If we try to define the term due diligence, it is an act of completely investigating and analyzing something before taking action. A due diligence report is a summary and findings of this analysis.

The acquirer makes the due diligence report before a merger or an acquisition. As defined by Deloitte, due diligence is the third step in the process of an M&A transaction. Following is the process:

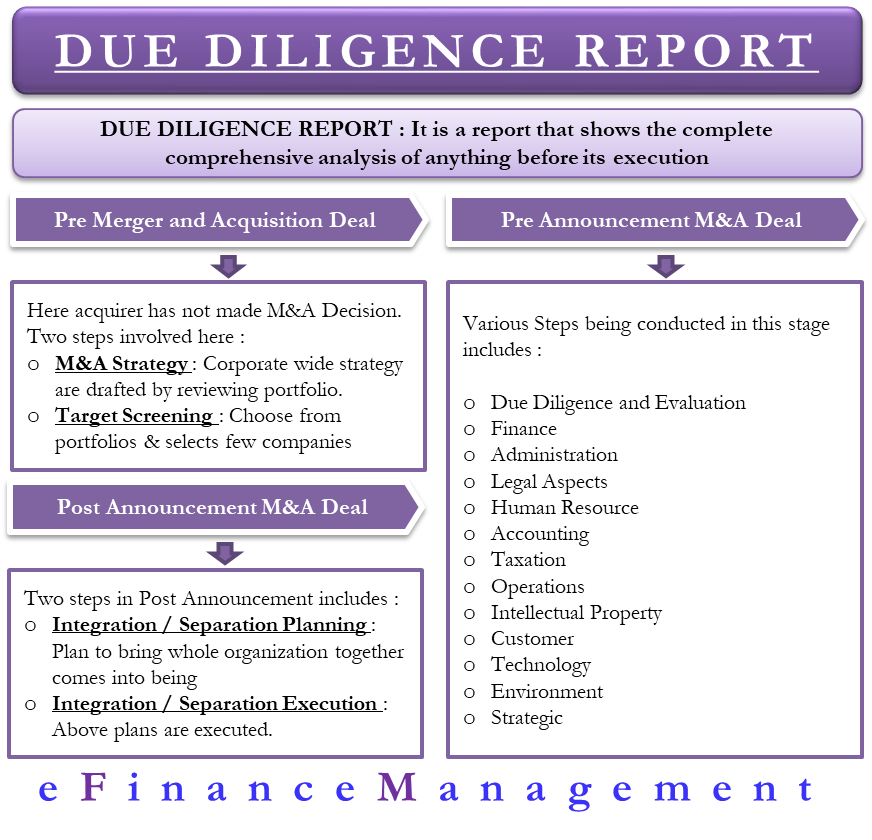

The M&A lifecycle is divided into three parts – pre-deal, pre-announcement, and post announcement.

Pre-deal

At this stage, the acquirer has not made a decision about going through a merger or an acquisition. This stage has two steps –

M&A Strategy

In this step, the acquirer establishes a broad corporate-wide strategy in-order to embark on the path of a merger or an acquisition. In this, M&A targets are determined, portfolios are reviewed, a list of potential acquisitions is prepared, and decision rights and accountabilities are established.

Target Screening

This is the second step of the M&A lifecycle. During an M&A transaction, the acquirer has a portfolio of hundreds of companies to choose from. In target screening, the acquirer brings this list down from hundreds to final few companies. Based on their business models, financial valuation, potential growth prospects, etc., the acquirer will select these final few.

Pre-announcement

Due Diligence and Evaluation

This is the third step of the M&A lifecycle; it follows the steps – M&A strategy and target screening, respectively, and is followed by steps of integration/ separation planning and integration/ separation execution. From the perspective of this article, this is the most important step for us because here, the acquirer conducts the due diligence and makes the due diligence report.

Talking about the due diligence report, let’s now elucidate on the topic. As stated previously, a due diligence report is a summary of all the findings that are derived from analyzing a company. A due diligence report includes information about the following items –

Finance

This may be the most important area in the due diligence report. This includes information about the financial health of the company. The acquirer includes data such as ratio analysis, cash flow, earnings, dividend yields, debt, equity, etc., in the due diligence report to explain the findings.

Administration

This area includes the administrative aspects of the company. This includes the workings of factories, office processes, etc. These findings help understand the regular workings of the target company.

Legal

This area explores legal aspects such as legal structures, pending litigations, contracts pertaining to loans, property, employees, etc. This basically examines the legal basis of the M&A deal.

Human Resource

This area analysis the human side of the company. The due diligence report includes Information on the number of employees, current positions, salaries, turnover rates, organization structure, accountabilities, etc. All this information helps understand the human capital and related liabilities that the acquirer will undertake after the acquisition.

Accounting

Accounting includes the analysis of the accounting policies and principles that the target company follows. For example, does the company follow IFRS or US GAAP accounting system? LIFO or FIFO? Etc. Once it is clear, the due diligence report includes the logic behind the choice of methods.

Taxes

Taxes have a maximum effect on the profitability of the company. This area of due diligence report includes a review of all types of taxes that a company pays. Furthermore, it also includes an analysis of tax liabilities and extraordinary taxes.

Operations

In this, a due diligence report tries to explain the operations of the company. This area covers all the operations-related questions. Some examples include – What is the product or service that the target company is selling? What is the USP of the product? What is the workflow and process flow in the company? How does the target company expand its market? Etc.

Intellectual Property

The acquirer thoroughly analyzes intellectual property as it is one of the company’s major selling points. Intellectual property includes items such as brands, patents, trademarks, copyright, trade secrets, etc. As these are the assets that differentiate the target company from its competitors, the due diligence report covers all the details pertaining to them. Details include – the type of intellectual property, the monetary value of each, liabilities on each, pending litigations, etc.

Customers

Customers or clients are the lifeblood of any business. This area of due diligence report includes information such as the largest customers of the target company, customer buying behavior, seasonal fluctuations, if any, credit policies for the customers, etc.

Technology

In this contemporary world, the tech ecosystem of any company is very important. The due diligence report includes data regarding the technology of the target company. This data provides information about the company’s hardware, software, the latency of the system, period when the existing technology will become obsolete. This gives the buyer an idea about future investment in technology.

Environment

This area of due diligence report helps understand the steps that the target company takes for environment preservation. In these times, this area has become a hot topic. Therefore, detailed analysis is required on the data of the target company’s carbon footprint, its water management, CSR activities for the environment, pending litigations regards to environmental laws, etc.

Strategic

The due diligence report covers this area in order to understand whether the target company is a good fit for the acquirer. This includes how easy/ difficult it is to merge the companies. Is it profitable to merge the company? Does it add value? Etc.

Once the due diligence report is made, the acquirer will finally decide if it wants to move forward with the merger or not. If the answer is yes, then the final part of the M&A transaction is undertaken. The last stage of the M&A transaction is –

Post-Announcement

There are two steps in post-announcement –

Integration/ Separation Planning

In this stage, the acquirer plans on the “how” of a merger or an acquisition. The question here is, “how will we implement this transaction?” In this, the acquirer combines and makes new operating models, integrates the management, people are addressed, new plans to implement new culture are made, and communications are synergized. Overall the plans to bring the whole organization together come into being.

Integration/ Separation Execution

In this final step, the acquirer implements all the plans made during the integration/ separation planning stage, and a new company comes into existence.