Crown Jewel Defense: Meaning

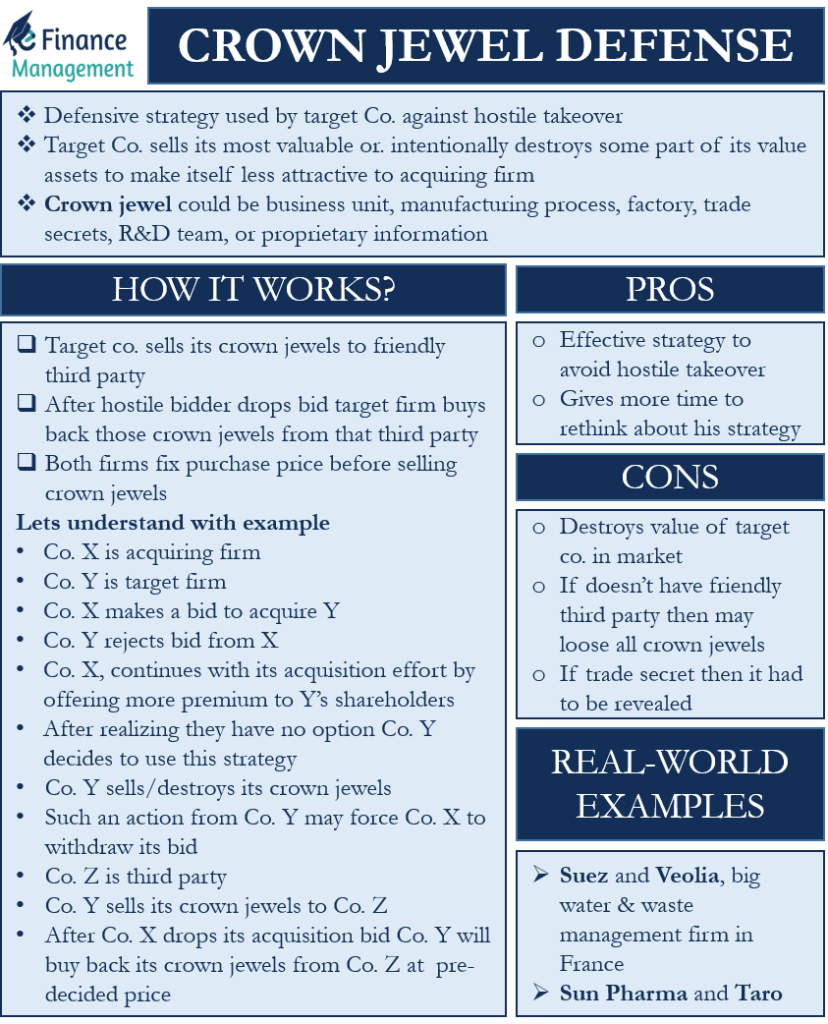

Crown Jewel Defense is a defensive strategy (or anti-takeover strategy) that a target company uses in case of a hostile takeover. So, this is one more option available to the target company to make efforts to save itself from any unwarranted takeover bid. In this strategy, the target company sells its most valuable assets to make itself less attractive and less valuable to the acquiring firm. Such a strategy is usually the last-resort defense strategy available to the target company. This is because the target company intentionally destroys some part of its value in an effort to avert the hostile bid.

Read more: Crown Jewel Defense – Meaning, Examples, How it Works, Pros and ConsIn the business world, the most profitable, valuable, and key strength assets of a company is known as crown jewels. A crown jewel could be a business unit, manufacturing process, factory, trade secrets, Research and Development (R&D) team, or proprietary information. And such crown jewels assets will vary from company to company. For instance, the crown jewel for an automobile company could be its manufacturing process. And, for a mobile company, it could be its technology.

Usually, the whole game of takeover happens where the acquiring company wants to acquire or control such crown jewels of the target company. So, when the target company sells these crown jewels, it automatically makes them less attractive to the acquiring firm. Or in other words, the main purpose of the takeover bid is lost.

Crown Jewel Defense – How it Works?

The following example will better explain how the Crown Jewel Defense strategy works. Suppose Company X is the acquiring firm, and Company Y is the target firm.

- Company X makes a bid to acquire Company Y.

- Company Y rejects the acquisition bid from Company X.

- Company X, however, continues with its acquisition effort by offering more premium to Company Y’s shareholders.

- After realizing that it is left with no more option to avert the acquisition offer, Company Y decides to use the Crown Jewel Defense strategy.

- Company Y sells or destroys its crown jewels.

- Such an action from Company Y may force Company X to withdraw its bid.

A very important point to note here is that usually when such a strategy is used, the target company finds a supporting friendly party. And then these crown jewels are sold to this friendly third party who acts as a white knight. So, after the hostile bidder drops the bid, the target firm buys back those crown jewels from that third party. Generally, both the firms fix the purchase price before selling the crown jewels.

Thus, it will not be wrong to say that such a defense strategy does not destroy the value of the target firm if the target firm is successful in averting the hostile bid.

In the above example, suppose Company Y sells its crown jewels to friendly Company Z. After Company X drops its acquisition bid, Company Y will buy back its crown jewels from Company Z at a pre-decided price.

Pros and Cons of Crown Jewel Defense

These are the pros of this anti-takeover strategy:

- It is an effective strategy to avoid a hostile takeover.

- It gives more time for a target firm to rethink its strategy.

These are the cons of this anti-takeover strategy:

- This strategy destroys the value of the target company in the market in the current situation.

- If the target company does not have such a resourceful friendly third party, then it may lose all its crown jewels.

- If the crown jewels are trade secrets, then the target company will have to reveal its trade secrets to a third party.

Real-World Examples

Suez and Veolia are two big water and waste management firm in France. In 2020, Veolia made a hostile bid for Suez by acquiring 29.9% of its shares. At the time, Suez made use of the crown jewel strategy to foil the takeover bid.

Sun Pharma and Taro are other good examples of the crown jewel strategy. In 2007, Sun Pharma and Taro (an Israeli company) made an agreement in relation to a merger. But due to some violations, the agreement was ended unilaterally by Taro. However, the Israeli Supreme Court ordered an injunction against Sun Pharma for the non-closure of the agreement. At the time, Taro used the crown jewel defense by selling its Irish unit to keep away Sun Pharma.

Final Words

Crown Jewel Defense is generally considered to be the last resort defense strategy available to the target company. It is because, in this strategy, the enterprise value destruction happens intentionally at the Target Company end. However, in case the target company sells its crown jewels to a friendly third party, then the use of such a strategy may not damage its value. Nevertheless, the target firm still needs to use this strategy with utmost care and caution to ensure that it does not backfire.

RELATED POSTS

- Poison Put – Meaning, How it Works and Example

- Poison Pill: Meaning, Pros & Cons, Types, Examples, and More

- Flip-in Poison Pill – Meaning, How it Works, Example, and Drawbacks

- Flip-over Poison Pill – Meaning, Benefits, Drawbacks, and How it Works

- Pac Man Defense – Meaning, Pros, Cons, and Example

- Hostile Takeover