What do we Mean by CAMELS Approach?

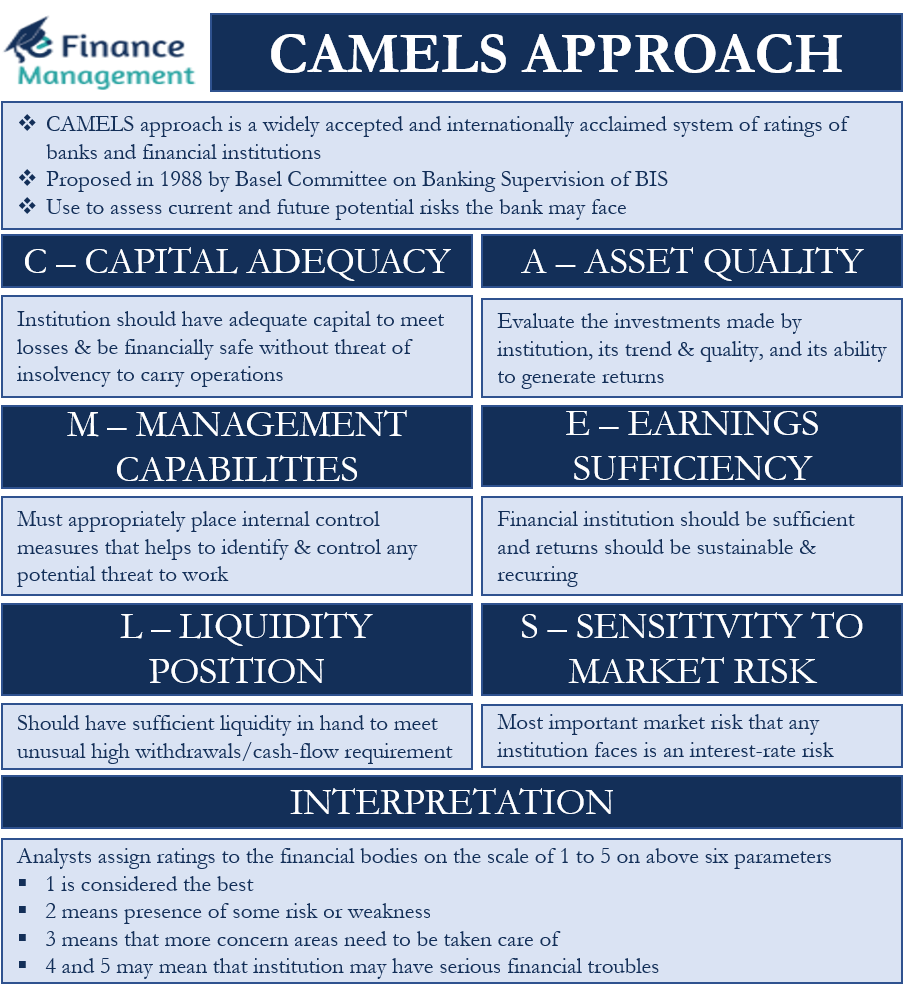

CAMELS approach is a widely accepted and internationally acclaimed system of ratings of banks and financial institutions. It was proposed in 1988 by the Basel Committee on Banking Supervision of the BIS (Bank of International Settlements). Analysts and regulatory bodies use this approach to measure the risk and performance of financial institutions. This is an approach to monitor and supervise the banking operations. Or we can say the robustness or otherwise of the bank under scrutiny. Through this approach, we can effectively and efficiently assess the current and future potential risks the bank may face. CAMELS is an acronym for six key performance parameters. C stands for Capital adequacy, A for Asset quality, M for Management capabilities, E for Earnings sufficiency, L for Liquidity position, and S for Sensitivity to market risk.

Methodology and Interpretation

Analysts assign ratings to the financial bodies on the scale of 1 to 5 on the above six parameters. The assigned rating works in a sequential manner, where a rating of 1 is considered the best. A higher rating means deterioration in parameter quality, with a rating of 5 being the worst. These ratings are used only for top management to take control and corrective measures. And for regulatory bodies to determine if the financial institution is in good condition to operate or not.

CAMELS approach and rating system, like any other rating system, helps one identify the financial institutions’ strengths and weaknesses. More importantly, the approach is helpful to identify the solvency and insolvency position of the institution. It helps to identify a failing institution at the right time. Therefore, this helps to take corrective measures and save them.

Six key Parameters of CAMELS Approach

Capital Adequacy

No one can deny the importance and critical status of Capital adequacy for the success of any financial institution. Hence, every banking and financial institution should have adequate capital, and it will help it absorb the losses arising out of defaults, operational losses, natural calamities, disasters, etc. Thus, the institution should have adequate capital to meet these losses and still be financially safe and secure without any threat of insolvency to carry on the operations smoothly.

Also Read: Objectives of Financial Statement Analysis

Basel III norms prescribe the minimum capital requirements for financial institutions. Regulators and analysts should consider capital trend analysis, dividend policy, interest practices, future growth plans, and their associated risk, earnings potential, and the overall economic environment. Also, they should use ratio analysis to ascertain the institution’s capital adequacy. The key ratios to consider are CRAR (Capital to risk-weighted assets ratio, Debt-Equity ratio, and Equity to total assets.

