Options Trading gives a right but not an obligation to buy or sell the security at a specified price. Credit Spread and Debit Spread are a few useful strategies in options trading. The most attractive part of trading with spread strategies is that one can trade and hope to make money irrespective of the market situation – bull, bear, or sideways. Both these strategies involve the purchase and sale of options of identical expiry but varying strike prices. Moreover, both these are a defined-risk strategy that allows investors to carry bullish or bearish speculative trades. To gain maximum benefit from the two strategies, it is imperative for an investor to know the differences between Credit Spread vs Debit Spread.

Key Difference

One basic difference between both these types of spread strategies is the receipt or payment of premiums (net premiums). In Credit Spread, the investor receives the net premium, whereas, in Debit Spread, the investor pays premiums, or a debit happens to his account by net premium. Besides, the two spread strategies have a few more differences between the two spread strategies. And we will discuss those differences in the following paragraphs.

Credit Spreads

Net Credit Spread is another term for the Credit Spread. Here the investor enters into two option contracts for the same stock. One for selling the option at a higher premium and another one for buying the same stock option contract with a lower premium. And, of course, both these contacts will be at a different strike price. So, whenever there is an open position, an investor account gets credit with a premium. This is because the premium on the selling option is more. And this premium (the net premium) is the maximum profit that an investor can expect to make in a credit spread.

Example

For example, Investor A uses the credit spread strategy. A sells a November call option having a strike price of $50 at $5. And he also buys a November call option of $55 at $2. So if the strategy works and narrows down, then A will get a net premium of $ 3 (5-2).

Also Read: Vertical Spread – All You Need To Know

Trading Environment

An investor can trade a credit spread in all environments, i.e., in low, as well as high volatility. During low volatility, an investor needs to reduce its position size. And, during high volatility, an investor needs to up the volume of their trade. A credit spread strategy is less directional in nature when we talk with respect to a debit spread. But, an investor can set it up to be bullish or bearish. Due to this inherent nature where we may not be so accurate and clear about the direction of the market, We may call it a conservative strategy in the investment arena. Moreover, devising this strategy aims to earn a moderate level of profits while limiting the losses.

Unlike the debit spread, an investor can make a profit with a credit spread even when the share price drops or remains the same. Since a credit spread is an out-of-the-money option (OTM), it is usually slow to respond to market volatility. And therefore, an investor in a credit spread realizes the profit very late. Bull Put Spread and the Bear Call Spread are the most popular credit spreads.

Debit Spreads

Like credit spreads, debit spreads are also about buying two contracts. However, this is the only similarity. And under this strategy, a trader buys an option with more premium, as well as sells an option but of a lesser premium. Again both the contracts are for the same security/ stock and with the same expiry. In this, the premium is debited from the investors’ account, or the investor has to pay the premium. Investors opt for such a strategy to compensate for the costs related to buying the long options positions.

Example

For example, Investor A buys a March put option at $6, having a strike price of $30. A also sells a March put option at $2, having a strike price of $35. So, A would need to pay a net premium of $4, which would be his maximum loss.

Also Read: Call Spread vs Put Spread

An investor would want to take the debit spread when the implied volatility is low. However, a way for an investor to profit from it is when the volatility rises after entering the spread contract. In such a trade, investors expect the stock to move, either in the same or opposite direction, and expect the premium gap to widen. The investor/trader expects to profit by the widening of the premiums. a Debit spread is very useful for hedging purposes as investors gain even when the stock moves in the opposite direction.

One best-case use of a debit spread is when an investor has many bearish positions and needs bullish exposure.

