Rolling forecasts are a type of forecasting method that uses the current data to predict the crucial aspects of a business throughout the year or on an ongoing basis. This forecasting method uses add/drop approach. This means it automatically drops the month or period that is no more relevant or the oldest ones and picks up the new month or period.

Thus, it gives management a forecast based on the most recent numbers. In this dynamic and fast-changing business environment, this method of using the latest numbers for forecasting becomes very crucial and critical.

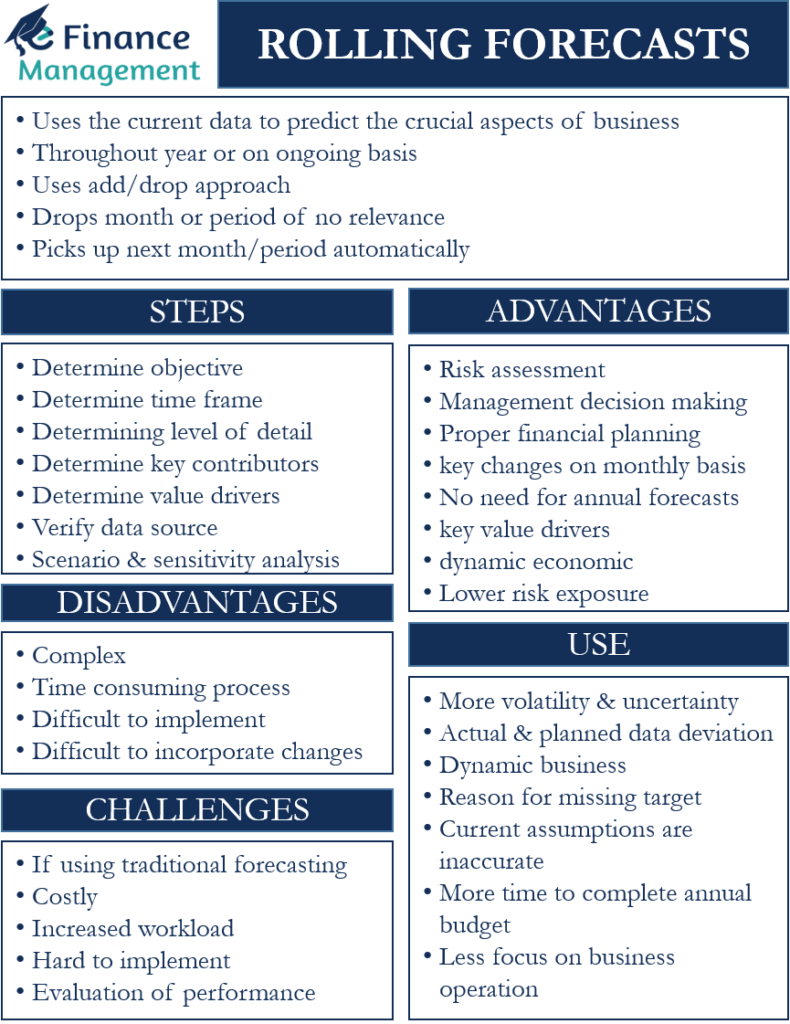

Rolling Forecasts – Steps

Rolling forecasts are very different from usual forecasting methods. Thus, it is crucial to know the steps to come up with accurate rolling forecasts. Following are the steps to create such types of forecasts:

Determine Objective

The team responsible for preparing the forecast must identify the usability of the forecasts. Also, the team should identify the person who will be using the forecasts for the decision-making.

Also Read: Rolling Budgets

Determine Time Frame

The team must always keep in mind the time frame of forecasts. Here, the time frame means how far the forecast will be relevant in the future. Also, the team must decide on the forecast increments.

For example, a team chooses an increment of a month for a 12-month forecast. This means the team will continuously forecast for 12 months and will drop and add a month every month.

Determining Level of Detail

Usually, it is the length of the forecast that partly helps in determining the level of detail in a forecast. For instance, if the forecast is for a longer period, then the level of detail is usually less. Also, suppose the decision that one will be taking on the basis of the forecast is very substantial. In that case, it becomes more important to ensure forecasts include a greater level of detail.

