What is the Reconciliation of Profit Under Marginal and Absorption Costing?

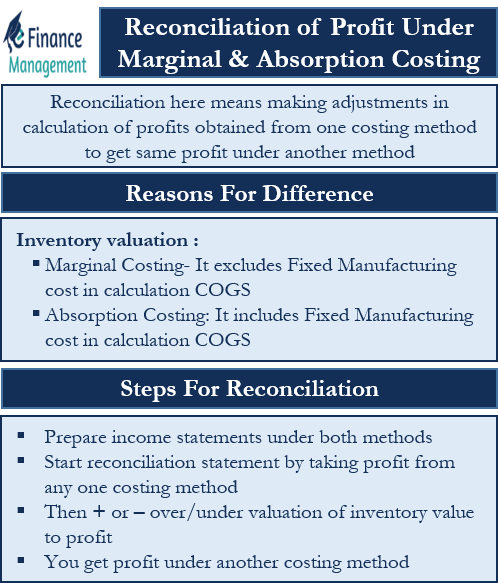

We have often heard about the reconciliation of profit under marginal and absorption costing. It means making adjustments in the calculation of profits obtained from one costing method to arrive at the same profit under another costing method.

Why the Need for Reconciliation Arises?

Marginal and Absorption Costing methods are very different from each other. Both of these are costing methods used to arrive at the cost of goods sold and also value inventory. The principle difference is in valuing the inventory. Companies mainly use absorption costing for financial and tax reporting. Often, companies follow marginal costing for internal management’s decision-making purposes. Thus, there arises a need to reconcile profit under marginal and absorption costing.

Inventory Valuation under Marginal Costing

Marginal costing considers only variable manufacturing costs like raw material costs and variable labor costs.

Inventory Valuation under Absorption Costing

Absorption costing considers both fixed and variable manufacturing costs in valuing inventory. It includes all costs of manufacturing the product, whether variable or fixed. Costs like direct material, direct labor (fixed or variable), factory overheads, etc.

Consequence: Difference in Profits

A different approach by these methods leads to a difference in inventory value. This inventory value carries the same difference in the ‘cost of goods sold’. Thus, the two methods give different profits.

Also Read: Absorption vs Variable Costing

How to Reconcile the Profits?

Before learning to make the reconciliation statement, let’s first see how this difference is created.

Understand the Difference in Profits with an Example

Let’s consider an example to understand the reconciliation of profit under marginal and absorption costing.

Company X makes and sells chairs. It provides the following costing and selling data for a month:

- Company X sells 2,400 units a month at $18;

- Production: 4,000 units.

- Variable Costs:

- Variable production cost per unit is $7.20;

- Variable non-production cost per unit 10% of sales revenue;

- Fixed Costs:

- Fixed production costs (per month) $11,800;

- Fixed non-production costs (per month) $7,200;

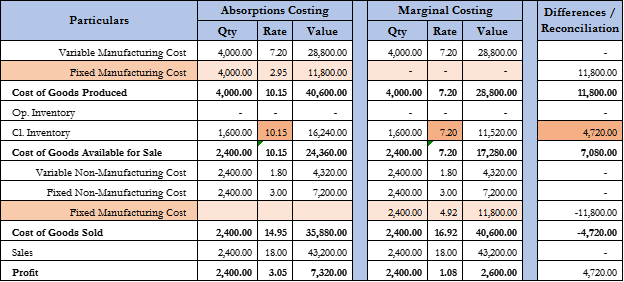

Following is the profit statement of company X using Absorption costing:

| Particulars | Qty | Rate | Value |

|---|---|---|---|

| Variable Manufacturing Cost | 4,000.00 | 7.20 | 28,800.00 |

| Fixed Manufacturing Cost | 4,000.00 | 2.95 | 11,800.00 |

| Cost of Goods Produced | 4,000.00 | 10.15 | 40,600.00 |

| Op. Inventory | – | – | – |

| Cl. Inventory | 1,600.00 | 10.15 | 16,240.00 |

| Cost of Goods Available for Sale | 2,400.00 | 24,360.00 | |

| Variable Non-Manufacturing Cost | 2,400.00 | 1.80 | 4,320.00 |

| Fixed Non-Manufacturing Cost | 2,400.00 | 3.00 | 7,200.00 |

| Fixed Manufacturing Cost | – | – | – |

| Cost of Goods Sold | 2,400.00 | 14.95 | 35,880.00 |

| Sales | 2,400.00 | 18.00 | 43,200.00 |

| Profit | 2,400.00 | 3.05 | 7,320.00 |

Following is the profit statement using Marginal costing:

| Particulars | Qty | Rate | Value |

|---|---|---|---|

| Variable Manufacturing Cost | 4,000.00 | 7.20 | 28,800.00 |

| Fixed Manufacturing Cost | – | – | – |

| Cost of Goods Produced | 4,000.00 | 7.20 | 28,800.00 |

| Op. Inventory | – | – | – |

| Cl. Inventory | 1,600.00 | 7.20 | 11,520.00 |

| Cost of Goods Available for Sale | 2,400.00 | 17,280.00 | |

| Variable Non-Manufacturing Cost | 2,400.00 | 1.80 | 4,320.00 |

| Fixed Non-Manufacturing Cost | 2,400.00 | 3.00 | 7,200.00 |

| Fixed Manufacturing Cost | 2,400.00 | 4.92 | 11,800.00 |

| Cost of Goods Sold | 2,400.00 | 16.92 | 40,600.00 |

| Sales | 2,400.00 | 18.00 | 43,200.00 |

| Profit | 2,400.00 | 1.08 | 2,600.00 |

We can also see the comparative statements in the following pic. The differences column presents the differences between the two methods.

Prepare Reconciliation Statement

Reconciliation can be done in two ways,

Begin from Profits of Absorption Costing

We will take profit from the absorption costing method and reduce the overvaluation of inventory to arrive at the profit as per marginal costing.

| Reconciliation | Value |

|---|---|

| Profit as per Absorption Costing | 7,320.00 |

| Reduce: | |

| Overvaluation of Inventory (1600* 2.95) (10.15 – 7.2 = 2.95) | 4,720.00 |

| Profit as per Marginal Costing | 2,600.00 |

Begin from Profits of Marginal Costing

We will follow the exact reverse process in this case.

| Reconciliation | Value |

|---|---|

| Profit as per Marginal Costing | 2,600.00 |

| Add: | |

| Undervaluation of Inventory (1600* 2.95) (10.15 – 7.2 = 2.95) | 4,720.00 |

| Profit as per Absorption Costing | 7,320.00 |

Conclusion

You will notice that the absorption costing method will always value inventory higher than the marginal costing method. The simple reason is that marginal costing does not take manufacturing fixed costs into consideration.