Companies calculate the quick ratio to handle the defects present in the current ratio. The acid-test ratio is a more progressive alternative to the well-known liquidity metric, the current ratio. Although the two are comparable, the acid-test ratio gives a more thorough appraisal of an organization’s capability to pay its current liabilities. So it is important to analyze/interpret and improve the quick ratio for the betterment of the company.

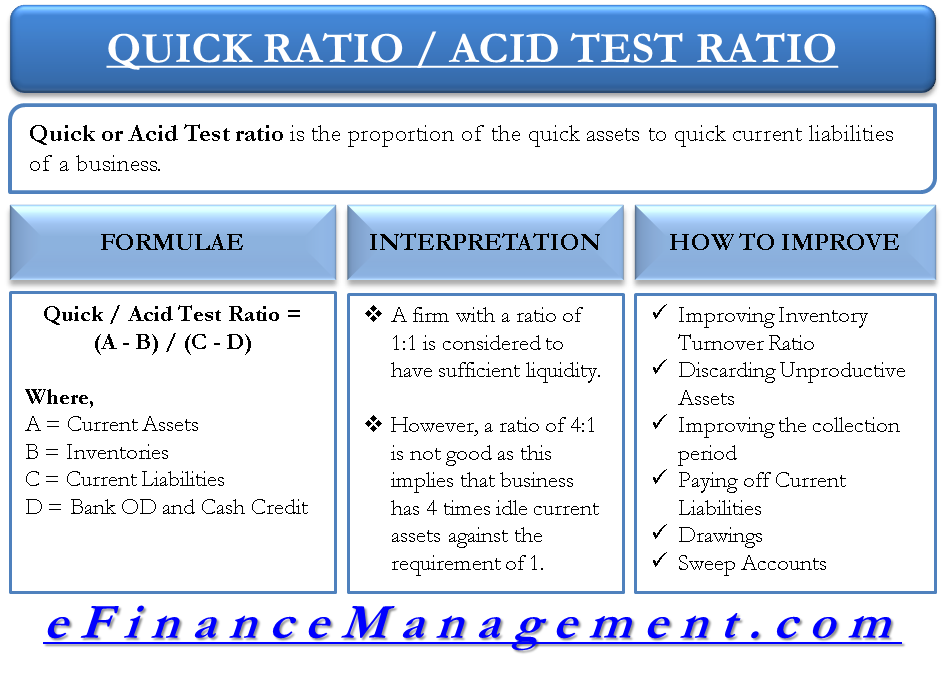

The acid test ratio eliminates all except the most liquid of current stakes. The stock is the most striking rejection because it cannot be quickly converted to cash. Similarly, bank overdrafts and cash credit are excluded from current liabilities because inventories secure them. A few investigators incorporate stock in the ratio due to its liquidity when compared to other receivables. Alternatively, the formula to calculate a quick ratio is as follows:

| Quick Ratio = (Current Assets Inventory – Prepayments) / (Current Liabilities – Bank Overdraft and Cash Credit) |

Interpretation of Quick Ratio / Acid Test Ratio

Quick ratio evaluates a company’s liquidity by comparing its cash plus almost cash current assets with its entire current financial obligations. It assists in verifying if the business or company has the capacity to pay off its current liabilities by means of the most liquid assets.

A firm with a quick or acid-test ratio of 1:1 is considered to have sufficient liquidity. It is fit enough to pay off all the liabilities/bills on time. Consequently, it might be said that, for the most part, a higher quick ratio is best because it implies more significant liquidity. However, a ratio of 4:1 is not good for a business as this implies that the business has 4 times idle current assets against the requirement of 1. These idle assets could have been utilized to make extra money, consequently contributing to net profits. Put differently, an exceedingly high rate of the quick ratio may point out incompetence in financial management. An excellent authority is to locate an industry standard and then contrast the business’s current and acid test ratios alongside this industry average.

How to Improve Quick Ratio?

The quick ratio is valuable to the in-house financial directors and creditors, loaners, banks, capitalists, and so on. A business has to work with all these stakeholders closely, and they consider the quick ratio as a measure of the liquidity of a business and accordingly extend their support. It is better to keep this ratio controlled and managed.

One of the quickest ways to improve the quick ratio would be to pay off the current bills. And at the same time, increase sales so that the cash on hand or AR increases. As the quick ratio is similar to the current ratio but does not include stock in current assets, it can be improved by similar actions that increase the current ratio.

Here are some ways of improving the quick ratio:

Improving Inventory Turnover Ratio

By faster-converting inventory into debtors and cash, the quick assets would rise, improving the quick ratio.

Discarding Unproductive Assets

If the company has any unproductive assets, it is better to sell them and have better liquidity. The reduction of such assets would result in a better cash position and, therefore, an improvement in the numerator of the quick ratio.

Improving the Collection Period or ARs

A reduction in the collection period will directly impact the quick ratio. A lower collection period means faster rolling of cash. Improvement in the collection period can result in a number of debtor’s cycles during the year resulting in better current assets. Moreover, the chances of long-term debtors, sticky debtors, and bad debts are also reduced. Right from the beginning, the payment terms have to be made clear to get the credit period as low as feasible.

Paying off Current Liabilities

Current liabilities, which form a part of the denominator of the quick ratio, are to be reduced to have a better current ratio. This can be done by paying off creditors faster or quicker payments of loans. The lower the current liabilities, the better the quick ratio is.

Drawings

Drawings for non-business reasons like owners’ withdrawals have to be kept at a minimum level. The increase in drawings means a reduction in the owner’s funds in the current assets. This would give rise to a higher level of current liabilities to fund the current asset instead of using the owner’s fund used for current assets. This will result in a direct reduction of the quick ratio. It is best to have profits invested back in business, and capital should be maintained ideally to balance the current ratio. The higher the drawings, the lower the current ratio would be.

Sweep Accounts

Sweep accounts can earn interest on any extra money by ‘sweeping’ or moving the idle cash into an account that brings interest when the finance is not required and sweeping them back into the working account when required. This will enable the management to keep the quick ratio high by keeping the cash in hand and still not losing the opportunity of better interest rates by reducing the cost of idle funds.

Such steps can help in stopping avoidable cash drain out of business. When the above easy tips are implemented, the business is sure to perk up liquidity.

Book:

Principles of Management Accounting – MANMOHAN & S. N. GOYAL, Sahitya Bhavan, Agra

Greetings! Very helpful advice on this article! It is the little changes that make the biggest changes. Thanks a lot for sharing!

Thanks for sharing this article. This will definitely help me to improve my inventory turnover ratio. This totally a very useful post.

Thanks for sharing this article. This will surely help me to improve quick ratio. I’ll follow what you said here. This article is very useful and easy to follow.