Credit Spread vs Debit Spread – Advantages and Disadvantages

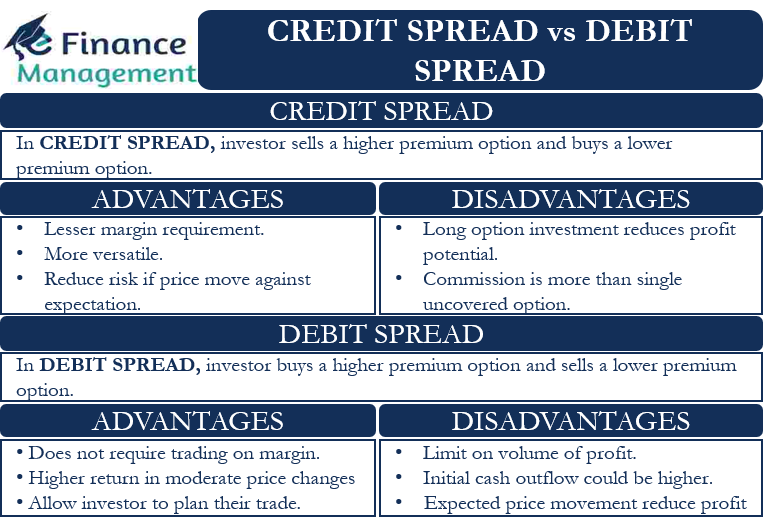

The advantages of a Credit Spread are:

- It helps to drastically reduce the risk if the share price moves against expectations.

- The margin requirement is less in comparison to uncovered options.

- This spread is more versatile. It means that investors get a lot of options with regard to the strike prices and expiration dates.

The Credit Spread Strategy has its own few disadvantages also. Those are:

- The profit potential reduces by the money an investor spends on the long option leg.

- The commission in this is generally more than a single uncovered position.

Now let us talk about the advantages of a Debit Spread:

- It allows an investor to plan their trade as they know the maximum potential loss.

- It doesn’t require trading on margin. This makes it useful for traders who may not be able to trade on margin.

- Investors can expect relatively higher returns even in the case of moderate price movements.

The Debit Spread has its share of disadvantages also:

- Here the quantum of profit that an investor can make is limited/capped.

- If the price of the security moves as per investor expectation, then the investor would lose the profit that they would have made by taking a direct position in the stock.

- An investor needs to deposit some money to enter the trade. The initial cash outflow will be more if the debit spread is higher.

Bullish and Bearish Approaches

Both debit and credit spreads can have bullish and bearish approaches. Lets’ understand them in detail:

Bull Call Spread (Debit Spread)

In a debit spread, a bull call spread, obviously, you should have a bullish view of the market. A bull call spread involves buying and selling a call option of identical expiry. But the strike price of selling the call option is always higher. Basically, in this case, a trader expects the price to go up. The investor will earn the maximum profit through the sold option if the price rises more than the strike price of the higher option.

Here the increased implied volatility brings in more profits. Hence, it is preferable to enter the contract if the implied volatility is rather low.

Bear Put Spread (Debit Spread)

In this, an investor buys and sells the put option of the same expiry. But, the strike price of the option that an investor sells is less. Of course, while using this strategy, your assumption of the market should be bearish. In this case, a trader will earn the maximum profit if the price drops below the strike price of the put option that they sell.

Bear Call Spread (Credit Spread)

A trader opts for this if they plan to benefit from a downward trend. In this, a trader buys and sells a call option with the same expiry. But, the strike price of the option that a trader buys is more. The trader will make more profit if the price goes below the strike price of the option they sell. In this case, the profit will equal the premium that the trader receives.

Bull Put Spread (Credit Spread)

A trader opts for this if they expect the price to remain the same or rise mildly. In this, a trader uses two put options with the same expiry but at a price less than the current share price. Also, the strike price of one option (sell) is lower than the other. A trader will make the maximum profit if the share price ends up more than the highest strike price. This way, the trader would get to keep all the premiums.

Credit Spread vs Debit Spread – Which is Better for You?

Time decay or time value of money is the important and critical criteria when we would like to see which strategy is preferable and likely to yield more profits. A debit spread is a go-to option if you expect the stock price to move in a specific direction. On the other hand, if you are unsure about the price movement direction, then a credit spread is better as you make money even if the share price doesn’t move.

Frequently Asked Questions (FAQs)

There is nothing like which one is better. They are better as per the given circumstances or market situation. Debit spreads are preferred when price moves in a specific direction, whereas credit spreads are a better option if you are unsure of price movement.

Some advantages of debit spread are listed below:

1. It allows an investor to plan their trade to become aware of their maximum loss.

2. Helpful for a trader who does not trade on margin.

3. Higher returns can be expected from moderate price movement.

A credit spread involves net receipts of premiums, while a debit spread involves net payments of premiums.

Thank you very much, Sanjay for your beautiful thoughts and ideas. This is appropriate and praiseworthy. Well done.