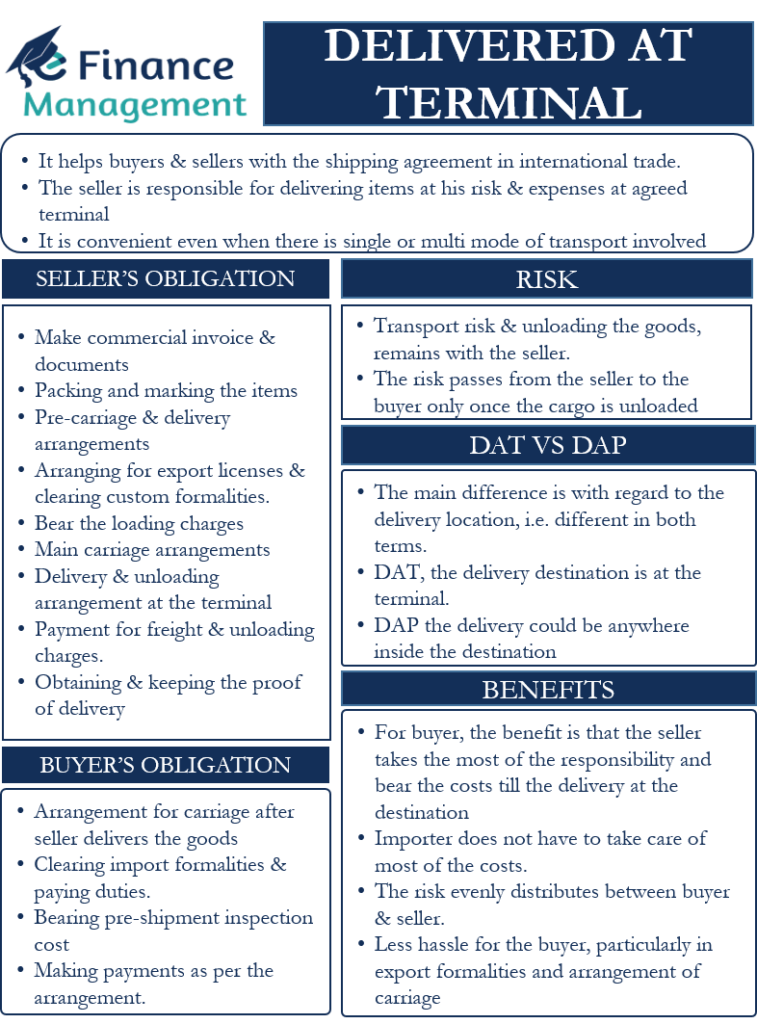

Delivered at Terminal or DAT is one of the Incoterms that helps buyers and sellers with the shipping agreement in international trade. In this, the seller is responsible for delivering the items at his own risk and expense at an agreed terminal (in the buyer’s country). The agreement may relate to any mode of transport. In other words, DTA is convenient even when there is a single or multi-mode of transport involved for sending the goods to the final destination.

So, we can say that the seller has the duty to arrange for the carriage and to deliver the cargo to the named place. Thus all the responsibility and costs squarely fall on the seller till the items are delivered and as well as unloaded at the end terminal. The seller has to bear all the expenses up till the place of delivery. On the other hand, the buyer has to bear the customs clearance and taxes at the destination.

In the 2010 edition of Incoterms, DAT replaced the earlier Incoterms DES (Delivery Ex Ship) and DEQ (Delivered at Quay). Both these were part of the Incoterms 2000. Also, a point to note is that even DAT got replaced in 2020. In the latest edition of Incoterms, i.e., Incoterms 2020, DAT was renamed Delivered at Place Unloaded (DAU). In this article, however, we will use the term Delivered at Terminal or DAT only.

Delivered at Terminal – What Terminal Means?

In this, the terminal does not necessarily have to be an airport. A terminal could be any place that suits the transfer of cargo, like a warehouse or depot. Also, a terminal could be terminals of land, air, sea, or airports, railway stations, seaports, or any other similar places, such as free zones, docks, warehouses, etc.

Since the terminal could mean many places, thus, it is crucial that the shipping agreement clearly states the specific destination that the buyer and seller agree on.

When Risk Passes Under Delivered at Terminal?

All the risk in connection with transporting and unloading the goods remains with the seller. However, the responsibility of the import clearance is with the buyer. Moreover, the payment of local taxes and import duties, etc., also have to be paid by the buyer. But, the seller should make available all the necessary documents that would help the buyer to get the clearance.

The risk passes from the seller to the buyer only once the cargo is unloaded. A point to note is that, unlike the CIP and CIF, there is no obligation for both buyer and seller to offer cargo insurance under the DAT Incoterm. However, for safeguarding the interest of both parties, it is preferable and warranted that the parties do arrange for the insurance of the goods. Also, if a party is taking insurance, then they must list the terms and conditions of the insurance clearly in the shipping contract.

Delivered at Terminal – Buyer and Seller Obligations

Following are the seller’s obligations in case of Delivered at Terminal (DAT):

- Prepare the goods as per the specifications; make the commercial invoice and the documents.

- Properly packing and marking the items so that they are export-ready.

- Arranging for export licenses and clearing custom formalities.

- Arranging for pre-carriage and delivery.

- Seller also needs to bear the loading charges.

- Arrange for the main carriage.

- Arranging for delivery and unloading at the named terminal or any other agreed place.

- Pay for the freight and unloading charges.

- Obtaining and keeping the proof of delivery.

Following are the buyer’s obligations under DAT:

- Arranging for onward carriage after seller delivers at the terminal.

- Clearing import formalities, as well as paying duties.

- Bearing the cost of pre-shipment inspection

- Making payments as per the arrangement.

Benefits of DAT

Following are the key benefits of this Incoterm:

- For the buyer, the benefit is that the seller takes the most of the responsibility as well as bears the costs till the delivery of the goods to the destination place.

- Importer does not have to take care of most of the costs.

- The risk is evenly distributed between the buyer and the seller.

- There is less hassle for the buyer, particularly export formalities and arrangement of carriage, etc., in the seller’s country.

DAT vs DAP

Many people get confused between DAT and DAP Incoterm. While both the terms are very similar, there remains a slight difference between these two terms. And this main difference is with regard to the delivery location, which is different in both the terms.

In the DAT, the delivery destination is at the terminal. The terminal, as said above, could be a warehouse, or air cargo terminal, or any other place depending on the transportation mode.

On the other hand, the delivery in DAP could be anywhere inside the destination nation/buyer’s country. The destination can even be further away from the terminal. Thus, it could be the warehouse, store, or factory of the buyer in his country. So the delivery responsibility and relevant costs are extended one in case of DAP for the seller.

Another key difference is that in DAT; the seller will be responsible for unloading the cargo at the terminal of the destination nation. But, in DAP, the unloading is the responsibility of the buyer at the agreed place or destination. The seller is responsible for the carriage of goods to the agreed destination, ready for delivery to the buyer.

Must read: Incoterms

RELATED POSTS

- What are the Differences Between Incoterms 2010 and 2020?

- Delivered Duty Paid – Meaning, Obligations, Advantages and Disadvantages

- Carriage and Insurance Paid To – Meaning, Obligations, and More

- Incoterms – Meaning, History, Benefits and More

- Cost, Insurance, and Freight – Meaning, Obligations, Advantages, and Disadvantages

- Inland Bill of Lading – Meaning, Importance and More