Imagine that you have a big jar filled with different kinds of candies. Now, let’s say you wanted to trade or sell some of those candies to your friends. The question is, how easy or difficult would it be for you to do that? That’s where the concept of “liquidity of inventory” comes in.

“Liquidity of inventory” is like asking how easily you can turn your candies back into money.

- Demand for the Company’s Products

- Seasonality of the Products

- Lead Time for Procurement and Production

- Obsolescence and Expiration Risks

- Economic Conditions and Market Trends

- Pricing and Discount Strategies

- Quality Control Measures

- Availability of Alternative Suppliers or Substitutes

- Marketing and Sales Strategies

- Distribution Network Efficiency

- Customer Preferences and Buying Patterns

- Product Lifecycle Stage

- Conclusion

Think about it this way: If you have a jar full of popular candies that everyone loves, like chocolate bars or gummy bears, those candies would be very liquid. It means you can easily sell or trade them because many people would want them, and you can find buyers or people willing to trade with you quite easily. However, if your jar is filled with candies that are not so popular or maybe they’re expired or broken, then it would be harder to find someone who wants them. Here, your inventory would be less liquid because it might take more time and effort to sell or trade those candies.

In our recent article “What is more Liquid – Account Receivable or Inventory?“, we have learned that accounts receivable are more liquid as compared to the inventory. In this article, we will learn what are the various reasons of inventory being less liquid.

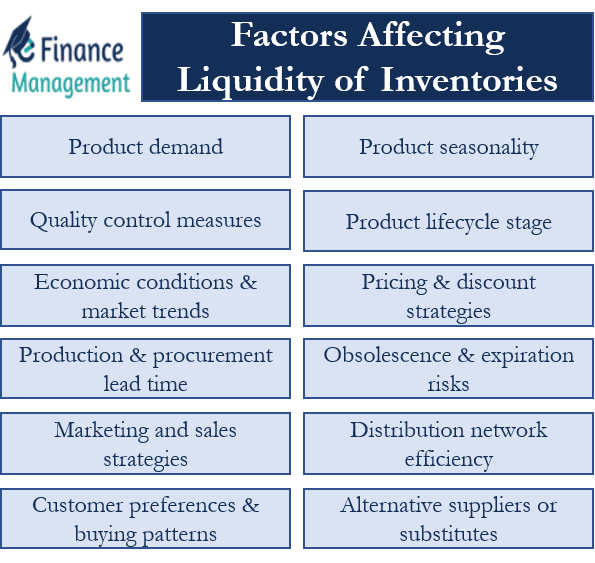

Several factors affecting the liquidity of inventories are as follows:

Demand for the Company’s Products

The level of customer demand directly affects the liquidity of inventories. Higher demand usually results in faster inventory turnover and increased liquidity, while lower demand can lead to slower inventory turnover and reduced liquidity.

For example, if you have candies that are really popular and lots of people want them, it will be easier to sell or trade them quickly. On the other hand, if your candies are not as popular or not many people are interested in them, it might take longer to find someone who wants them.

Seasonality of the Products

If a company’s products are subject to seasonal fluctuations in demand, it can impact inventory liquidity. During peak seasons, inventory may sell quickly, leading to higher liquidity. In contrast, during off-peak seasons, inventory may accumulate, potentially reducing liquidity. For example, winter clothing tends to be more liquid during colder months. Understanding the seasonal patterns of a product is crucial in assessing its liquidity.

Lead Time for Procurement and Production

The time it takes to procure raw materials and components, as well as to produce finished goods influences inventory liquidity. Longer lead times may result in increased inventory levels, potentially impacting liquidity.

Obsolescence and Expiration Risks

Inventory items that are prone to obsolescence or perishability pose liquidity risks. If products become obsolete or expire, their value may diminish, potentially impacting the company’s liquidity. Perishable goods have a limited shelf life, and their liquidity decreases as they approach their expiration dates. It becomes essential to sell or trade them quickly before they become unsellable.

Let’s say a fisherman catches a batch of fresh fish, such as salmon, that needs to be sold quickly. Initially, when the fish is fresh and in high demand, it has good liquidity, and buyers are willing to purchase it at a good price. However, as the fish approaches its expiration date, its liquidity decreases. The fish starts to deteriorate, losing its freshness and quality, making it less desirable to buyers.

To maintain liquidity, the fisherman must sell or trade the fish quickly, possibly by offering discounts or promoting its sale to attract buyers before it becomes unsellable. If the fisherman fails to sell the fish before it spoils, it becomes unsellable and must be discarded, resulting in a loss of inventory and decreased liquidity.

Time-sensitive management of inventory is crucial to maximize liquidity and prevent losses due to unsellable items.

Economic Conditions and Market Trends

General economic conditions and market trends can impact inventory liquidity. During economic downturns or in declining markets, demand may decrease, leading to slower inventory turnover and reduced liquidity.

Pricing and Discount Strategies

Pricing decisions and discount strategies can influence inventory liquidity. Competitive pricing and attractive discounts can stimulate demand, leading to faster inventory turnover and improved liquidity. If the price is set too high, it may deter potential buyers or traders, leading to slower liquidity. Conversely, if the price is set too low, it may attract buyers or traders quickly, but it may result in lower profitability.

Quality Control Measures

Ensuring product quality is important for maintaining customer satisfaction and demand. Effective quality control measures minimize the risk of product recalls, returns, or rejections, which can affect inventory liquidity.

Availability of Alternative Suppliers or Substitutes

The availability of alternative suppliers or substitutes can impact inventory liquidity. If a company has limited options for sourcing materials or faces competition from substitute products, it may affect the liquidity of its inventory.

Marketing and Sales Strategies

Effective marketing and sales strategies can drive customer demand and inventory turnover. Well-executed strategies, such as targeted promotions, advertising campaigns, and efficient distribution channels, can enhance inventory liquidity.

Distribution Network Efficiency

An efficient distribution network ensures that products reach customers promptly. If a company has a well-organized and effective distribution network, it can help maintain inventory liquidity by minimizing transit times and reducing inventory holding costs.

Customer Preferences and Buying Patterns

Changes in customer preferences or buying patterns can impact inventory liquidity. Understanding and adapting to customer demands and preferences are crucial for maintaining a desirable product mix and optimizing inventory levels.

Product Lifecycle Stage

The stage of a product’s lifecycle influences its demand and liquidity. In the introduction and growth stages, higher demand may lead to increased liquidity. However, during the maturity or decline stages, slower demand can affect inventory liquidity.

Conclusion

These factors affecting the liquidity of inventories interact with each other and can vary across different industries and types of inventory. Assessing and understanding these factors is important for businesses to effectively manage their inventory and ensure its liquidity.