What is Altman Z-Score?

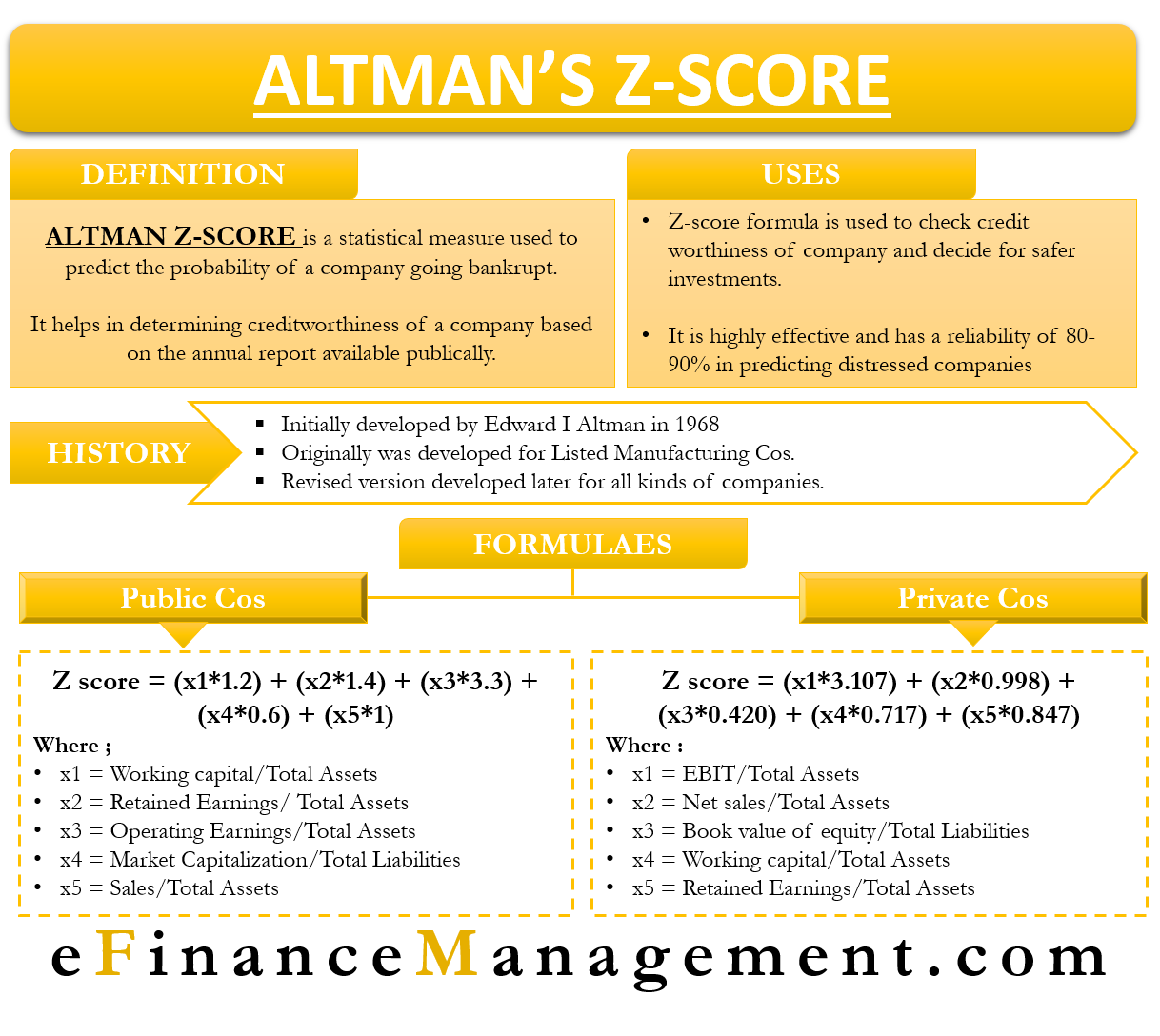

The Altman Z-Score is a statistical measure used to predict the probability of a company going bankrupt. It is an important measure to gauge a company’s creditworthiness using data publicly available in the annual report of a company.

Use of Altman Z-Score?