Determine Key Contributors

It is important to determine the key contributors to the forecast. The key contributors are those that make meaningful contributions to the process. A company must reward these contributors when it achieves set targets. Also, these contributors should be held accountable if the company is unable to meet the targets.

Also Read: Forecasting Models

Determine Value Drivers

Instead of focusing on all the aspects, it is crucial to identify the value drivers. Because certain items affect or drive the whole success of such forecasts. One may easily identify the value drivers from the company’s past performance, as well as from the industry benchmarks.

Verify Data Source

The data that the team uses for the forecast must be reliable and credible. So to get accurate and reliable results, it is crucial to verify that the source of the data is trustworthy. It would otherwise lead to wrong predictions and, ultimately, wrong direction and wrong results.

Comparing Actual and Estimated Forecasts

Once the rolling forecast is ready, one should first test it with the past data to find variances (if any). In case of any variance, the team should identify the mistake and take corrective action to ensure the accuracy of the forecast.

Scenario and Sensitivity Analysis

Once the team comes up with the forecast method, it should test it with different assumptions and drivers. This will help in testing the accuracy of the results. Moreover, the team can also use different (but realistic) value drivers to get an idea of other possible outcomes. For example, base, good and bad scenarios. (Read more about sensitivity analysis and scenario analysis).

Advantages and Disadvantages of Rolling Forecasts

Below are the advantages of rolling forecast:

- It takes into account regular changes that are crucial for risk assessment.

- It plays a crucial role in management decision-making, particularly in the industry segment where changes are very fast and short-term oriented.

- Such a method assists in setting up a proper Financial Planning & Analysis team.

- It brings into light key changes on a monthly basis.

- Since this method keeps forecasting on a rolling basis, it does away with the need to make the full annual forecast once the year ends.

- It keeps track of key-value drivers that are crucial for the success of the business.

- Use of this method allows businesses to continuously adapt to the dynamic economic and industry scenarios. Thus, this helps to lower the risk exposure.

Below are the disadvantages of rolling forecasts:

- It is a complex and time-consuming process.

- Some businesses may find it difficult to implement.

- It could get difficult to incorporate changes period over period.

Rolling Forecasts – Challenges

One of the biggest hurdles for rolling forecast comes up if a company is already using traditional forecasting methods. In such a scenario, it gets very difficult for a company to move away from the old method and fully incorporate the new method.

Once it overcomes this challenge, it faces a new set of challenges. A rolling forecast can cost a company considerable time and money. Also, the company would need to give more training to the accountants to carry out such a forecast. The rolling forecast also considerably increases the workload of the accountants.

Rolling forecast is also harder to implement. Such a method is a feedback loop that keeps on changing based on real-time data. Such a methodology makes it extremely harder to implement in comparison to the traditional methods.

Another challenge for the company is determining how to evaluate performance based on a rolling forecast. This is because such a forecast keeps on changing regularly.

When to Use Rolling Forecasts?

Generally, the use of the rolling forecast method is recommended for all types of businesses. However, the use of this method is especially useful for businesses witnessing more volatility and uncertainty.

So, if the business regularly witnesses a deviation between the actual and planned data, then it is better one switch over to the rolling forecasts.

Usually, if the volatility in a business is more than that of the industry benchmark, then one must use a shorter interval for the forecast. But, if the volatility in the business is less, then the use of longer intervals is good.

Separately, if one is still unable to decide whether or not the business needs a rolling forecast, then one needs to answer the following questions:

- Is the business dynamics faces difficulty in adapting to the change?

- Did the firm or any department miss the target? And where the company is not very clear, what are the reasons for missing the target.

- The forecasting method that the company is using currently is unclear and lacks reasoning?

- In the inner business meetings, does one spends more time on talking about the variances and less on business operations?

- Do the assumptions of the current forecasting method usually turn out to be inaccurate?

- Does it take more than usual time to complete the annual budget?

If the answer to most of these questions is yes, then one must switch to the rolling forecast method. Or, one should at least start using this forecasting method along with the traditional forecasting approach.

Final Words

Even though rolling forecasts are complex and time-consuming, it is still very popular among businesses. It has its advantages over the usual forecasting methods. Several companies use the rolling forecast alongside the traditional methods. Moreover, several tools are available in the market that helps to automate the process of rolling forecasting.