What is chapter 12 Bankruptcy?

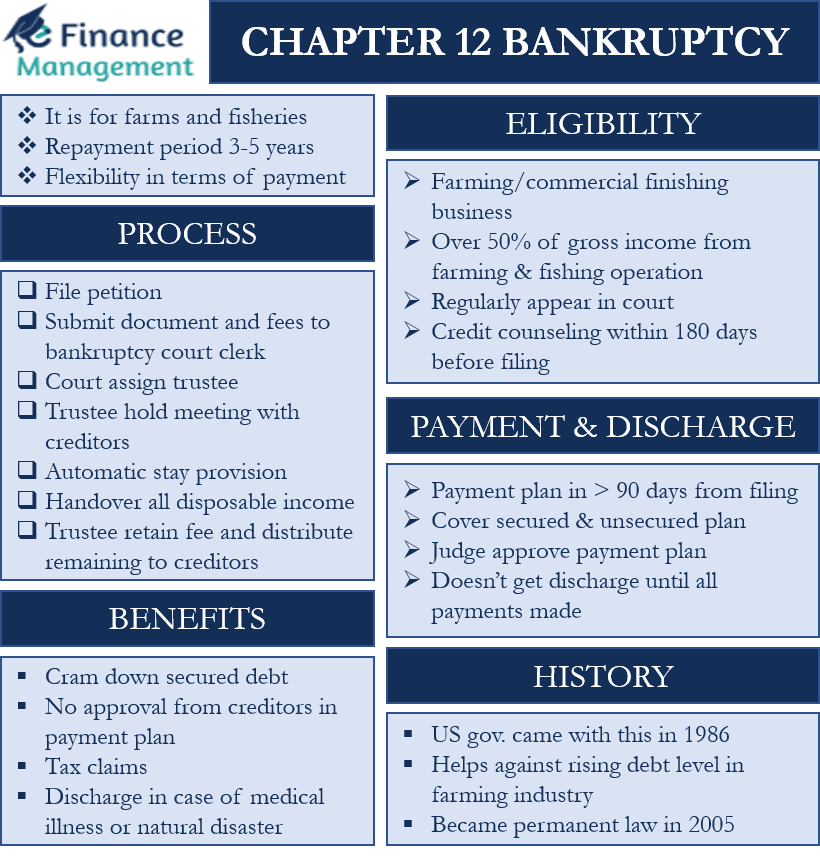

Chapter 12 bankruptcy is applicable to the farms and fisheries businesses. This means this bankruptcy assists the owners of farms and fisheries reorganize their finances while keeping the ownership of their assets. After filing for bankruptcy, the owners need to work with the bankruptcy trustee and creditors to come up with payment programs. The repayment period in this bankruptcy can vary from three to five years.

Such a type of bankruptcy applies to farms and fisheries under sole proprietorship (married or single) and under partnerships and corporations. In comparison to Chapter 13, Chapter 12 gives more flexibility in terms of payment as it considers the seasonal nature of the farming and fishing business.

History of Chapter 12 Bankruptcy

Before 1986 there was no specific financial protection available to the farmers. The farmers had to go for Chapter 13, which was expensive as it was primarily for big companies and generally dealt with relatively small outstanding debts.

Thus, the U.S. government came up with the Chapter 12 bankruptcy in 1986 to help farms and fisheries. Its objective was to help farms and fisheries against the rising debt level in the farming industry. In 1983, the industry debt rose to about $216 billion, primarily due to high commodity prices.

Also Read: Bankruptcy – Chapter 13

This act and provisions of Chapter 12 bankruptcy were intended to be applied initially only up to the year 1993. The authorities, however, extended it until it became permanent law in 2005.

Eligibility for Chapter 12 Bankruptcy

To be eligible to file for bankruptcy, the farms and fisheries need to meet some requirements. These requirements include the petitioner must be in the farming or commercial fishing business. The total debt for farmers must not be over $11,097,350 and $2,268,550 for fishermen (for cases between April 1, 2022, and March 31, 2025).

Also, over 50% of their gross income should have come from their farming or fishing operations in the last year. Also, half of their total debt should be related to such business. This means debt for a home or for any other purpose will not count.

The prescribed debt levels for those planning to file this bankruptcy keep changing depending on the economic scenario and commodity prices. For instance, the Farmer Family Relief Act of 2019 raised the debt limit from $3.3 million to $10 million. Such a rise in the debt limit was the result of rising U.S. farm debt, a trade war with China, adverse weather conditions, and more.

