Foreign Exchange Risk: Meaning

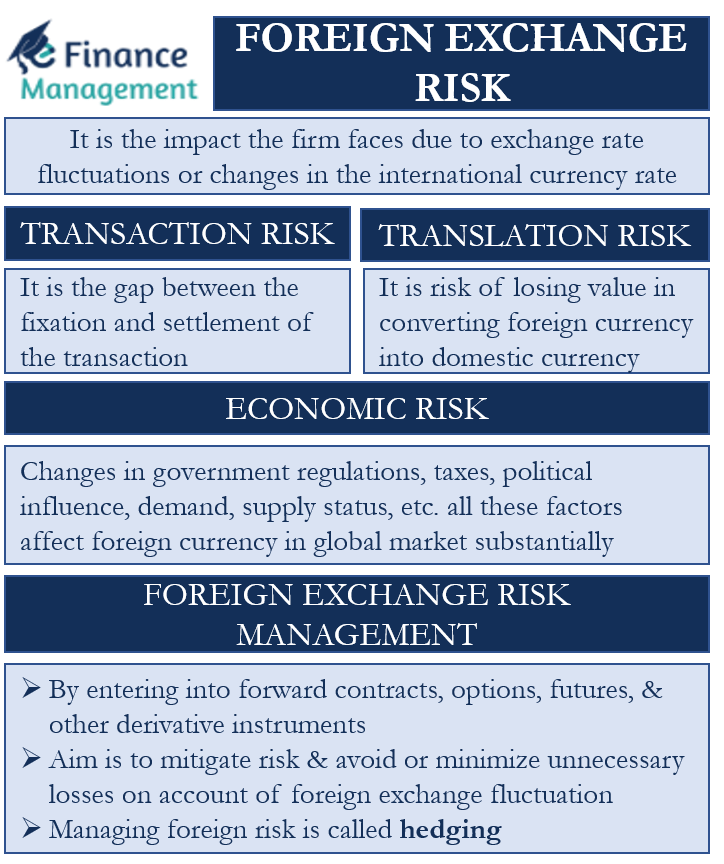

In simple words, foreign exchange risk is the impact the firm faces due to exchange rate fluctuations or changes in the international currency rate. Many global firms called ‘Multi-National Corporations’ operate in many different countries. For example, Nestle is currently selling products in 186 countries along with its operations in many countries. The effect of the change in the foreign currency of these countries on Nestle’s financial position is paramount. Global companies that import and export goods frequently are exposed to foreign exchange rate risk directly.

Let us assume, the headquarter of Nestle is in Switzerland. Now, as Nestle is present worldwide, it is also doing business in the US. The foreign currency of Switzerland is euros and that of the US is dollars. As the firm is doing major business in the US, the currency received is dollars. The financial transactions carried out in dollars (foreign currency) must be converted back to euros (domestic currency). And that is where foreign exchange rate risk comes into the picture. The fluctuations in the USD/Euro, either appreciation or depreciation can cause a significant effect on the transaction value of business and financial statements of Nestle.

Types of Foreign Exchange Risk:

Transaction Risk

Transaction risk arises when the exchange rate fluctuates before the firm closes the settlement. It is the gap between the fixation of the transaction and the settlement of the transaction. The time delay could be due to prolonged paperwork, the occurrence of unforeseen circumstances. Or the difference in the date of agreement and date of completion of the transaction. The higher the time frame or the time gap between the two, the higher will be the transaction risk. Not only MNCs and corporations, but hedge funds, mutual funds, and institutional investors also face transaction risks.

Translation Risk

Translation risk is the risk of losing value in converting foreign currency into domestic currency. As a protocol, firms file quarterly reports in their home country. And it is done by converting the values into domestic currency. As we saw in the case of Nestle when the firm wants to convert their business financial statements from US (dollars) to Switzerland’s currency (Euros) there is a potential translation risk. Hence, a company holding its assets and liabilities in foreign countries possesses translation risk. So, if the foreign currency appreciates, the revenue in the home country’s currency will lose more value. Then what it previously would have been with the old foreign exchange rate. And vice versa if the foreign currency depreciates during the time of translation.

Economic Risk

Macroeconomic conditions affect the currency value of the country to a great extent. Changes in government regulations, taxes, political influence, demand, supply status, etc. All these factors affect the foreign currency in the global market substantially. For example, if Nestle wants to sell a product in the US. And the euro appreciates against the dollar due to positive changes in macro factors in Switzerland. Then, the importers in the US will be reluctant in buying the product at the appreciated euro price. If a country is facing frequent uncertainties or fluctuations in the macro trends, then the MNC doing business in the country will face frequent economic risk.

Foreign Exchange Risk Management

There are thousands of companies operating in different countries, facing foreign exchange risk. There are ways to mitigate the risk by entering into forward contracts, options, futures, and other derivative instruments. The main aim is to mitigate the risk and avoid or minimize unnecessary losses on account of foreign exchange fluctuation. Every firm according to their needs will customize and adopt ways to lower their exposure to the risk. A common word for managing foreign risk is ‘hedging’.

For example, ABC company based in Africa is selling spices in the US. As there are constant fluctuations of domestic currency against the dollar, the firm will use forward contracts in managing the risk. So, if a consignment of spices is to go out in the next 30 days, they will enter into a forward contract. As the forward contract is customizable, both parties will choose the details and fix a rate of the dollar. Thus, this way ABC company will avoid facing the risk of dollar price appreciation against their domestic currency.