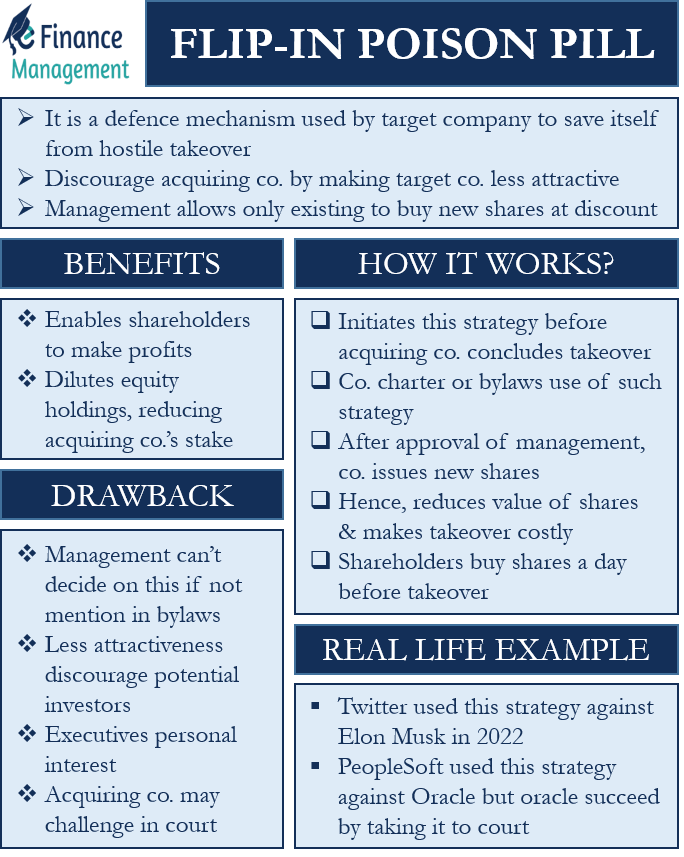

A poison pill is a defense mechanism a target company uses to save itself from a hostile takeover. The objective of the poison pill strategy is to dis0courage the acquiring company by making the target company less attractive. There are mainly two types of poison pill strategy – Flip-in Poison Pill and Flip-Over Poison Pill. In this article, we will discuss the flip-in poison pill strategy.

What is Flip-in Poison Pill?

In this strategy, the management allows only the existing shareholders (not the hostile acquirer) to buy the new shares at a discount. This strategy gives the entity two advantages. The first benefit is that the existing shareholders get an opportunity to make a profit by getting further shares at a discount. And the second, more important benefit is that it dilutes the equity holdings, including the equity that the acquiring company has. So this reduces the percentage stake that the acquiring company has in the target company, making the takeover harder. It also makes the takeover attempt costlier for the acquirer.

How does it Work?

The target company initiates this strategy before the acquiring company concludes the takeover. It is also possible that this strategy gets activated automatically when the acquiring company buys shares more than the threshold limit. The company’s documents, such as charter or bylaws, must mention the use of such a strategy.

A point to note is that not all firms can use a flip-in poison pill to fail a hostile takeover. The firms whose bylaws allow the use of such a strategy can only use it in case of a hostile takeover.

There is a little difference between the flip-in and the flip-over poison pill. In flip-in, existing shareholders buy the shares of the target company. But, in a flip-over strategy, it is the acquiring company whose shares are bought at a discount by the existing shareholders. The condition that needs to be fulfilled for the exercise of the flip-over strategy by the target company is when the hostile takeover is first successful.

After the management approves the use of the flip-in poison pill strategy, it issues new shares at a discount to the market price. Only existing shareholders can buy these shares. Such action reduces the value of the shares that the acquiring company owns. This makes the hostile takeover more difficult and costlier to execute.

Usually, the existing shareholders can buy the new shares at a discount a day before the actual takeover day. As said above, the company’s bylaws usually mention a threshold limit that can trigger this poison pill strategy. This threshold limit is the number of shares that the acquirer can own before the poison pill strategy is triggered.

Example of Flip-in Poison Pill

Company A is witnessing attractive growth over the past few years. This attracts Company B towards it, which acquires a 10% stake in Company A. This rings an alarm bell in Company A. Thus, Company A redrafts its bylaws to prevent any hostile takeover.

Under the new bylaws, if any entity buys more than 12% shares in Company A without any approval from the board, then the company can issue new shares into the market. Now, if Company B wants to acquire Company A, it would have to get approval from the board or buy a controlling stake by spending more money.

Now, let us consider a couple of real-life examples of companies using this strategy.

Twitter recently used such a strategy in an attempt to fail a hostile takeover bid by Elon Musk in April 2022. Musk, who is the co-founder of Tesla and among the world’s richest men, was one of Twitter’s biggest shareholders.

To fail the hostile takeover, Twitter management used the shareholder rights plan. As per Twitter’s SEC filings, the shareholders get the right to buy the shares at $210. The exercise price of $210 was 50% less than Twitter’s current market value of $420.

However, the triggering point of the poison pill strategy was when a shareholder acquires more than 15% of Twitter’s common shares. At the time, Musk’s stake in Twitter was at 9%. Eventually, Musk was able to acquire Twitter mainly because of increasing pressure on Twitter’s board due to the dismal performance of Twitter’s stock price.

In 2004, PeopleSoft also used this strategy to foil a takeover attempt by Oracle. At the time, Oracle challenged the defensive strategy in the court. In December, Oracle finally got success in its takeover attempt with its final bid of about $10 billion.

Drawbacks of Flip-in Poison Pill

Following are the drawbacks of this poison pill strategy:

- Management can not decide on its own whether or not it can implement this defensive strategy. A company can only employ this strategy if its bylaws permit it.

- Since the strategy makes the target company less attractive, it may discourage other potential investors as well.

- There is a possibility that executives who are not good at their job implement the strategy to save their positions. They fear that the new management will find them to be unfit for the job.

- There is a possibility that the acquiring company can challenge the use of such a strategy by the target company in court.

Final Words

Flip-in Poison Pill could prove both good and bad for a company. Though it is a very effective defensive tactic, it could deter other potential investors as well. To the existing shareholders, the strategy is very beneficial. It allows the shareholder to buy the shares at a significant discount, thereby making an instant notional profit. However, it would remain beneficial for the shareholders only if the share price of the target company remains above the purchase price of new shares.