All bankruptcy filers (individual, corporation, or partnership) must not fail to appear in the court. Moreover, obviously, all the petitioners need to obey all the court orders. Moreover, the petitioner needs to get credit counseling within 180 prior to filing the petition under this chapter. The counseling must be from an approved agency.

Chapter 12 Bankruptcy: Process

The process of filing for this bankruptcy is similar to other bankruptcies. To start with, the farmer or fisherman has to file a petition. The petition should accompany schedules, financial statements, a list of debts and creditors, and any other document that the court may want. And finally, all these documents need to be submitted to the bankruptcy court together with necessary fees if any.

The court will assign a Trustee once they receive the petition. The responsibility of the trusty includes checking documents, reviewing the operations of debtors, making recommendations to the court, and collecting and distributing payments.

The trustee will then hold meetings with the creditors. The trustee and creditors can question the filer about their petition and financial conditions during the meeting. All this information will be helpful in creating the payment plan. The trustee will also measure the assets of the filers, and the court may then use them to pay the due debt.

Also, like other bankruptcies, this bankruptcy triggers an automatic stay provision. This limits creditors from collecting debt directly from the filer. Along with protecting the debtor, the automatic stay in Chapter 12 also secures anyone liable for any of the Chapter 12 debtor’s consumer debts. Such debts could be for personal, family, or household purposes and not for meeting business needs. So, even those lenders can not take any action for recovery once the petition is filed.

The bankruptcy filer needs to hand over all their “disposable income” to the trustee during the payment period. The “disposable income” is the difference between the revenue that the filer generates from the operations and the amount they spend on business expenses and supporting the family. The trustee retains some fee from the payment that the debtor makes and distributes the remaining among the creditors.

Payment and Discharge

Payment Plan

Once all the formalities are over, the debtor will have to come up with a payment plan to pay the debt in three to five years. The debtor must come up with a plan in less than 90 days from the date of filing the bankruptcy. However, the bankruptcy court can give more time under specific circumstances.

The plan must cover secured and unsecured debts as per the requirements of the bankruptcy law. One important criterion and rider for the payment plan is that the suggested payment to the secured creditors’ should at least be equal to the value of the collateral asset. So nothing less than the security provided will be acceptable for the secured debt payment plan. Payment towards secured debt could stretch beyond the plan term. The payment to unsecured creditors must at least equal to the payment such debts would have gotten under the Chapter 7 bankruptcy.

The bankruptcy judge should approve the payment plan from the debtor. After the confirmation hearing (within 45 days of the date of filling the payment plan), the debtor can start making the payments. After this, the trustee can forward those payments to the creditors.

Discharge of the Petitioner

In this type of bankruptcy, the debtor does not get the discharge until they make all the payments. However, there is one exception to this rule. And that is known as “Hardship Discharge”. Under this, the debtor gets a discharge if they can give evidence that they were unable to make the payments with no fault of theirs. Or, the reason for not making full payments was not under their control, such as severe illness. For the application of this exception, there is one condition or rider. And it provided that, the creditors should get a minimum at least equal to what they would have been got under the Chapter 7 bankruptcy. We call such a rule meeting the “best interests of creditors” test.

And once all the payments are made by the debtor, he gets a discharge. A debtor, however, can also choose to dismiss the Chapter 12 case or change it into Chapter 7.

Most of the obligations are dischargeable under this bankruptcy. However, a few obligations are non-dischargeable even under this bankruptcy, such as child support and alimony.

Benefits of Chapter 12 Bankruptcy

Following are the benefits available under the Chapter 12 bankruptcy:

- Debtors are able to trim down the secured debt quantum. This means the debtor needs to pay the present value of the collateral only and not the full outstanding debt amount.

- If a debtor proposes the repayment plan in accordance with Chapter 12, then creditors can not vote against it. Moreover, there is no need to get approval for the payment plan from the creditors.

- Debtors or the petitioners have a right to sell or lease assets in the normal course of business without getting permission from the court. Moreover, farmers can treat the tax claims from the sale of farm assets as unsecured claims.

- The debtor may even get a discharge if they fail to make the full payment. And such discharge could be on the grounds of medical illness or natural disasters.

Final Words

Chapter 12 bankruptcy is a quick and relatively easier way for farmers to reorganize their finances. Farmers also benefit from a seasonal repayment schedule, as well as lower bankruptcy costs in comparison to other bankruptcies. Moreover, farmers get more repayment flexibility under this chapter. If we compare the same to what would otherwise have been available to them under Chapter 7 or Chapter 11 of bankruptcy.