Options Trading across markets -stocks, securities, currency, and commodities is a very, very prominent trading stream now across the world. It garners the maximum trading volume. Buying a call and selling a put are part of bullish options strategies. Both strategies assume that the stock will remain strong until the expiry. That is, the market will move only in one direction, and that is the upward move. But the similarities end here. And both these strategies are quite different from each other. To benefit most from these two strategies, it is very important that we know and understand the difference between buying call vs selling put.

Before detailing the difference between the buying call vs selling put, let us understand what the two strategies are:

Buying Call vs Selling Put – Meaning

Buying Call is an easy-to-understand strategy. In this, an investor expects the price to rise aggressively and quickly. This big and quick jump in stock prices is supposed to offset the speed and value of the time expiration. Theoretically, the profit prospects in this tactic are unlimited. However, at the same time, the maximum quantum of loss, if the market goes adverse, is pre-defined/ decided. In this strategy, the maximum an investor can lose is the amount of premium he pays to buy the Call Option. Thus, in this strategy, investors benefit from leverage and hope to earn by increasing the security price.

Selling a put is a neutral to bullish strategy. An investor does not expect the share price to rise significantly until expiration. Instead, the investor expects the security price to remain range-bound, around the strike price until expiry. Thus, with this strategy, an investor could make a profit in all situations, i.e., if the price falls slightly, rises, or stays the same. However, selecting the right strike price is very crucial for this strategy.

The profit prospects of this tactic are limited to the premium a trader collects by selling the put. This premium is the maximum possible gain for the seller, even if the share price doubles or even increases. In contrast, the chances and prospects of loss are unlimited in theory. If the share price falls significantly, a trader could suffer a massive loss.

Also Read: Call Spread vs Put Spread

Now that we have an idea of what the two strategies are let’s take a look at the differences between buying call vs selling put.

Buying Call vs Selling Put – Differences

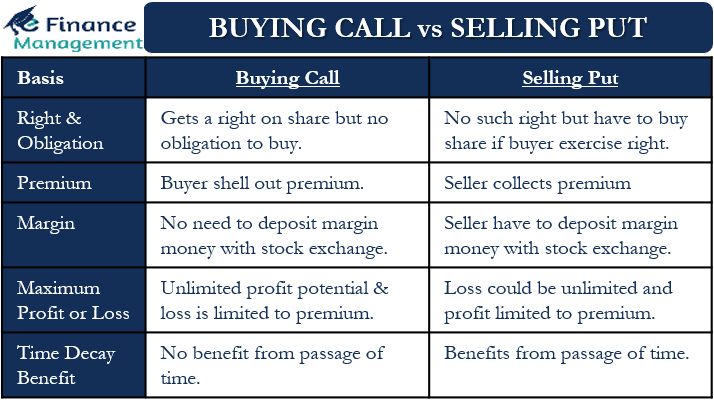

The following are the differences between buying call vs selling put:

Right and Obligation

Buying a call means that the buyer has the right to buy the underlying share at the agreed strike price on the expiry. Here we should know that all options trade gives only a right to act to the buyer, but he is under no obligation to exercise his right.

When selling the put, the seller does not receive such a right as the right remains only with the buyer. Instead, the seller must buy the underlying share if the buyer exercises his right at the time of expiry.

Premium

When buying a call, the buyer has to shell out the premium, while the put seller collects the premium for selling the put.

Margin

The buyer of the call does not need to deposit margin money with the stock exchange in order to carry the trade. Because as we discussed above, the extent of loss is capped for the buyer. Hence, no more margin money he needs to pay irrespective of the movement in the stock prices. However, the seller of the put must deposit the margin money with the stock exchange in case of adverse movement in stock prices to carry the trade.

Maximum Profit or Loss

As mentioned above, the loss for the buyer of the call is limited to the premium he pays to purchase the call. The profit potential, in contrast, is unlimited and depends on the extent of the price increase in the underlying stock.

On the other hand, for the seller of a put, the maximum profit is limited to the amount of the premium he has received. Still, the loss could be unlimited depending on the price drop in the underlying value of the share.

Time Decay Benefit

Put sellers gain from the passage of time. The option value decreases as it approaches expiration. On the other hand, call buyers receive no such advantage.

Buying Call vs Selling Put – Example

Investor A buys a call for one lot (100 shares) of Company X stock at a $5 premium. The strike rate is $250. In this case, A will pay a total premium of $500 ($5 * 100). If the share price of X drops below $250, A will not exercise the option and thus, would lose the premium amount of $500. But, if the share price rises to $300, A will exercise the option and gain $5,000 [($300 – $250) * 100]. The net gain for A will be $4,500 ($5,000 – $500 premium).

Now let’s take an example for the seller of the put. Suppose B sells put for one lot (100 shares) of Company Y shares at a $5 premium. The strike rate is $250. In this case, B will get a total premium of $500 ($5 * 100), which will be his maximum gain.

If the share price of Y drops to $200, the buyer will exercise the option; the seller, in this case, will lose $4,500 [($50 * 100) – $500]. However, if the buyer does not exercise the right to sell, the buyer will lose the amount of premium he paid, which would be the profit for the seller of the put.

Final Words

There is an immediate outflow of cash (premium) when you buy a call, but the profit potential is enormous. There is an immediate inflow of cash when selling a put, but there is no limit to the loss potential. So, if an investor is bullish, he should choose between the two strategies based on his risk tolerance. Also, an investor should only sell a put if they have enough money to deposit as margin money. The important point to note is that generally, the buyer earns a profit only and only when the price of the security goes in the uptrend. In all other scenarios, usually, the seller of the put stands to gain.

Frequently Asked Questions (FAQs)

On buying a call, the buyer gets a right over stock at an agreed strike price on expiry, but there is no obligation to buy.

Loss in buying a call is limited to the amount of premium, but the profit potential is unlimited. In contrast, profit in selling a put is limited to the amount of premium, but the loss can be unlimited. Therefore when one is sure of upmove, call buying is preferable and profitable. In other circumstances selling a put may be preferable.