What is Maturity Matching / Hedging Approach?

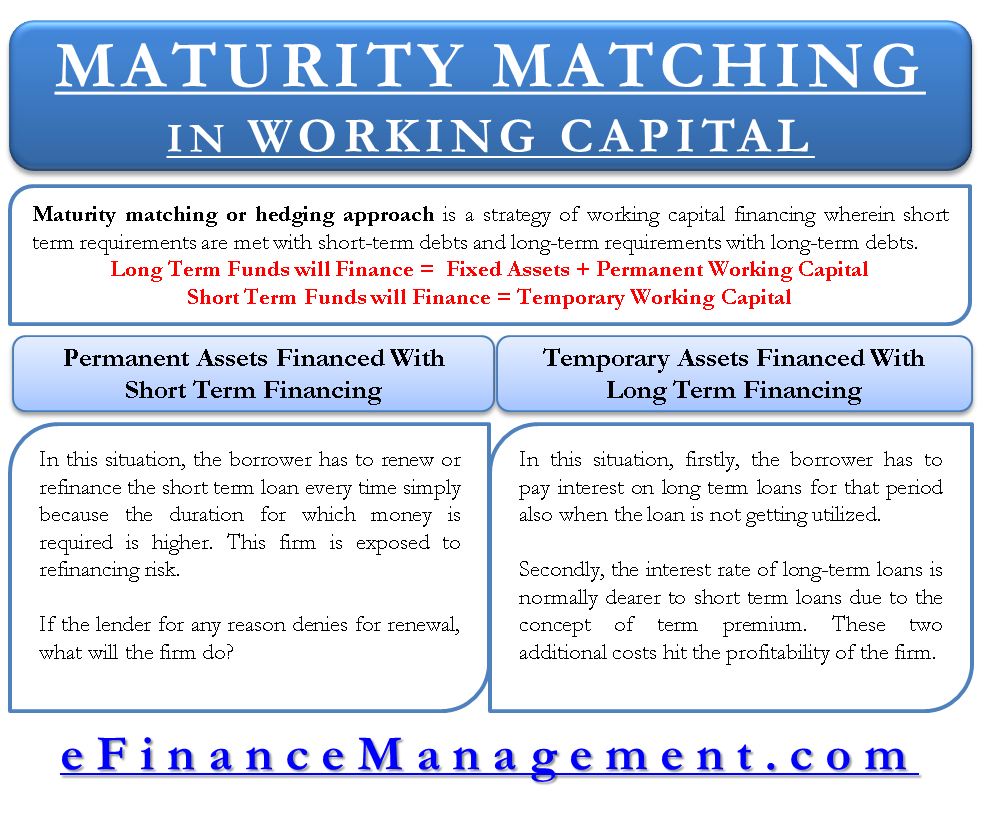

Maturity matching or hedging approach is a strategy of working capital financing wherein we finance short-term requirements with short-term debts and long-term requirements with long-term debts. The underlying principle is that each asset should be financed with a financial instrument having almost the same maturity.

Maturity Matching Explained with Example

To understand it with an example, assume a company bought machinery with a life of 5 Years worth $10 million. Let’s assume there are two options to finance it, i.e., issue of 10 Year debenture or apply for cash credit renewable every year. What will you opt for? The obvious answer would be 5 Year Debenture.

- What is Maturity Matching / Hedging Approach?

- Maturity Matching Explained with Example

- Maturity Matching or Hedging Approach Equation

- Hedging or Maturity Matching Approach Diagram

- Rational behind Maturity Matching or Hedging Approach

- Advantages of Matching Maturity Approach

- Disadvantages of Matching Maturity Approach

Similarly, take another example of extending credit to accounts receivables worth 0.5 million if you have the same two options mentioned above. I believe you will opt for a cash credit.

But why? Here is the answer. I suggest reading thoroughly along with the diagram to understand it correctly.

Maturity Matching or Hedging Approach Equation

This matching approach to working capital financing can be explained in a simple equation as follows.

Long Term Funds will Finance = Fixed Assets + Permanent Working Capital

Short Term Funds will Finance = Temporary Working Capital

In the equations, long-term funds match long-term assets and vice versa.