Asset Quality

There is a variable amount of credit risk with any institution’s loans and investments. High credit risk will result in a higher rating and vice-versa. However, the credit risk of loans in turn depends upon the creditworthiness of the borrower. The regulators should break up the loans and advances into two parts- the loans made to relatively safe banks and other financial institutions and the advances made to the general public or customers. They should evaluate the investments made by the institution, its trend and quality, and its ability to generate returns. Also, regulators should consider the adequacy of measures in place to withstand any credit loss. Moreover, they also need to see and assess that the institution has a well-documented and proper working system in place to identify potential risks timely in advance.

Some key ratios to consider while evaluating the asset quality are Financial assets to Assets, Non-current receivables to total receivables, Interbank loans and investments to assets, etc.

Management Capabilities

The capability of the management to adequately balance the risk and return opportunities is the key to the success of any financial institution. The management must be active, open to new ideas and investment opportunities, and capable of exploiting the new technology and innovations to maximize returns while minimizing risk. Risk can be in the form of operational risk, market risk, credit risk, social risk, or legal risk.

The management must appropriately place internal control measures that will help it identify and control any potential threat to work. After that, the regulators should check for internal audit measures, clarity, transparency of communication from the management, and quality of financial reporting followed by the institution. Also, they should consider the future growth plan of the management, the growth rate, and its ability to achieve those goals while deciding on the ratings.

Some key ratios to consider to judge the management capabilities are Total advances to Total Benefits, the business generated per employee, and the return on advances.

Earnings Sufficiency

The Earnings of any financial institution should be sufficient. Moreover, the returns should be sustainable and recurring. Also, the rate of return should be above the cost of the capital to generate adequate profits. The analysts evaluate the earnings potential and plans of the management to sustain and grow the earnings. Also, they assess the core earnings of the institution because they are usually long-term and permanent. While the interest and service income are more desirable because they are relatively long-term in nature, earnings from trading activities are more volatile and non-permanent and can adversely affect the ratings.

The key ratios that affect the ratings of the institutions regarding earnings sufficiency are Net Profit to Total Assets, ROA and ROE, Net interest margin, etc.

Liquidity Position

Liquidity is of paramount importance to any bank or financial institution. It should have sufficient liquidity in hand. The liquidity comes in handy to meet any unusual high withdrawals or cash-flow requirements. Such withdrawals should not significantly impact the institution’s day-to-day operations. Analysts rate the institutions based on their liquidity position. It is again a vital rating parameter. A prolonged and severe liquidity crisis can result in the collapse of the entire banking/system and economy.

Analysts take a few key ratios into account while rating the institution on its liquidity position. These ratios include the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio(NSFR).

Sensitivity to Market Risk

Analysts take into account the market risks that can adversely impact the performance of any financial institution while rating them. The most important market risk that any institution faces is an interest-rate risk. An increase in the interest rates will directly increase its net interest income and vice-versa. Moreover, the analysts should consider whether the institution has heavy exposure to any particular sector such as agriculture, industry, energy, etc., and its future potential. The ratings can be affected if the future of that specific sector is bleak or seems unstable. Also, any institution having high exposure to foreign exchange, commodity, or equity markets can affect its ratings.

Banks and financial institutions can use the Value at Risk (VAR) tool to measure, monitor, and control market risk. Some ratios that can help ascertain the sensitivity to market risk are Total assets to Sector assets or Deposits to Sector deposits.

How does the CAMELS Approach Work?

Analysts and regulators rate any bank or financial institution on the above six parameters on a scale of 1 to 5. The usual method they follow is to first jot down a few sub-indicators under each of the six parameters. Adopting a ratio-analysis approach is the safest and most reliable. They then compare the results under each sub-indicator with the industry average. After that, they rate the institution accordingly.

A rating of 1 is the best. It means that the institution is absolutely safe and sound. It promises good future performance and earnings at minimum risk. And it is adequately covered in case of an adverse event. A rating of 2 means that there is a presence of some risk or weakness. However, it is minimal and controllable. A rating of 3 means that more concern areas need to be taken care of. A rating of 4 and 5 may mean that the institution may have serious financial troubles. They are imminent and unavoidable in the current scenario. The risk management practices are inadequate. Thus, the problems need to be taken care of immediately for the institution to survive and to remain solvent and operational.

Summary

CAMELS approach is fundamental and useful for the management, analysts, and regulatory bodies to adjudge the performance and risk involved with banks and financial institutions. Banks are the backbones of any economy. Hence their performance evaluation and benchmarking are of paramount importance to ensure that they are financially stable and sound without any unsustainable operational risk in the near future.

However, this approach has a few limitations as well. It is subject to the respective evaluator’s judgment, subjectivity, and bias. Improper or incomparable reports can result in inconsistency in the final ratings. Therefore, this approach should be used with utmost care. It should be one of the tools to judge the performance of any particular bank or financial institution and not the only one.