The exchange rate is, as we all know, the rate at which we convert one currency to another currency. There are two types of exchange rates. And these are – real and nominal exchange rates. Both rates are used when buying or selling currencies on the international market. Therefore, people often use the two terms interchangeably. In reality, the two concepts are very different from each other. To understand their meaning and use, it is crucial that we know the differences between real vs nominal exchange rates.

Nominal Exchange Rate

It is the rate that most groups know about. A nominal exchange rate is the general exchange rate of one country’s currency relative to another. Or, we can say, it is the rate at which one country’s currency can be exchanged for another country’s. In simple words, if there are two currencies, X and Y, the nominal exchange rate indicates how much you can buy currency X by giving a unit of Y, and vice versa.

We can express a nominal exchange rate in two ways, depending on the base currency. If X is the base currency, the rate is how many units of X you get when you give a unit of Y. And if Y is the exchange rate, the nominal rate is how many units of Y you get when you give a unit of X.

Let us take a simple example to understand the concept clearly: let us assume that Mr. A goes to the bank with $100 and wants to convert it into Euro. The bank offers an exchange rate of EUR 0.75 per USD. This means that one dollar equals 0.75 euros. So Mr. A gets 75 euros ($100 * 0.75) in exchange for 100 dollars.

Also Read: Types of Exchange Rates

Mr. A can, if he wants, convert 75 EUR back into USD. In this scenario, the exchange rate is USD 1.33 per EUR. This means that Mr. A receives 1.14 USD for every euro. On this basis, Mr. A gets 100 dollars back (75*1.33).

It is noteworthy that the above example is a very simple representation of the foreign exchange market. In reality, the foreign exchange market functions somewhat differently. The exchange rate can change every second, and there are two different rates, one for buying and one for selling a currency (bid and ask).

Real Exchange Rate

By means of real exchange rates, we try to determine the actual purchasing power of that currency, and for determining the real exchange rate, we use the same nominal exchange rate. It indicates the rate at which one nation’s goods and services can be exchanged for the goods and services of another nation. Or, we can say, it tells how much of the goods and services of the foreign country can be bought by exchanging the goods and services of the home country.

We need a nominal exchange rate to calculate the real exchange rate because we need to convert the prices of the applicable goods and services in both countries into the same currency for comparative purposes.

The formula for calculating the real exchange rate is, therefore, = (Nominal Exchange Rate x Domestic Price) / Foreign Price

A simple example will better clarify this concept. Suppose you (in the U.S.) are planning a trip, and you have to choose between Europe and the US. If you compare hotel prices, you will find that a room in Europe costs 80 euros. In the US, a similar room costs 180 dollars.

Based on the nominal exchange rate from the example above, we know that the nominal exchange rate is EUR 0.75. Putting the values in the formula for real exchange rate:

Real exchange rate = (0.75 * 180)/ 80 = 1.69

This means that for the same amount of money, you can spend almost twice as many nights in Europe as in the US.

In reality, we use the consumer price index and not just a product to calculate the real exchange rate. We can say that you have to compare a basket of goods from one country with the same basket of goods from another country to determine the real exchange rate. The real exchange rate is very important and crucial to arrive at the value of a country’s net exports.

Real vs Nominal Exchange Rate – Differences

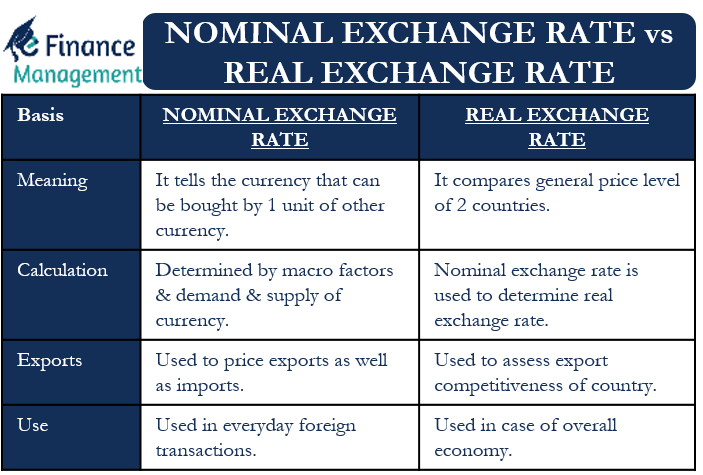

The differences between the real and nominal exchange rates are as follows:

Meaning

A nominal exchange rate indicates how much one currency we can buy with one unit of another currency. In contrast, the real exchange rate compares the general price level of certain commodities or baskets of commodities of the two countries.

Calculation

Macro factors and the supply and demand of a currency help determine the nominal exchange rate. On the other hand, we use the nominal exchange rate to determine the real exchange rate. Or we can say that we adjust the nominal rates for the price levels to get the real exchange rate.

Exports

We use the nominal exchange rate to evaluate both exports and imports. On the other hand, focusing on the real exchange rate is important in assessing a country’s export competitiveness, or we can say that the real exchange rate guides a country’s export policy.

Floating

Although nominal exchange rates are constantly changing, we can say that real exchange rates are even floating. This is because even if there is a system of fixed nominal exchange rates, the real exchange rate will change as a result of a change in the price level.

Use

The nominal exchange rate is more commonly used in everyday foreign exchange transactions, such as trade, foreign trips, remittances, etc. The real exchange rate is of no use for the average citizen. However, the real exchange rate is more important when it comes to the overall economy, which is more important for economists, governments, analysts, etc.