What is a Reverse Merger?

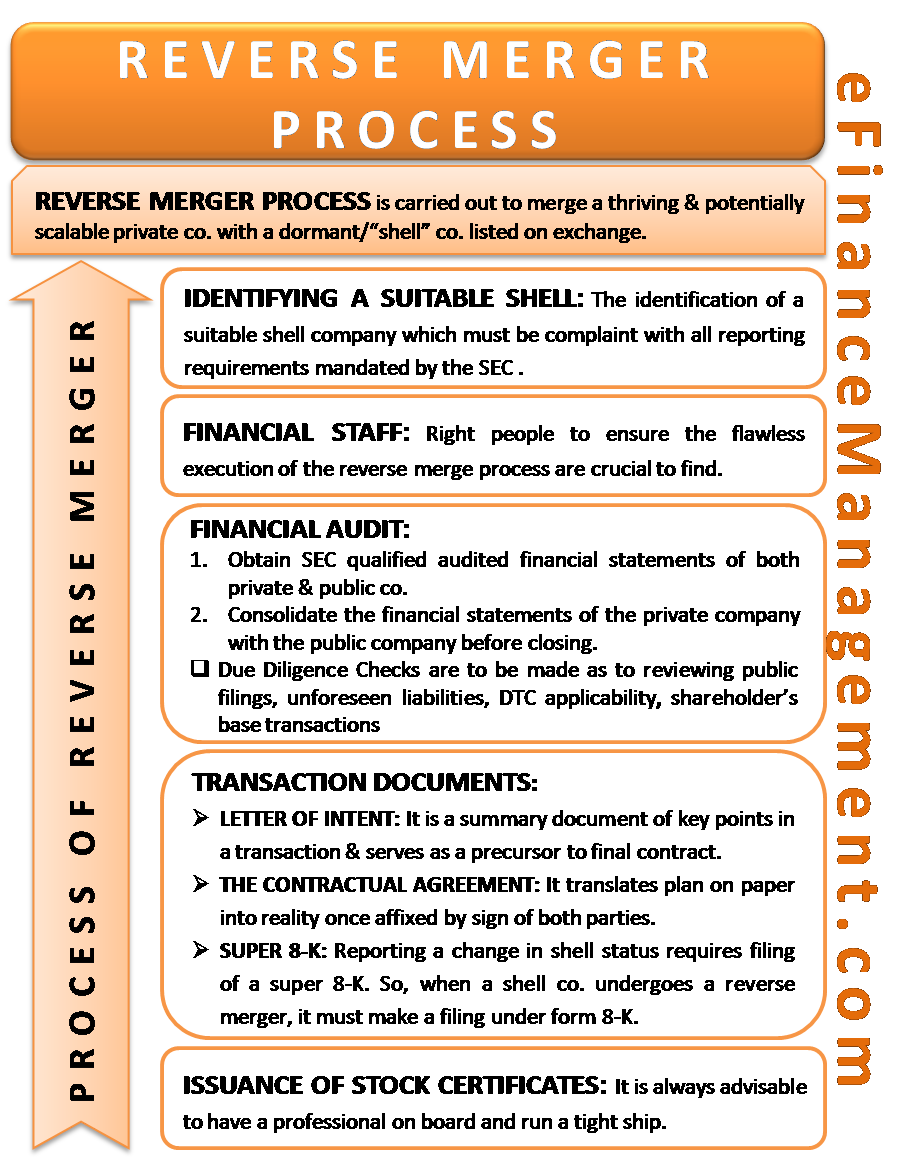

A reverse merger process is carried out to merge a thriving and potentially scalable private company with a dormant or “shell” company listed on the exchange. The foremost objective of a reverse merger process is to bypass the extensive procedures and regulations imposed by the government on a company seeking to issue an IPO. The private companies achieve this by acquiring greater than 51% of the equity share capital of the public shell company or commanding control over the board of directors.

Think of a reverse merger as a back door entry for a private company wanting quick entry to the arena of listed entities. The private company is able to save on significant amounts of time, money, and management expertise when it opts for a reverse merger against an IPO. Also, going for an IPO does not always guarantee a listing on the exchange. Insufficient funds raised during an IPO may cause all efforts to go in vain. Therefore, a reverse merger is an inexpensive and simple route to gain access to the exchange.

Reverse Merger Process

Stage I: Identifying a Suitable Shell

Spotting a perfect fit shell is the foremost step in a reverse merger process. An amalgamation with any abandoned shell company is not acceptable. The shell company, though out of business, must be compliant with all reporting requirements mandated by the SEC (The U.S. Securities & Exchange Commission). Moreover, a merger with a shell in extremely poor health will ultimately bog down its successor. Therefore, the shell must be free of all potential debt, obligations, or legal hassles.

Stage II: Financial Staff

The right people to ensure the flawless execution of the reverse merge process is crucial to find. The services of an experienced securities law firm cannot be overstated at this stage since a reverse merger process is full of trap doors and loopholes. It is, therefore, always advisable to have a professional on board and run a tight ship.

Also Read: Reverse Merger

Stage III: Financial Audits

After having a financial team in order, the saga of audits and due diligence begins.

• Obtain SEC-qualified audited financial statements of the private and the public shell company for at least two preceding fiscal years.

• Consolidate the private company’s financial statements with the public company before closing. Ensure conciliation in accordance with the standards of US GAAP.

Due Diligence Checks:

- Review all public filings and background checks, for example, a record of material litigations.

- Rule out potential/unforeseen liabilities related to past business or management.

- Is it DTC (Depository Trust Company) eligible? DTC provides safekeeping and electronic clearance services for corporate and municipal securities.

- Shareholder base sanctions for the target (private) company to take control.

The private company must classify the shell based on findings in the due diligence: Clean Shell Vs. Messy Shell Vs. Dirty Shell.

Stage IV: Transaction Documents

Letter of Intent

The LOI (letter of intent) may or may not precede the final contractual agreement. It is a non-binding or partially-binding document that formalizes the interest of both parties in a deal. The LOI is a summary document of the key points underlying a transaction and serves as a precursor to the final contract.

The Contractual Agreement

It is the most essential document of the reverse merger process. It translates the plan on paper into reality once affixed by the signature of both parties. Its major content includes:

- Consideration and mode of settlement (cash, stocks, or a combination thereof).

- Changes in management control.

- Representations and Warranties.

- Termination clauses and breakup fees are applicable.

Super 8-K

Reporting a change in the shell status requires filing a super 8-K. Therefore, when a shell company undergoes a reverse merger, thereby nullifying its existence as a shell, it must make a filing under form 8-K. The 8-K, in addition to reporting change in shell status, also requires disclosure of information otherwise covered in Form 10. Form 10 covers all material information such as changes in control, material agreements, risk factors, information regarding directors and officers, etc.

Filing of Form 8-K must be completed within 4 days of the close of the reverse merger process (or any event triggering the change in the status from the shell company to a not-so-shell company).

Also Read: Takeovers

Stage V: Issuance of Stock Certificates

The reverse merger process can be said to be complete once the paperwork has been taken care of. The stock certificates of the acquiring (previously shell) company are then issued to the directors and shareholders of the target company.