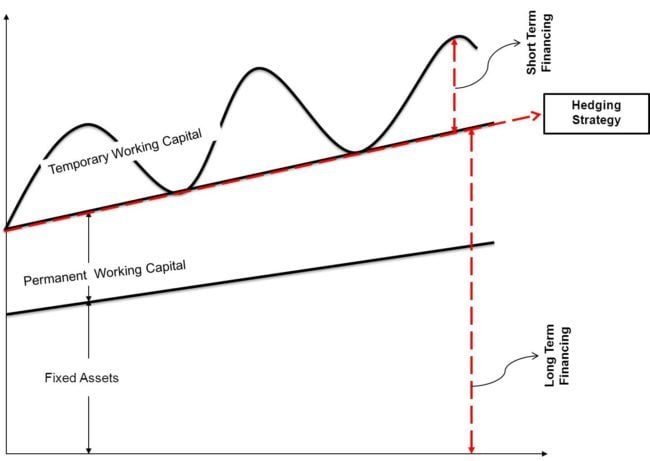

Hedging or Maturity Matching Approach Diagram

A diagram can bring crystal clarity to the concept. In the diagram, we can see three levels: fixed assets, permanent working capital, and temporary working capital. The red vertical dashed line represents the type of financing. The bigger dashed line stretches till permanent working capital is long-term financing, and a smaller line is the temporary working capital. The line from where the temporary working capital starts and the line of a hedging strategy are the same. Any strategy below this line will be aggressive, and an approach above it will be conservative.

Rational behind Maturity Matching or Hedging Approach

Knowing why to apply a maturity matching strategy is very important. It suggests financing permanent assets with long-term financing and temporary with short-term funding. Now assume the opposite situation and see. There can be two such situations.

A. Permanent Assets Financed with Short Term Financing

Taking the same example, the period of money requirement is 5 years, whereas financing is with a loan maturing after 1 year only. In this situation, the borrower has to renew or refinance the short-term loan (cash credit) every time. The firm needs to renew the loan 5 times. This firm exposes to refinancing risk.

If the lender for any reason denies renewal, what will the firm do? In such a situation for paying off the loan, either the firm will sell the permanent assets, which effectively means closing the business or filing for bankruptcy.

B. Temporary Assets Financed with Long Term Financing

In this situation, two possible situations will take place.

- Firstly, the borrower has to pay unnecessary interest on long-term loans (5 Year Debenture) for the period (4 Years) when the loan amount is of no use.

- Secondly, the interest rate of long-term loans usually is dearer than short-term loans due to the concept of the term premium. The higher interest cost will incur.

These two additional costs will hit the profitability of the firm.

After all the discussion, we should learn that costs (cash credit interest rate) might be low in situation A, but the risk (refinancing risk) is too high. On the other hand, situation B concludes too high cost (5 Year Debenture Interest + 4 Year’s unwanted interest cost) with low risk. Situation A is not acceptable because of such a high risk, and situation B hits the profitability, which is the primary goal of doing business and the basis of survival. Therefore, the hedging or matching maturity approach to finance is ideal for effective working capital management.

Advantages and Disadvantages of Maturity Matching or Hedging Approach

The maturity matching approach has various advantages and disadvantages. The most significant advantages are that it maintains an optimum level of funds, saves interest cost, has no refinancing risk and interest rate fluctuation risk, etc. The main disadvantage is its difficulty in implementation.

The maturity matching or hedging approach of working capital financing is idealistic. It is based on the basic principle of finance that long-term assets should be financed with long-term sources of finance such as equity, term loan, debentures, etc. Short-term assets should be funded with short-term sources of finance such as short-term loans, current liabilities, cash credit, bank overdraft, other working capital loans, etc.

Advantages of Matching Maturity Approach

Optimum Level of Funds (Liquidity)

The funds remain on the balance sheet only until they are in use. As soon as they are not needed, they are paid off. This is how this approach optimizes the interest cost. Interest is paid only for the amount and time for which money is used. There is no unutilized cash lying idle in the business.

Savings on Interest Costs

When short-term requirements are not funded with long-term finances, the firm saves interest rate difference between long-term and short-term interest rates. It is already known that long-term interest rates are comparatively higher due to the concept of risk premium.

No Risk of Refinancing and Interest Rate Fluctuations during Refinancing

Since it follows the fundamental principle of finance here, i.e., a long-term asset to long-term finance and short-term assets to short-term finance, there is no risk of refinancing and interest rate fluctuations during refinancing. This means that while renewing a loan if the market scenario changes, the interest rate may also adversely change. Here, the problem of frequent refinancing does not exist.

Disadvantages of Matching Maturity Approach

Difficult to Implement

It is one of the best or ideal strategies, but it is challenging to implement. Exactly matching the maturity of assets with their finance source is practically impossible. There is quite a lot of uncertainty on the current asset’s side. One cannot precisely predict when the debtor will pay or what time the sales will occur. Once the credit sales take place, the ball goes into the customer’s court.

Risks Still Persist

After adopting this strategy and planning everything following it, if the realization of assets is not on time, it will not be possible to unreasonably extend the loan due dates. In that situation, the strategy moves either towards a conservative or aggressive approach. Once that happens, the analytics and risks of those strategies will apply. The risks which we were avoiding with this strategy again come into play.

Also, read about Different Approaches to Working Capital Financing Strategies.

Wonderful.. tough made easy?