What is a Vertical Merger?

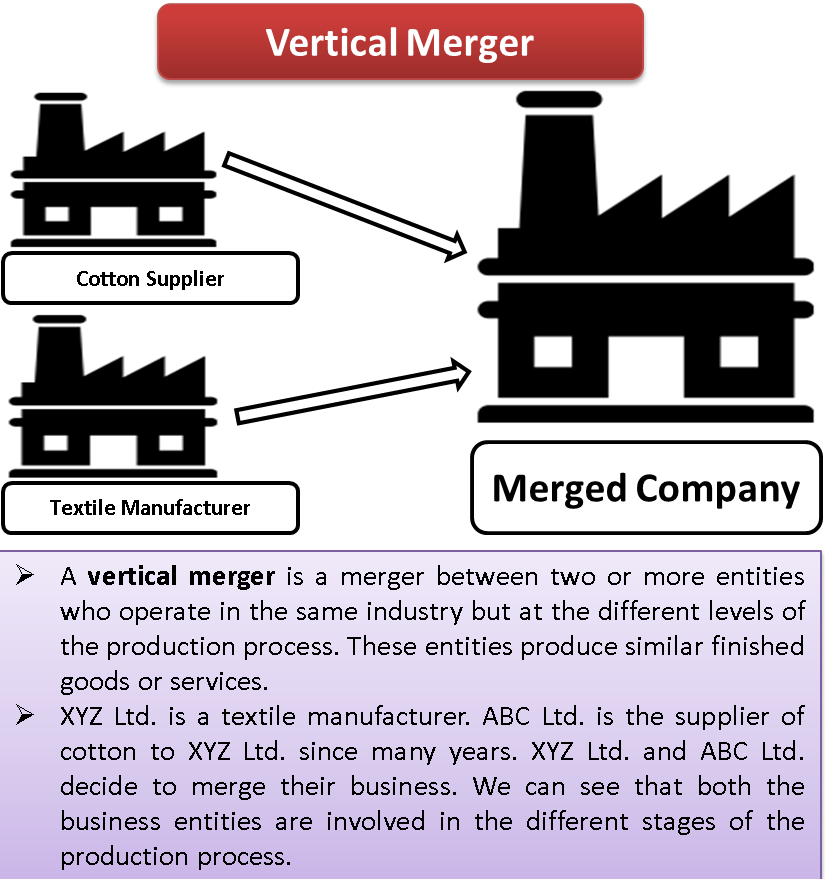

A vertical merger is a merger between two or more entities that operate in the same industry but at different levels of the production process. These entities produce similar finished goods or services. Such a merger helps in bringing efficiency to operations and expanding the revenue streams of the business. It is a strategy for expanding the company’s business operations into different steps on the same production path.

Economic Definition of Vertical Merger

As per the business definition on MBDV.Gov, “Vertical merger occurs when two or more firms, operating at different levels within an industry’s supply chain, merge operations.” While as per another definition on business.gov, “Vertical Merger is a combination of two or more firms involved in different stages of production or distribution of the same product.”

Along with such mergers, there are a few more types of mergers and acquisitions, which are also useful for the growth and diversification of the companies businesses.

Vertical Merger Example

XYZ Ltd. is a textile manufacturer. ABC Ltd. is the supplier of cotton to XYZ Ltd. for many years. XYZ Ltd. and ABC Ltd. decide to merge their business. We can see that both the business entities are involved in the different stages of the production process. The reason for merging is to bring efficiency to operations. By cutting the extra costs and increasing the profits of both businesses.

Also Read: Horizontal Merger

Real-life Examples of Vertical Mergers

The following are real-life examples of vertical mergers:

AT&T and Time Warner

In 2018, AT&T, a telecommunications company, acquired Time Warner, a media and entertainment conglomerate. This merger allowed AT&T to vertically integrate its distribution networks with Time Warner’s content creation and distribution capabilities, creating a comprehensive media and telecommunications company.

Amazon and Whole Foods Market

In 2017, Amazon acquired Whole Foods Market, a supermarket chain specializing in organic and natural foods. This vertical merger allowed Amazon to enter the grocery industry and gain control over the entire supply chain, from food production to distribution and retail, bolstering its presence in the retail market.

CVS Health and Aetna

In 2018, CVS Health, a retail pharmacy and healthcare company, acquired Aetna, a health insurance provider. This merger combined CVS’s pharmacy services and retail presence with Aetna’s health insurance expertise, aiming to create an integrated healthcare delivery system and improve patient outcomes.

Vertical Merger and Horizontal Merger

Vertical mergers and horizontal mergers are two separate concepts. It usually takes place between a manufacturer and a supplier. In contrast, horizontal mergers occur by acquiring a competitor in the same business line as the acquiring company.

The main aim of a vertical merger is to increase the market share, improve efficiencies and maximize cost savings to realize higher profits. In contrast, a horizontal merger aims to expand the company’s product range and increase its revenue by selling more and more goods or services.

It is also known as ‘Vertical Integration’ and can occur either through forwarding integration or backward integration. On the other hand, a horizontal merger, better known as ‘Horizontal Integration,’ consists of the acquisition of companies in the same industry, producing similar goods or services.

Read more on the Differences between Vertical Integration and Horizontal Integration.

The logic behind the vertical merger is to increase synergies created by the merging firms. And increase the overall operational efficiency. In contrast, horizontal mergers’ logic is to reduce the competition in the marketplace, creating a monopoly for the business.

Conclusion

A vertical merger is becoming an integral part of many business strategies nowadays. The economic benefits of the vertical merger are driving many business houses to join hands with other businesses working at different levels of the supply chain for similar products and services. Going ahead, the vertical merger will become a common norm because of many economic benefits.