Why is Improvement in Current Ratio Important?

The current ratio is a critical liquidity ratio utilized extensively by banks and other financing institutions while extending loans to businesses. “How to improve the current ratio?” is a general question that keeps hitting the entrepreneur’s mind now and then. For improving the current ratio, the management needs to focus on various strategies, including its current liabilities and assets, which are not one-time activities. The company has to monitor it throughout the year.

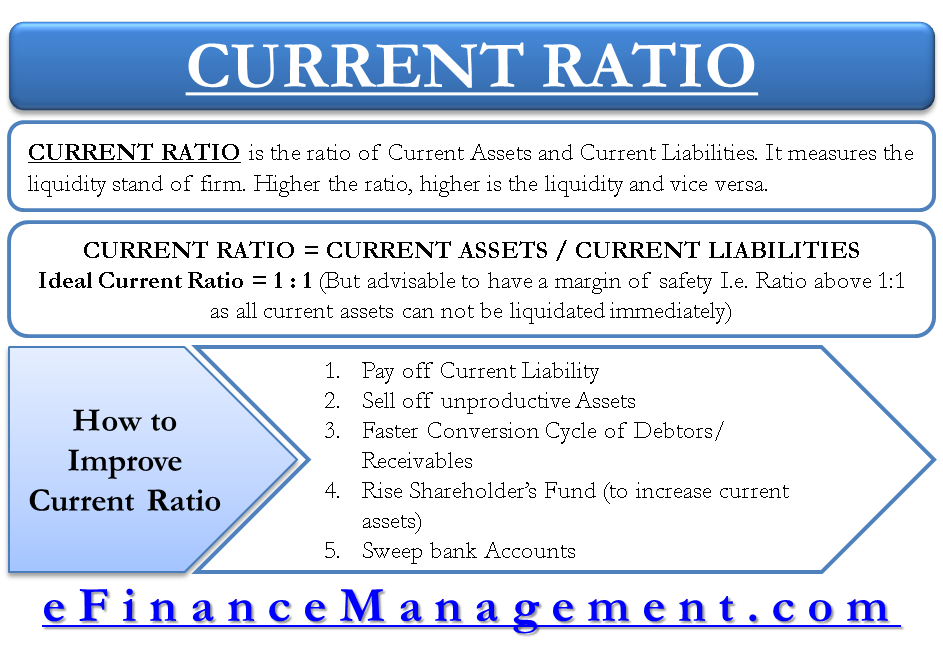

Current Ratio in Brief

The current ratio is a figure that results from dividing current assets by the current liabilities. This figure is important because it measures the liquidity stand of a firm. Normally, the assumption is that the higher the ratio, the higher is the liquidity, and vice versa. It would be unfair to conclude the liquidity based on the ratio. Without further knowing what makes this ratio, it isn’t easy to form an opinion. We can understand it better with the help of the following situation:

Explanation

- Normally, a dipping sale would increase the level of inventories. We cannot settle the claims of creditors with inventory; it would require hard cash. Undoubtedly, the ratio, in this case, is increasing but without improving the liquidity.

- Secondly, delayed payments by customers will increase the debtor’s level and eventually the current assets and, therefore, the current ratio. Here also, we can see the increase in the current ratio but a decline in the actual level of liquidity.

With the help of the above example, let us understand better, a current ratio of 1:1 is not sufficient because all the current assets are not readily convertible into cash. There is always a requirement for a cushion over and above 1. This cushion is technically called “Margin of Safety.” In other words, current assets over and above the current liabilities are the margin of safety. We need marginal current assets simply as all the current assets can quickly liquidate to cash.

Refer to CURRENT RATIO for details.

How to Improve the Current Ratio?

Faster Conversion Cycle of Debtors or Accounts Receivables

Faster rolling of money via debtors will keep the current ratio in control. At least, the ratio will show the correct picture if the debtors are liquid. A constant follow-up with the debtors can improve the collections from them. The payment terms should be clear in the first dealing itself, and the negotiated credit period should be as low as possible.

Also Read: How to Reduce Current Ratio and Why?

Pay off Current Liabilities

Not only does the current ratio depend on current assets, but it is also equally dependent on the current liability, which is the denominator. They should pay off as often and as early as possible. It would decrease the level of current liabilities and, therefore, improve the current ratio. Early payments to creditors can save interest costs and earn discounts, directly impacting the firm’s profits.

Sell-off Unproductive Assets

The cash level can also increase by selling unused fixed assets. Otherwise, the money unnecessarily gets blocked into them, and idle cash accrues interest costs.

Improve Current Assets by Rising Shareholder’s Funds

When the current assets are financed by equity rather than the creditors, the level of current assets will increase with current liabilities remaining the same. Consequently, this exercise will improve the current ratio. Considering the improvement of the current ratio, drawings are not advisable. It is because drawings would reduce capital investment in the current assets. And therefore, the level of current liabilities will increase to finance the current asset. All this directly impacts the current ratio. In essence, owners’ funds, i.e., capital and reserves, and surpluses should remain invested in the firm to balance the current ratio.

Sweep Bank Accounts

First of all, the firm’s management should always try to cut down on challenging cash levels and keep the money in bank accounts. The sweeping facility should be available in the bank accounts, which almost every bank and financial institution provide. Sweeping is a facility by which the excess funds from the current account are transferred to another account that fetches interest on that fund. At the same time, these funds are available to use when required.

Our conversation above is mainly focusing on analyzing and improving the current ratio. Normally, the rule for this ratio is “higher the better.” It would be pretty interesting to know that in certain situations, it is advisable to reduce the current ratio.

Let’s check out Why and How to Reduce Current Ratio?

Quiz on How to Analyze and Improve Current Ratio?

It’s very useful.

Thank you for helping me in understanding more about reducing current ratio.

You are most welcomed.

I want to analyze and improve the current ratio. This article is really helpful and very easy to understand. This is a very helpful site. Thanks for sharing this article.

First of all I have to say that, this site is superb. Thanks for your efforts to make us understand these ratios in as easy as possible.