents the debtor’s estate in the proceeding. The primary role of the trustee is to analyze and make recommendations about the debtor’s estate on the basis of the U.S. Bankruptcy Code.

However, a trustee can not act on its own. They work along with the bankruptcy court, which has the ultimate authority over the distribution of debtors’ assets.

Bankruptcy Trustee – History

In the U.S., trustees have been part of bankruptcy cases for over 150 years. They were primarily created to ensure courts and creditors do not get the responsibility to collect and distribute a bankrupt debtor’s property.

The laws covering the trustee have changed over the years. Initially, the court or even the creditors were responsible for assigning trustees. After the Bankruptcy Reform Act of 1978, the U.S. Trustee, who is an officer of the DoJ (Department of Justice), appoints the bankruptcy trustee.

The trustees could be private individuals or corporations, and they work under the court and U.S. trustee officers. Such an evolved process has, over the years, ensures that an impartial and professional person or entity is managing and is responsible for the entire bankruptcy process.

Bankruptcy Estate

To better understand a bankruptcy trustee, one should know what a bankruptcy estate is.

After a debtor files for bankruptcy, all their property moves to a bankruptcy estate. This estate is a separate legal entity from the debtor. To manage and oversee this estate, there is a need for a trustee/ a third experienced party. The trustee also performs various other functions depending on the circumstances of the bankruptcy case.

Read Absolute Priority to learn more about the preferences for the debt settlement.

Bankruptcy Trustee – Responsibilities

The responsibilities of the trustee will vary depending on the type of bankruptcy they are handling. For instance, in Chapter 7 bankruptcy, they are primarily responsible for the liquidation of assets. This means a trustee will oversee the sale of assets and payment to the creditors.

Also Read: Bankruptcy

The responsibilities change under Chapter 11, where the objective of the debtor is to overcome bankruptcy and continue with operations. Similarly, the responsibilities differ under Chapter 13. In this, the debtors hope to retain some of their assets in return for paying some debt.

In all types of bankruptcies, it is the duty of the trustee to verify the debtors’ financial data. Or, we can say it is the responsibility of the trustee to ensure the bankruptcy claim is not fraudulent.

During the process, a trustee is entitled to file adversary proceedings (AP) lawsuits. This is to challenge and confirm the outstanding balance claim of the creditors. These lawsuits are not part of the bankruptcy case but are similar to any other lawsuits. A trustee can file an AP to question a creditor’s claim, decide the validity of a lien, and more.

The specific responsibilities under each type of bankruptcy are detailed below:

Chapter 7 Bankruptcy

Trustees under Chapter 7 bankruptcy are “panel trustees” because the U.S. trustee appoints them to a panel. Following are the responsibilities of a trustee under Chapter 7 bankruptcy:

- The trustee is responsible for rounding up the debtor’s assets.

- The trustee is responsible for selling the entire bankruptcy estate.

- If there is a need, a trustee is also responsible for challenging the claims of the creditors.

- Apart from the disposal of the estate, the trustee also needs to monitor the receipt and distribution of funds to the creditors.

- A trustee can also object to a bankruptcy discharge if there is a need.

- A trustee can also decide on whether or not there is a need to sell debtors’ non-exempt property.

Chapter 13 Bankruptcy

Trustees under Chapter 13 bankruptcy are “standing trustees” because they have standing appointments to the bankruptcy cases in specific geographic areas. Since the debtor hopes to retain the possession of the property in such a bankruptcy, thus, the primary responsibility of the trustee revolves around handling payments. Following are the responsibilities of a trustee under Chapter 13 bankruptcy:

- The trustee reviews the repayment plan that a debtor proposes.

- If necessary, a trustee can also make objections to the proposed plan.

- It is the job of the trustee to collect payment from the debtor as per the repayment plan.

- And finally, the distribution of funds to the creditors is also the responsibility of the trustee.

Chapter 11 Bankruptcy

Such a bankruptcy is a type of “reorganization” as it allows individuals or businesses to reorganize their credit while continuing with their operations. Such a bankruptcy is mainly for businesses.

Usually, there is no trustee for this type of bankruptcy. Instead, the debtor performs the responsibilities of the trustee. In case there is a trustee from the court, they take over the debtors’ property.

On the other hand, Chapter 11 for Small Businesses (Subchapter V) involves a trustee. In this case, the trustee reviews and monitors the activities of the debtors. Basically, a trustee, in this case, works with the debtor and creditors on an agreeable reorganization plan.

Meeting of Creditors

Once a debtor files for bankruptcy, the court assigns their case to a trustee. The debtor then receives a notice with the trustee’s contact information. However, a debtor may not be able to meet the trustee until the meeting of creditors or “341 meetings.”

A trustee calls for this meeting, and it is mandatory for the debtor (not for creditors) to attend it. Such meetings are usually brief. In the meeting, the trustee or creditors may ask debtors about their financial standing or health.

During the meeting, the trustee will also verify the financial details of the debtor, such as income proof, amount of debt, and more. A debtor needs to share all information that a trustee asks for.

Who Pays Bankruptcy Trustee?

The payment of the trustee would vary on the basis of the type of bankruptcy filings. For instance, under Chapter 7, the trustee can get a commission. In such a bankruptcy, the trustee is responsible for the selling of debtors’ property and then distributing the proceeds to the creditors. For this, the trustee can keep a commission of 3% to 25%. If the debtor has no assets to sell, then there is no commission for the trustee.

Under Chapter 13 bankruptcy, the monthly payment plan includes the trustee’s fee. This fee could vary on a case-by-case basis, but it can not be more than 5% of the total bankruptcy amount.

Final Words

It is clear now that the trustee plays a crucial role in bankruptcies. They are involved in almost every aspect of a bankruptcy case, be it reviewing claims of the creditors and debtors, raising objections, disposing of the estate and distribution of proceeds, and more. Thus, it is very important for both debtors and creditors to build a positive relationship with the trustee. On the part of the debtor is preferable to remain open and transparent with the trustee for easier completion of the entire process.