The stock exchanges have various jargons that are known to experienced traders, but for a beginner, these would be entirely new. However, almost everyone would have heard the two most commonly used terms – Bid and Ask, which are more prevalent in the stock exchange, commodity exchanges, etc. Many may have heard about these terms, but they may not be familiar with their meaning and importance. The simplest way to understand the meaning and importance of both these terms is to know the differences between bid vs ask.

Bid vs Ask – Meaning

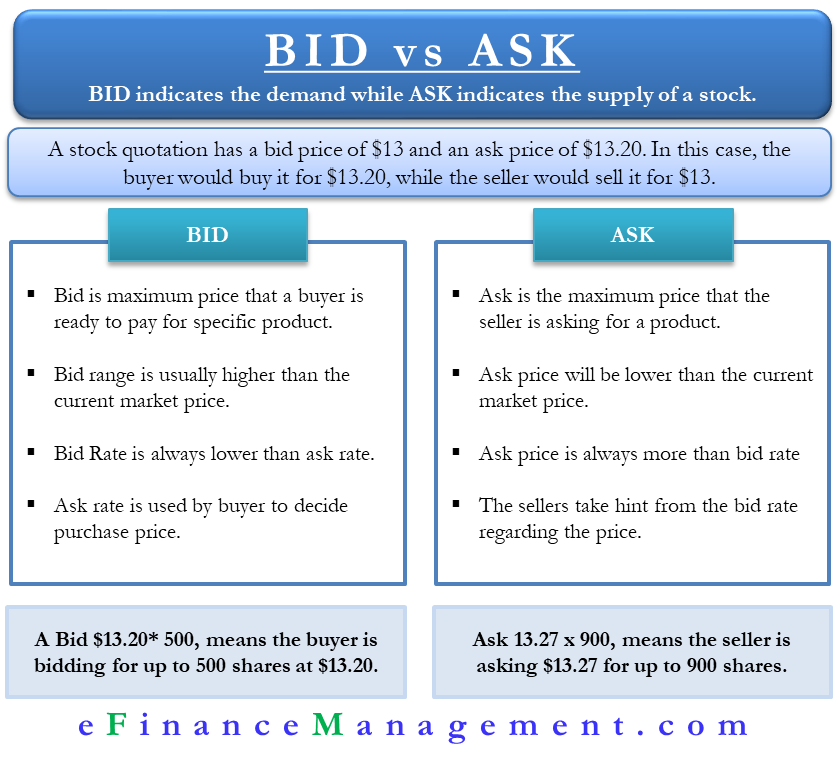

Both the terms together constitute a two-way price quotation. They represent the best potential price at which a stock or financial security can be bought or sold in the market at a given time. Buyer and seller enter into a transaction after both agree on a price that is not less than the ask price and not higher than the bid price.

Both concepts are very important for retail investors. The current stock price is the last trading price of the stock, or we can say the historical price. However, the bid and ask are the prices that buyers and sellers would offer. A point to note is that both bid and ask prices are for a particular time. Moreover, both keep changing on a real-time basis.

To put it simply, a bid indicates the demand while an ask indicates the supply of stock. For example, a stock quotation has a bid price of $9.10 and an ask price of $9.17. In this case, the buyer is willing to buy it for $9.10, while the seller is willing to sell it for $9.17. The difference between the two, i.e. 0.07 is the spread. At the point when this spread becomes zero, a transaction between buyer and seller happens. For example, in our case, if the buyer decides to increase the price for the sake of buying this share to $9.17 from $9.10 or vice versa, a transaction will take place between these parties.

Bid vs Ask – Differences

Following are the differences between bid vs ask:

Definition

A bid is a maximum price that a potential buyer is willing to spend for a specific share. On the other hand, the ask price is the minimum price that the seller is asking for a share. In the context of the stock market, it is the price at which the seller is looking to sell the share.

Range

The bid is usually higher than the current market price. On the other hand, the ask price will be lower than the current market price.

Value

The bid price is usually quoted low, and since a seller will never sell at a lower rate, the ask price will be higher.

Users

Sellers use the bid rate, and buyers use the ask rate.

Spread

It is the gap or the difference between the bid price and the ask price. A higher spread indicates a wide difference between the bid and ask. It is usually difficult to make a profit with a bigger spread. A general rule is smaller the spread, the better the liquidity.

Convention

A Bid of $13.20* 500 means a potential buyer is bidding for up to 500 shares at $13.20. Similarly, Ask 13.27 x 900 means the seller is asking $13.27 for up to 900 shares.

Also Read: Stock Exchange

Status/ order

On the buy-side, i.e., the BID would always be in decreasing manner, and the topmost bid rate would be shown on the top of the list. Likewise, the sale price would be in increasing manner, and the topmost ask price will be shown on the top of the list.

Final Words

Hopefully, after reading the above points, you will now be familiar with the meaning and importance of bid and ask. A firm understanding of these stock market terms and various aspects, such as bid and ask spread, could help new entrants trade easily in the market.