No one likes to face financial crises, but it can hit you, whether you like it or not. So whenever you come across a situation like this, the only way to deal with it is to prepare and plan ahead for such contingencies. Advance does not mean that you proceed normally, but when the signals and triggers start to flow. Savings are the best tool to deal with financial crises. But, in case you cannot overcome the crisis, you have another weapon at your disposal, and that is bankruptcy. It is a viable option to become debt-free and start from scratch. However there are different types of bankruptcies, but the two most popular are Chapter 11 and Chapter 13. It is very important for you to know the difference between Chapter 11 vs Chapter 13 in terms of requirements, procedures, timeline, expenditure, etc. Awareness and knowledge of the differences in all these areas will enable us all to better prepare for bankruptcy and to file for it.

Chapter 11 and Chapter 13 – What are They?

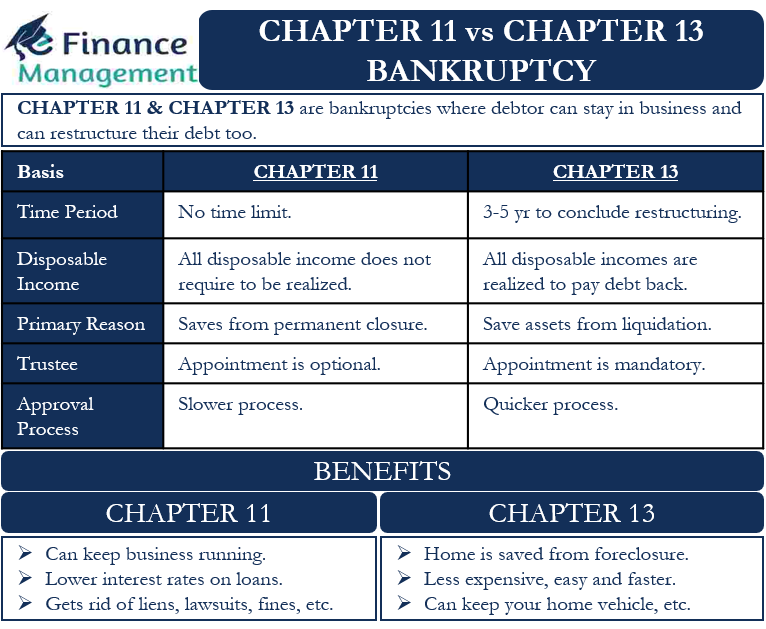

Both bankruptcies give debtors the chance to stay in business and restructure their debt. Moreover, both allow the filers to change the terms of payment for secured loans, gain time to sell assets, and eliminate debts that a person cannot pay during the term of the plan.

In both types of bankruptcy, the court may appoint a trustee, if it feels so, once you file the application for bankruptcy. You will submit your repayment plan and latest income tax return to the trustee. It is possible that your creditors do not like your plan and object to it. If this is the case, you, your attorney, and the trustee must submit a plan that is in agreement with the creditors.

Once the paperwork has been completed, the court will instruct creditors not to contact you. You will have to report your income, assets, expenses, finances, debts, and other relevant details to the court. This would help the court assess the viability of your repayment plan.

Also Read: Chapter 11 Bankruptcy

If the court agrees, you will start paying according to the plan. And as long as the payments continue according to the plan, you need not worry anymore. And your remaining debts will stand discharged over time. However, if you fail, if you are unable to make the payments according to the plan, then the creditors have the right to sue you.

So both Chapter 11 and Chapter 13 help you restructure your debt and keep your business going. But each has a different set of rules and requirements. Moreover, they have their own share of advantages and disadvantages. Thus for individuals, sole-proprietorship, and small businesses, it is very crucial to know the difference between Chapter 11 vs Chapter 13. Understanding the two will allow you to save money, and time, as well as from mental harassment.

Chapter 11 vs Chapter 13 – Who can File?

