What is a Controllable Cost?

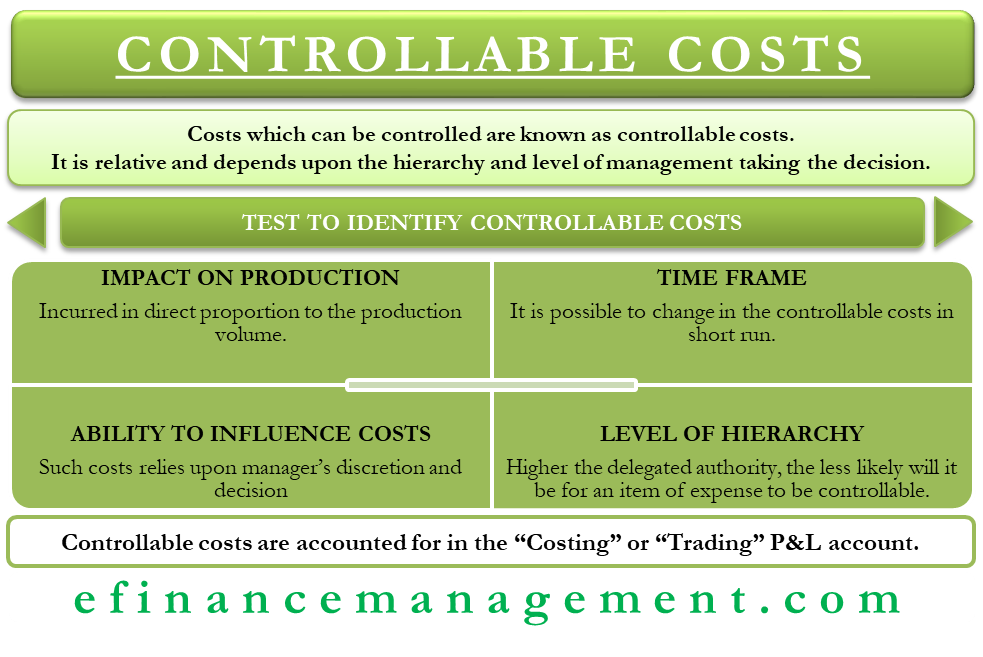

As the name suggests, a straightforward definition of controllable costs is costs that can be controlled. Such costs are controllable in the short run, and the discretion lies with the managers or production supervisors whether to incur them or not.

Also, the “controllable” factor is relative and depends upon the hierarchy and level of management taking the decision. For instance, consider the case of a yarn purchase in a cotton mill. Now since the yarn is a direct material for the production of cotton and the management is authorized to negotiate vendor contracts best suited to the organization’s needs. However, the production supervisor charged with running day-to-day operations has no say in yarn prices. Direct material cost is consequently a controllable cost for the management but an uncontrollable cost for the supervisor.

Controllable costs can also be referred to as variable costs, commonly used in accounting parlance. In short, controllable costs are likely to direct costs related to the level of production or core services of a business.

Test To Identify Controllable Cost

Impact on Production

This is the first and the most accurate measure to determine whether or not a cost is controllable. Above all, if an item of expense directly impacts the manufacturing process, it is a controllable cost. Secondly, the controllable cost is incurred in direct proportion to the production volume.

Also Read: Variable and Fixed Costs

Controllable cost constitutes the bulk of production costs. As a result, it has a direct impact on profitability margins. For this reason, it is also intuitive that such costs remain controllable. The management would always like to control or tailor these costs in order to ensure they are in line with the profit forecasts and budgetary requirements. To sum up, direct materials, direct labor & factory overheads are prime examples of controllable costs.

Time Frame

A controllable cost will demonstrate complete flexibility and will, therefore, be possible to change in the short run. However, certain expenses remain fixed and must be honored in the long run as a result of a commitment made in the form of a legal obligation or undertaking.

For example, managers can easily take the call to switch to a cheaper power alternative or re-arrange the mix of skilled and unskilled workers to save on labor costs. Since the changes can be imposed in a short period, they are classified as controllable costs. On the contrary, the rentals of a factory are pre-determined and subject to lease binding for a fixed period. They are, therefore, uncontrollable costs.

Ability to Influence Costs

If the manager has a total say in whether the cost should be incurred, it is likely a controllable cost. As a result, such costs rely upon his discretion to decide the extent and requirement of spends. However, there are other expenses incidental to running of a business that cannot be done away with. These costs are “imposed” on the business, and management must incur them even if no direct benefit accrues from it.

For example, every business must pay some statutory taxes to the government. The tax expenditure subsequently depends upon the rate of tax imposed, turnover thresholds, and other factors not controlled by the business.

Level of Hierarchy Making Decision

Additionally, examining the level of decision-making authority is a sure-shot check to determine the extent of controllability of cost. In other words, the higher up the delegated authority the less likely will it be for an item of expense to be controllable.

For example, the higher-ups would not like to concern themselves with the rate per liter of fuel used in production or to decide between two transporters. However, decisions like the lease of a factory, insurance costs, advertisement expenditure, and customer discounts are all major decisions and certainly not taken by the production managers.

Accounting for Controllable Cost

Controllable costs are accounted for in the “Costing” or “Trading” P&L account. In summary, the costing P&L accounts for all the income and expenditure directly related to production. Also, a sharp distinction is made while recording controllable and uncontrollable costs. As a result, this enables clear visibility of the impact variable and fixed costs have on the profits. The distinction also enables quick calculation of margins, thus facilitating prompt pricing decisions.

Below is an illustration of a Costing P&L account for a business manufacturing steel brackets. The below is an account for a monthly production volume of 1000 units.

| Costing P&L Account | |||

| Particulars | Amt (in $) | Particulars | Amt (in $) |

| To Controllable (Variable) Costs: | By Cash From Sales ($30 per piece) | 30,000.00 | |

| Direct Materials | 5,000.00 | ||

| Direct Labour | 3,000.00 | ||

| Power & Fuel | 2,500.00 | ||

| Electricity | 1,200.00 | ||

| Total Controllable | 11,700.00 | ||

| To Fixed Costs | |||

| Factory Rental | 7,000.00 | ||

| Machinery Lease | 3,200.00 | ||

| Depreciation | 320.00 | ||

| Total Fixed | 10,520.00 | ||

| To Gross Profit from Operations | 7,780.00 | ||

| 30,000.00 | 30,000.00 |

From above, the per-unit cost of production is easily computable at $11.7. Thus, giving a margin of $18.3 per unit. The production manager will have a clear motive to ensure all uncontrollable costs are paid out of the margin so released after adjustment for the controllable costs from the sales proceeds.