A derivative is a financial instrument that derives its value from an underlying asset. The underlying security could be shares, bonds, currencies, commodities, and more. These financial instruments are relatively intricate tools that many may find hard to comprehend but they offer hefty rewards as well. Investors or traders primarily use these instruments for hedging and speculation purposes.

Similar to shares, investors can trade derivatives contracts as well. Some derivatives contracts trade over-the-counter (OTC), while some trade on recognized exchanges. Some of the biggest derivatives exchanges in the world are the CME Group, Eurex, and the Korea Exchange. There are mainly four types of derivatives. Let us know about them in detail.

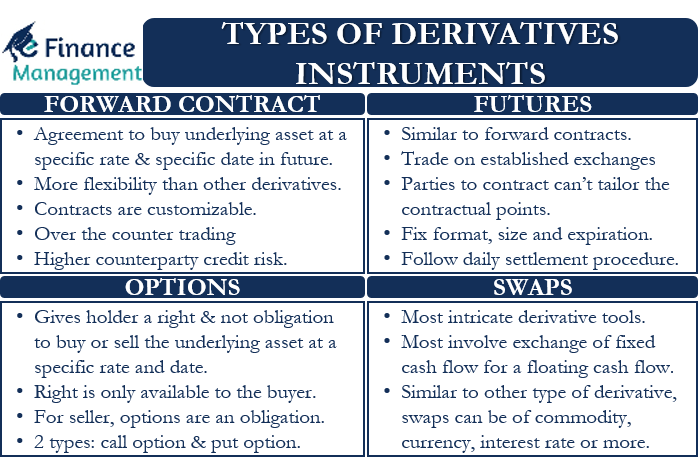

Types of Derivatives

Following are the types of derivatives:

Forward Contract

Forward contracts are the oldest and simplest types of derivatives. In this, the buyer or the holder of the forward contract enters into an agreement to buy the underlying asset at a specific price and date in the future. Such types of contracts give holders more flexibility than any other types of derivatives. This is because such contracts do not trade on recognized exchanges and are highly customizable, thus, provide traders with the flexibility to customize the price and expiry date of contracts. Such type of derivatives trades in the over-the-counter market, and thus, it is a direct contract between two parties.

Since there is no involvement of exchange, these contracts carry higher counterparty credit risk. The terms of the forward contracts remain as decided between the two parties, who may or may not make it public. We also call such contracts ‘forward commitment’ because the parties do not get the right to cancel the contract.

Suppose Mr. A owns a car and plans to sell it a year later. But he is of the view that the value of his car will decrease after one year due to regular wear and tear. So he goes to the second-hand car dealer and sell second-hand cars and shares his thought regarding the uncertainty of the price he will receive after a year for his car. The dealer put forward an idea to enter into a forward contract today where he (the dealer) will buy Mr. A’s car a year later at a price they agree on today.

Futures

The working modalities of future contracts are like that of a forward contract. Similar to the forward contracts, these agreements are also an obligation for the parties. The only difference between the two is that futures are standardized contracts that trade on established exchanges. Thus, the parties to a futures contract can not tailor the contractual points. Also, unlike the forward contracts, the buyer and seller do not enter into a contract with each other directly. Instead, they enter into a contract with the exchange. Moreover, all such contracts and their terms and conditions are no more private, as it is in the contracts of the exchange-traded market.

Futures contracts have a fixed format, size, and expiration. As all these contracts are traded on the exchange, they follow the exchange’s standard daily settlement process. This means the losses and gains settle on a daily basis. Such procedures help to reduce counterparty credit risk.

For example, Mr. A expects the price of Company X shares to go up in the near future. Thus, Mr. A buys Company X futures at the current price. Now, if the price of shares goes up in the future, Mr. A would still be able to buy shares of Company X at less than the market price.

Also Read: Forwards vs Futures Differences

Options

These are the most popular types of derivatives. Unlike forward and futures contracts, options give the holder a right. But he is under no obligation to exercise his right to buy or sell the underlying asset at a specific rate and date. In case of an option, the right is only available to the buyer. For the seller, however, options are an obligation. It means that the seller would have to fulfill the contract if the buyer exercises the option.

Options have two variants – the call option and the put option. The call options give the holder the right (not obligation) to acquire the underlying asset at a future date and at a specific price. The opposite is the status of a put option. Thus, the put option holder has the right (not obligation) to sell an underlying asset at a future date and at a specific price.

So, we can say that investors have 4 choices for trading options. They can be:

- Buyers of a call option.

- Buyers of a put option.

- Sellers of the call option.

- Sellers of the put option.

The buyer of the option has to pay a charge or fee, and we call it the option premium. Also, there are three different types of options on the basis of exercisation – European, American, and Bermudan. Depending on the type (European, American, and Bermudan), the holder can exercise the option on or before the expiry.

Assume Company A expects shares of XYZ to gain next month. Company A does not own the shares of XYX, whose current price is $10. Thus, Company A buys call options worth $2, which gives it the right to purchase shares of XYZ on or before the expiry. Now assume that the share price rose to $12. Company A will now use the option to buy the shares, which are worth $12, at $10. It means a profit of $2 per share, excluding option costs.

In both – the call and put – option, the seller must fulfill the contract if the buyer wants.

Swaps

Swaps are the most intricate derivative tools. These derivatives allow parties to exchange or swap cash flows. Most swaps involve the exchange of fixed cash flow for a floating cash flow. Similar to other types of derivatives, swaps can be of commodity, currency, interest rate, or more. Interest rate swaps are the most common types of swaps.

For example, Company ABC has a loan of $10,000 at a variable interest rate of 10%. Company ABC, however, is worried that the interest rate may rise significantly in the future. Thus, it enters into a swap agreement with Company XYZ, which is ready to exchange the 10% variable rate with a 12% fixed rate.

Now, Company ABC will pay interest at 12% to Company XYZ, who, in turn, would pay interest at 10% to the lender. In reality, the parties pay only the difference amount, in this case, 2%.

Swaps, generally, do not trade on any exchange. They are private agreements where two parties negotiate directly with each other. Thus swaps do carry a high amount of credit risk. Swaps are also risky because, ‘interest and currency’ – its most popular underlying assets – are volatile.

Final Words

All types of derivatives are a good investment avenue for experienced investors to put their surplus funds. They have emerged as popular tools to either hedge risk or make money by speculating. However, they are risky, as well. Investors must fully understand derivatives markets and instruments, as well as their consequences.