What do we mean by Contribution margin and Gross margin?

Contribution Margin and Gross Margin are two important concepts in Management Accounting. They also help in key management decisions. The contribution margin is an important concept in Cost Accounting. And the contribution is the difference between the sales value of a product and the variable production costs of that product. Further, when this contribution is expressed in terms of a percentage or ratio, it becomes Contribution Margin. It measures the contribution of a particular product to the company’s profit. For calculation purposes, the contribution margin concept does not include the fixed portion of a company’s total cost for manufacturing a product.

Gross margin is the difference between the net sales revenue from a product or service and its cost of goods sold or COGS. The cost of goods sold includes the direct expenses that a firm incurs to produce a product or render a service. It includes the cost of direct labor and direct materials. COGS is a mix of fixed and variable costs that the firm incurs as part of its direct expenses.

Fixed and Variable Costs and their impact on Calculation

Fixed costs do not depend upon the volume or quantum of goods or services that a firm produces or renders. They are the indirect or overhead costs that the company will incur even with zero production levels. These costs include rentals, salaries, interest expenses, etc. On the other hand, variable costs vary with every single unit of production of a product or offering of a service. In other words, variable costs are basically the marginal cost for the production of one extra unit or provision of additional service. Such costs include electricity charges, direct labor charges, wages, raw material costs used in the production, etc.

The calculation of contribution margin takes into account the variable portion of the total cost. The main purpose of finding out the contribution margin is to ensure that the firm is not losing money by producing every additional unit of the output. Moreover, whether it is able to cover at least the marginal cost of production. And how much is the margin generated by selling to cover the fixed operating cost and towards profit.

Also Read: How to Calculate Contribution Margin?

What are the key differences between the Contribution Margin and Gross Margin?

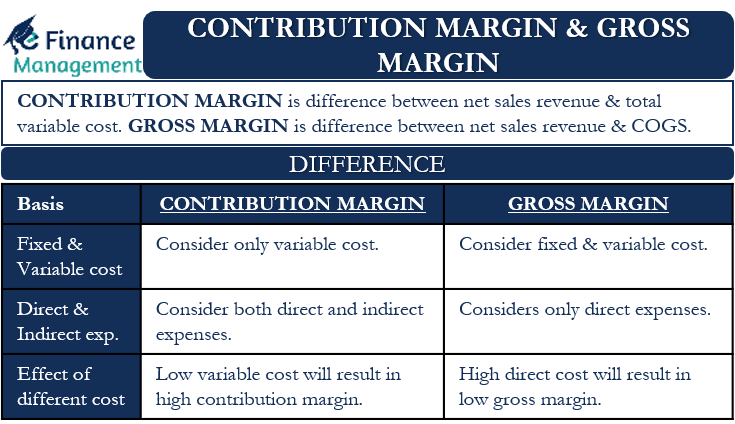

Contribution margin and Gross margin both use the net revenue figure or net sales price figure for calculation purposes. Also, a business will always keep finding out ways to increase both the figures as high as possible for its well-being and to generate profits. Similarly, lower input prices such as direct material and labor will also positively affect both the figures. However, beyond these similarities, there are a lot of differences between these two concepts. And we will discuss below these differences:

Fixed Costs and Variable Costs

The contribution margin concept solely considers the variable cost portion of the total cost. The fixed cost portion, however, remains outside the consideration.

Whereas gross margin calculation takes into consideration both the variable as well as fixed costs. COGS includes the variable portion of direct costs of material and labor related to production activities. COGS also includes the fixed cost portion like factory overheads. For example, COGS will include salaries for product quality checking and supervision staff. Also, it may include depreciation charges associated with plant and machinery directly used in production activity, etc.

Direct and Indirect Expenses

For calculating the contribution margin of a product, deduction of variable costs from the net sales value happens. The variable costs include direct expenses that relate to labor and material. It also includes indirect expenses that are variable in nature. Such costs are sales administrative expenses, advertising, and publicity expense, marketing expenses, sales commission and incentives, etc. Hence, the contribution margin considers both the types of costs- direct and indirect.

The cost of goods sold or COGS only includes the direct costs. These are costs relating to the production of a particular product or rendering of a service. It does not take into account the indirect costs. Examples of these costs can be distribution expenses, the cost of maintaining a marketing and sales team, etc. Therefore, such costs are not a part of calculating the gross margin.

Also Read: Contribution Margin

Calculation and effect of different types of costs

Low Variable Cost

A company with a high fixed cost and a relatively small portion of the variable costs will automatically have a high contribution margin.

Let us assume that XYZ Pvt. Ltd. had net sales revenue of US$ 10000 for the period under consideration. Its variable costs amount to US$ 3000 over the period consisting of US$ 2000 attributable to manufacturing materials and labor and US$ 1000 to marketing and distribution expenditure. Also, there is a fixed cost of US$ 500 attributable to salaries of supervision staff of machinery over the period.

As we have discussed earlier, Contribution margin= Net sales revenue – Variable costs. Hence, its contribution margin for the said period will be :

US$ 10000 – US$ 3000= US$ 7000.

We see that the fixed cost portion does not have any bearing on the above result. Now let us calculate the gross margin with the above example.

Gross margin= Net sales revenue – Cost of Goods Sold (COGS).

Hence, Gross margin= US$ 10000 – (US$ 2000+ US$500)

= US$ 7500.

However, suppose the same company makes a fresh fixed investment in a new plant and machinery for increasing production. Two of its major fixed costs will go up salaries for a supervisory staff of those machineries and quality maintenance staff and depreciation charges. This will result in the gross margin numbers going down. Therefore, a company with high fixed costs that are direct in nature will have lower gross margin levels.

High Variable Cost

Similarly, a high level of variable costs such as commissions to salespersons and distribution costs will lower contribution margins. These expenditures will not affect the calculation of gross margins.

Final Words

The Break-even point is another important concept where contribution margin is the most important factor for calculation. This is a point or level of sales where the entity makes no profit or no loss. It just covers up all the costs. Anything over that point will result in profits for the company.

The concept of gross margin is important for a company if its revenue figures are adequate, but the gross margins are still low. Low gross margin levels alert the company to check the pricing of its product or service as they may need an upward revision. Also, it may be a signal to curb and control the direct expenditure levels and check the material purchase price.