Anyone can choose Chapter 11 bankruptcy, including companies, partnerships, LLCs, joint ventures, etc. Generally, the idea is that an individual may not file under Chapter 11, but that is not the case. However, as it is expensive and somewhat complex, it is best for those who have massive debts and complex debt structures and are therefore assumed to be for the companies and businesses. Therefore, companies usually use this type of bankruptcy.

However, not everyone can file for Chapter 13 bankruptcy protection. There are a few qualified parameters to decide who can file for bankruptcy:

Debt Limits – Chapter 13 specifies the minimum debt limit. As of 2019, the debt limit was $419,275 for unsecured debt and $1,257,850 for secured debt. It is important to note that these debt limits are regularly updated and increased. Therefore, it is advisable to review the current debt limit with your attorney at the time of filing.

Also Read: Bankruptcy

Business Structure – Only individuals and sole-proprietor can opt for Chapter 13 bankruptcy. On the other hand, corporations, partnerships, LLCs, or other entities are not qualified for that bankruptcy.

Stable Income – The debtor who files under Chapter 13 must have a reasonable level of regular and stable income to prove that he will be able to pay the debt in accordance with the plan submitted.

Time Limit – You can file for Chapter 13 bankruptcy if you have not filed for Chapter 7 bankruptcy in the last four years. Or you have not filed for Chapter 13 bankruptcy in the last two years.

Chapter 11 vs Chapter 13 – Other Differences

Following are more differences between Chapter 11 vs Chapter 13:

Time Period

Under Chapter 13 bankruptcy, a debtor has three to five years to conclude its restructuring. Whereas chapter 11 does not have any such cap on the timeline for completion of the plan, effectively, there is no such timeframe.

Disposable income

Under Chapter 13 bankruptcy, debtors must use all their disposable income to repay the debt. But, there is no such provision under Chapter 11 bankruptcy.

Primary Reason

If you want to stay in business and have confidence, and would like to take the chance to revive your failed business, then you have the only option available to you, Chapter 11. In other words, the main reason for filing for Chapter 11 is to save the company from liquidation. This gives the company a chance to make a comeback. General Motors and Chrysler are good examples of this kind of bankruptcy.

The main reason to file for Chapter 13 bankruptcy is to save some assets from liquidation. In this type of bankruptcy, filers can keep part of their assets, such as a house and car, which are not used to pay off debts.

Trustee

Under Chapter 13 bankruptcy, it is a must for a court to appoint a trustee. But, the appointment of a bankruptcy trustee is optional in Chapter 11 bankruptcy.

Approval Process

The approval process for a Chapter 13 bankruptcy is usually quicker than for a Chapter 11 bankruptcy.

Chapter 11 vs Chapter 13 – Benefits

The advantages of filing for Chapter 11 bankruptcy are:

- Under the repayment plan, you can make smaller payments to creditors.

- You can keep the business going.

- It helps to lower the interest rate on higher interest-only loans.

- You can get rid of liens, lawsuits, fines, and much more.

- The court does not take into account your disposable income.

- Your company’s reputation remains intact.

Following are the pros of filing for Chapter 13 bankruptcy:

- You can keep /save your vehicle, house, or other assets.

- Your home is saved from foreclosure.

- An affordable payment plan will help you pay off certain tax debts.

- Finally, compared to Chapter 11, it is cheaper and faster.

Final Words

Both Chapter 13 and Chapter 11 bankruptcy are better for businesses because they help you stay in business. So, if you have too much debt but don’t want to go out of business, you’ll need to file either of two bankruptcies depending on your circumstances, come up with an agreeable payback plan, and ensure that you stick to it.

Please note that in these two bankruptcies, there may have been some changes with regard to the process and criteria under bankruptcies to take care of the coronavirus pandemic. And that can be for a limited period too. So, one must consult and consider those recent changes.

Frequently Asked Questions (FAQs)

Chapter 11 bankruptcy helps lower interest rates on higher-interest loans. Also, one can keep the business running and generate more revenue, and the company’s reputation remains intact.

Only individuals and sole proprietors can opt for Chapter 13 bankruptcy.

Chapter 13 bankruptcy is faster than Chapter 11 bankruptcy.