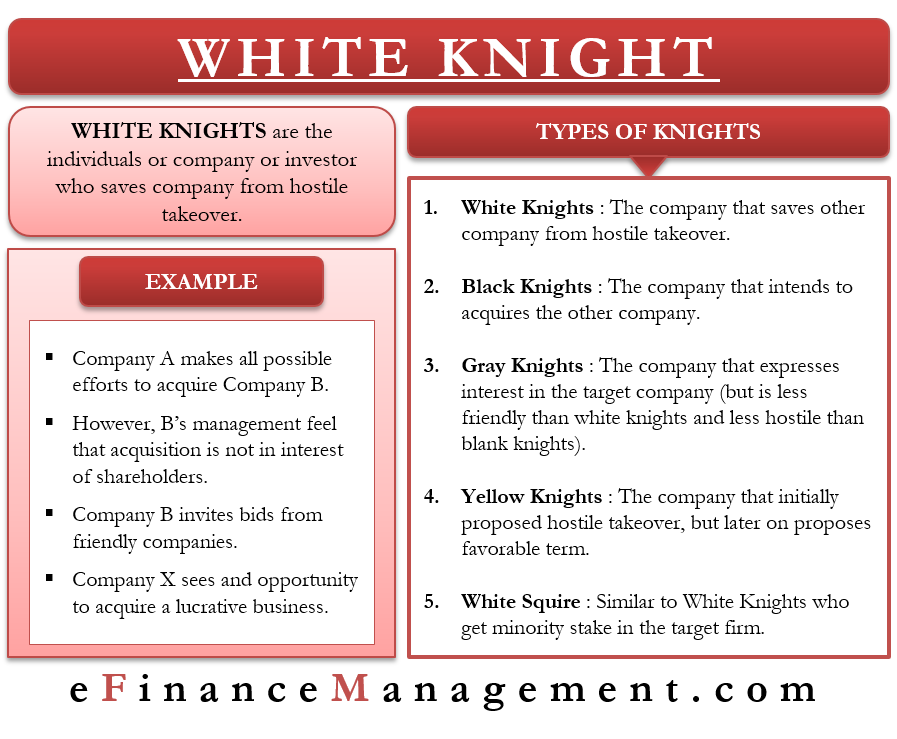

A White Knight is a term that comes into use when talking about takeovers. Basically, it refers to an individual, investor, or company that saves another company from a hostile takeover. The White Knight saves the target company by acquiring it before a hostile company acquires it.

Concept of White Knight

Generally, the term white knight is associated with goodness and virtue. In a battle, the White Knight is the one that saves people from being killed. The same concept applies to the financial battlefield as well.

In the business world, hostile takeovers are a common thing. Generally, businesses or individuals buy shares of the company they want to acquire from the open market or make unsolicited proposals to get hold of the company. A hostile takeover could be in two ways:

- The acquiring company buys or gains a controlling stake in the target company.

- Or, the acquiring company wins the approval of the shareholders to replace the current board with the new board, which is in favor of the takeover.

To avoid such a takeover, the target company seeks a friendly investor or a company to acquire it by offering acceptable terms. Though any kind of takeover takes away the independence of a company, a takeover by a friendly investor is still better than a hostile takeover.

Usually, there is no change in management in a friendly takeover. To acquire the target firm, the white knight may offer a higher bid or offer better terms to the management of the target firm.

Every company wants to avoid a hostile takeover because:

- It takes away its independence.

- It takes away the company’s vision, mission, and objectives.

- A company won’t be able to create value for the stakeholders, including investors, employees, and customers.

Read more about Hostile Takeover.

Example

Assume Company A is making all possible efforts to acquire Company B. However, the management of Company B feels that the acquisition by Company A is not in the interest of the shareholders. To avoid this, Company B invites bids from friendly companies.

Company X has long been associated with Company B and shares good terms with its board as well. So, Company X here sees an opportunity to save Company B from the hostile takeover and, at the same time, acquire a lucrative business. Thus, Company B accepts the bid from Company X to avoid the acquisition from Company A.

Real-World Examples

- In 1984, Saul Steinberg was threatening Walt Disney Productions with a hostile takeover. At the time, Sid Bass and his sons bought a significant stake in the company to save Walt Disney from the hostile takeover.

- Bayer rescuing Schering from Merck KGaA in 2006.

- In 2007, Nissin Foods acquired Myojo Foods after a US hedge fund (Steel Partners) made efforts to acquire it.

Other Types of Knights

In the above example, Company X is the White Knight, while Company A is the Black Knight or a corporate raider. And, if a fourth company expresses an interest in acquiring Company B, but it is less friendly than Company X and less hostile than Company A, then it is called a Gray Knight. In a situation where a target company is unable to find a White Knight, it can go with the Gray Knight, which is always better than the Black Knight.

Also Read: Hostile Takeover

There is also a Yellow Knight. It is a company that was initially planning a hostile takeover but later proposes favorable terms to the target company.

There can also be a White Squire, who is similar to the White Knight. A White Squire does not plan to acquire a majority stake in the target firm but instead supports the company to avoid a hostile takeover. Usually, a White Squire gets a minority stake and special voting rights in the target firm. It buys only those numbers of shares in the target company that can help to stop the Black Knight.

For example, in 2016, billionaire Patrick Soon-Shiong became White Squire by investing $70.5 million in Tribune Publishing Co. The $70.5 million investment made Patrick Soon-Shiong Tribune’s second-largest shareholder. And this allowed Tribune to avoid the hostile takeover bid by Gannett Co.

Tribune initially rejected the offer from Gannett as it was not in the best interest of the shareholders. After the initial rejection, Gannett asked Tribune’s shareholders to revolt against the company.

Acquisition Not Necessary

In a few rare cases, White Knight is also said to be a firm that acquires a struggling company to turn it around. In this case, the struggling company faces no threat of a hostile takeover. For example, Bear Stearns was struggling with its share price in 2008. At the time, JPMorgan Chase became the White Knight and acquired Bear Stearns to save it.

Or White Knight can also be a firm or an individual who helps the company pay off its debt burden. In such a case, the company helps the other company to survive and not to avoid any hostile takeover. For example, the American Broadcasting Company (ABC) was nearing bankruptcy in 1953. United Paramount Theatres became the white knight by buying ABC at the time.

Bidding War

In many cases, it is seen that the entry of the White Knight starts a bidding war with the Black Knight. Black Knight will continue to raise its bid so that the management of the target company gets no reason to accept White Knights’ bid. On the other hand, the friendly investor would also increase its bid to prevent the hostile takeover. This may lead to a bidding war between the two.

Instead of a bidding war, Black Knight may also follow a different strategy. After the entry of the friendly investor, Black Knight steps back and does nothing. Once the friendly investor acquires the target company, the Black Knight re-enters the scene and acquires the White Knight.

RELATED POSTS

- 18 Hostile Takeover Defense Strategies (Pre and Post-Offer) – An Exclusive List

- Takeovers

- Poison Pill: Meaning, Pros & Cons, Types, Examples, and More

- Scorched Earth Policy – Meaning, Types, Drawbacks, and More

- Bear Hug – Meaning, Bear Hug Letter, Advantages, Disadvantages, and Example

- Just Say No Defense – Definition, Advantage, Limitations, and Example