What is Chapter 13 Bankruptcy?

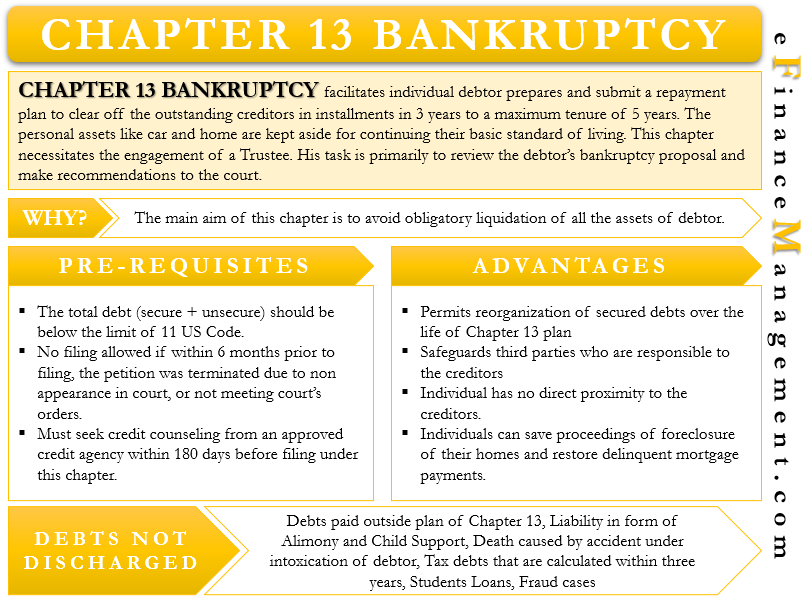

Chapter 13 bankruptcy, more commonly referred to as a wage earner’s plan, facilitates individuals having a regular income to construct a scheme whereby they repay all or part of their debts. Filing under this chapter is permissible for persons having income stability, with an overall cap on the debt outstanding. Under Chapter 13, an individual debtor prepares and submits a repayment plan to clear off the outstanding creditors in installments in 3 years to a maximum tenure of 5 years.

In this chapter, individuals propose an arrangement of repaying their debt outstanding, keeping aside their primary home and car required to continue their basic living standard. When the debtor’s monthly income is below the state’s median, the court allows a repayment term plan of 3 years. The court may approve a longer period not exceeding 5 years, generally when the debtor’s monthly income is above the state’s median. Under this, debtors pay a fixed monthly amount to the trustee, who pays the creditors to discharge debts. This paycheck has to be better or at least equal to the amount that the creditors may receive in other Chapters under bankruptcy trials.

Why File for Chapter 13 Bankruptcy?

A debtor may not prevent the forced sale of a home under Chapter 7, or it may be quite expensive and tangled under Chapter 11. The main aim is to avoid the obligatory liquidation of all of the assets of the debtor. It is only possible if the debtor meets both the income and the total debt outstanding limits as prescribed under the 11 US code.

This chapter necessitates the engagement of a bankruptcy trustee. His task is primarily to review the debtor’s bankruptcy proposal and make recommendations to the court. Further, it also involves collecting payments from debtors as per the scheduled term and discharging the creditor’s liability.

The approval procedure for this chapter is quite beneficial, as it has a set commitment phase between 3 to 5 years. This period can be shorter but cannot extend. During the plan period, all the available income of the debtor is transferred to the appointed trustee for ultimate distribution to creditors.

Who is Eligible to File under this Chapter?

Any individual is eligible to file a petition under this chapter as long as his debts, both secured and unsecured, are within the limits of 11 US Codes issued from time to time. These restrictions are periodically monitored and altered to reflect changes in CPI (Consumer Price Index).

However, no filing is possible by a person who has within 6 months prior period filed a petition and if:

- His petition was terminated due to his willful failure to appear before the court or

- Has not met the terms of Court orders or

- His case was voluntarily discharged after creditors obtained relief from the court to recover assets they hold a lien.

To categorize himself as a debtor, any individual must seek credit counseling from an approved credit agency within 180 days before filing under this chapter. Such counseling can be in the form of individual or group counseling. There are some exceptions if there are insufficient credit agencies to grant such counseling.

Advantages

There are some advantages of filing under this chapter in comparison to other Chapters under Bankruptcy. These are as below:

- Individuals can save proceedings of foreclosure of their homes and restore delinquent mortgage payments.

- It permits reorganizing of secured debts over the life of the Chapter 13 plan – other than on the primary house. This assists in lowering the debtor’s monthly payments.

- This chapter has a special provision that safeguards the third parties who are responsible to the creditors for the outstanding debts together with the debtor. It also protects “co-signers.”

- Under this chapter, the individual has no direct proximity to the creditors. The said individual makes payments as per the plan to the trustee, and the latter discharges the debts.

Also, read Cramdown to know more about the reorganization plan enforced by the government despite objections from creditors.

Preference of Chapter 13 over Chapter 7

Chapter 13 is preferable over Chapter 7 for the below reasons:

- The individual intends to clear all / most of his debts. He can do this in an acceptable time frame.

- The person has valuable non–exempt belongings. He fears that he might lose these during proceedings in Chapter 7

- Possibility of the debtor failing the mean test.

- Within the last eight years, the debtor got discharged under Chapter 7.

- The assets of the debtor are sufficient to discharge maximum debts. But to complete the process, the debtor needs time and temporary relief from any action from the creditors.

- Debts are so much that it is impossible to pay off under Chapter 7, but Chapter 13 can be helpful here.

Discharge Under Chapter 13

Discharge of a debt under chapter means there is no more payment requirement from the debtor to clear off the creditors. It refers to the Court Order, which releases the debtor from all of its debts. It further gives instructions to the creditors not to try to reclaim debt from the debtor. A discharge is said to have occurred once the repayment plan is completed. If the said plan is partially completed, partial discharge is issued; else, the case is converted to Chapter 7.

Debts not Discharged

Under Chapter 13 below, debts are usually not discharged :

- Debts that are paid outside the plan of Chapter 13

- Liability in the form of Alimony and Child Support

- Death caused by accident under the intoxication of the debtor

- Tax debts that are calculated within three years

- Students Loans

- Fraud cases

Continue reading Chapter 11 vs. Chapter 13 Bankruptcy.

It’s good to know that the commitment phase of a chapter 13 bankruptcy can last for up to five years. A friend of mine is considering filing one in the near future because of a very messy financial situation that started back in March. I hope that he could find a good chapter 13 bankruptcy lawyer in order to see better what her best courses of action could be.