As we are all aware, the fundamental idea to make higher profits in a stock market is “Buy Low – Sell High.” This means we need to buy a stock at its lowest possible value and sell it when it reaches its highest possible value to make higher returns. Hence, it happens many times that a potential investor waits for the stock to go as low as possible before entering into it. Therefore, in haste to buy a stock at its lowest value, one should not neglect its chances of going bankrupt. Hence, investors use the Z-score formula to check a company’s creditworthiness and decide on safer investments. During the big financial crisis in 2008, the Z-Score formula has helped Altman to predict the crisis beforehand. The formula is highly effective and has a reliability of 80-90% in predicting distressed companies in advance.

History

Edward I. Altman developed the formula in 1968 for evaluating the default rate of publicly listed manufacturing companies. The formula was initially tested on a set of 66 manufacturing companies. Revised versions developed in later years have extended its usability to all types of companies – public, private, manufacturing, and non-manufacturing firms.

The Formula for Altman Z-score

Z-score for Public Companies

The Z-Score formula is composed of a combination of a few financial ratios. Each ratio captures information on different aspects of the heath of the firm. The equation for Z-Score is the sum of all the ratios multiplied by pre-determined weights. The formula for publicly listed companies is:

Also Read: Altman Z-Score Calculator

Z score = (x1*1.2) + (x2*1.4) + (x3*3.3) + (x4*0.6) + (x5*1)

- x1 (liquidity factor) = Working capital/Total Assets

- x2 (profitability factor) = Retained Earnings/ Total Assets

- x3 (profitability factor) = Operating Earnings/Total Assets

- x4 (compares company’s value vs. liabilities) = Market Capitalization/Total Liabilities

- x5 (efficiency factor)= Sales/Total Assets

Interpretation

In general, the lower the Z-score value, the higher the probability of a company going bankrupt.

A value of less than 1.81 means there is a high chance for the company to file bankruptcy or high distress company.

If it is between 1.81 and 2.99, the company has a medium chance of going bankrupt or a medium distress company. A score higher than 2.99 means the company is far from filing bankruptcy or b a low distress company.

For a more conservative approach, 2.69 is the cut-off mark instead of 2.99.

The above score has proved to predict if a company is likely to bankrupt before one year with 95% accuracy and before two years with 83% accuracy.

For calculation, use our Altman Z- Score Calculator

Z- Score for Private Companies

The financial ratios and their weights vary a bit to predict bankruptcy in private companies. The formula for private companies is:

Z score = (x1*3.107) + (x2*0.998) + (x3*0.420) + (x4*0.717) + (x5*0.847)

- x1 = EBIT/Total Assets

- x2 = Net sales/Total Assets

- x3 = Book value of equity/Total Liabilities

- x4 = Working capital/Total Assets

- x5 = Retained Earnings/Total Assets

Interpretation

If the score is less than 1.23: there is a high chance for the company to file for bankruptcy or high distress company.

Between 1.23 and 2.9: Company has a medium chance of going bankrupt or medium distress company.

Higher than 2.9: Company is far from filing bankruptcy or low distress company

For Non-Manufacturing Company:

Z-Score = x1*6.56 + x2*3.26 + x3*6.72 + x4*1.05

Where,

- x1 = Liquidity Factor = Working Capital / Total Assets

- x2 = Leverage Factor = Retained Earnings / Total Assets

- x3 = Profitability Factor = EBIT / Total Assets

- x4 = Solvency Factor = MV or BV of Equity / Total Liabilities

- x5 = Activity Factor = Net Sales / Total Assets

Interpretation

If the score less than 1.1 is treated as very bad, while more than 2.6 is a good indicator of solvency.

Example of Altman Z-Score

Suppose Mr. X, an investor, is willing to invest in a company. He has two options, that is, to invest in A Ltd. or B Ltd. The details of the two companies are as below:

| Particulars | A Ltd. ($) | B Ltd. ($) |

| Working Capital | 250,000 | 440,000 |

| Retained Earnings | 500,000 | (100,000) |

| EBIT | 250,000 | (60,000) |

| MV / BV of Equity | 1,500,000 | 1,170,000 |

| Total Liability | 500,000 | 1,500,000 |

| Net Sales | 500,000 | 1,800,000 |

| Total Assets | 1,000,000 | 2,000,000 |

Z-Score of A Ltd.:

(0.25*1.2) + (0.5*1.4) + (0.25*3.3) + (3*0.6) + (0.5*0.999) = 4.1245

Z-Score of B Ltd.:

(0.22*1.2) + (-0.05*1.4) + (-0.03*3.3) + (0.78*0.6) + (0.9*0.999) = 1.4621

Highly useful blog

Very educative