What is the Balance of Payments?

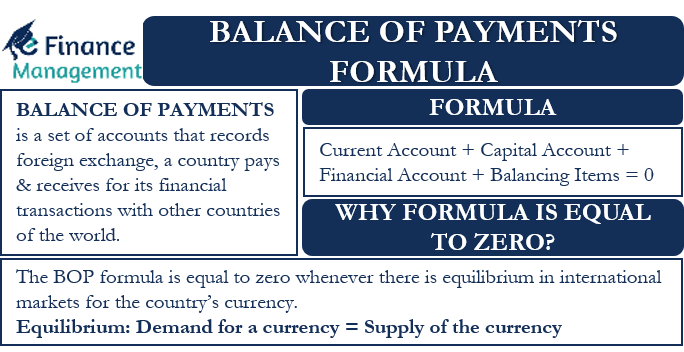

A Balance of Payments is a set of accounts that records the foreign exchange that a country receives and pays for its financial transactions with other countries of the world. We prepare this statement for a fixed period of time, usually annually, in a country’s domestic currency. We also call this statement Balance of International Payments, while BOP is the abbreviation. The BOP records any international transaction made by individuals, businesses, and even governments. There are three types of accounts in the Balance of Payments statement. These are the Current Account, Capital Account and Financial Account. The Balance of Payments formula is written as:

Current account + Capital Account + Financial Account+ Balancing Items = 0 .

The above equation means that the sum of all the components of the Balance of Payments should be equal to zero. The Current Account usually has the maximum transactions. And to match and keep the statement in balance, the total of capital and Financial Account should match with the balance of the Current Account. The balancing item simply takes care of statistical errors and omissions. And we use it to balance the equation.

The statement of Balance of Payments helps to keep track of all the imports and exports of goods as well as services from a country with the help of the Current account. The Capital account records the entire transfers that take place with foreign countries for the exchange of non-financial capital assets. These assets may include forex reserves, deposits, and loans, payments for patents, copyrights, etc. Lastly, the Financial account includes any monetary flow that may arise internationally because of investment in land, business, stocks, and bonds, etc.

Why is the Balance of Payments Formula Equal to Zero?

The BOP formula is equal to zero whenever there is equilibrium in the international markets for the country’s currency. In other words, somewhere, the demand of the currency should match with its supply, or the demand becomes equal to the supply. International trade of goods and services makes it compulsory for any country to become active in the foreign exchange markets as well. This is so because whenever a country imports goods or services from another country, it has to pay that country in its currency. Similarly, whenever a country exports goods or services to another country, the other country will have to make the payment in the exporting country’s currency. Thus, they will have to engage in foreign exchange markets as well.

Demand for a Currency

The demand for a country’s currency will go up in case of a current account surplus. The current account includes the receipts and payments of foreign exchange. This arises because of exports and imports of goods as well as invisible or services. A current account surplus is a situation when the foreign exchange receipts are higher than the foreign exchange payments over a period of time. This happens when the exports from the country are on the rise. The importing nations have to pay back in the domestic currency of the exporter.

The second situation when the demand for a country’s currency rises is when foreign countries buy assets or invest in the country. In such a case, the buyer will have to buy more of the domestic currency in order to make the payment. An increase in investment in the country will benefit the country’s GDP growth. But it also means that the ownership rights to more and more domestic assets start transferring into the hands of foreigners. Control of production and allied activities gradually gets transferred from domestic producers to foreigners.

Supply of a Currency

The current account deficit will result in the exact opposite situation. And here, the currency of the country (exporting) need to be purchased by others (current account deficit / importing countries) to make payments towards purchases or goods and services or towards investments in that country. It is a situation when imports outnumber exports. Thus, foreign exchange payments are higher than foreign exchange receipts. The domestic currency supply goes up to buy foreign exchange.

Similarly, the supply of domestic currency will go up when residents of a country buy assets or make investments in foreign countries. Whenever they purchase an asset, they will have to pay the seller in his currency. For this payment, they will have to use the domestic currency.

Also Read: Balance of Payments Accounts

Market Equilibrium

There will be equilibrium in currency markets whenever the demand for a currency is equal to its supply. This is when our Balance of Payments formula will be equal to zero and be in equilibrium. In order to explain and prove our point, let us take both sides of the equation to understand.

Equilibrium: Demand for a Currency = Supply of the Currency

As we have discussed above, demand for a currency arises due to two factors. These are surplus exports and investments by foreign countries in the domestic market. Similarly, the supply of a currency is determined by the number of imports as well as investments in assets of foreign countries. We can put this in the form of an equation as:

Exports + (Purchase of Domestic Assets by Foreigners)= Imports + (Purchase of Foreign Assets by Residents)

Therefore, Exports – Imports = Purchase of Foreign Assets by Residents – Purchase of Domestic Assets by Foreigners

Explanation

The left side of the equation will give us the current account surplus or deficit. When the total exports of goods and services are more than the total imports, a country will experience a current account surplus. On the other hand, when the total imports outnumber the exports, the country will experience a current account deficit.

The right side of the equation is a combination of a financial account and a capital account. This side of the equation may include the reserve account. It denotes the operations that the central bank of the country performs in the foreign exchange markets. Also, it includes the loans and investments that take place between the domestic country and foreign countries. A financial account deficit will arise when the residents of a country buy more foreign assets than what the foreigners buy in the domestic market.

Therefore, for the Balance of Payments formula to be in equilibrium, a current account surplus will be offset by a financial and capital account deficit. In the case of a current account deficit, there will be a financial and capital account surplus. The formula holds logically too. With a current account surplus, the domestic residents will have more money in their hands to buy assets in foreign countries. This will result in a financial account deficit. When we will add the current account surplus with the financial and capital account surplus, the result will be equal to zero, and the markets will be in equilibrium.