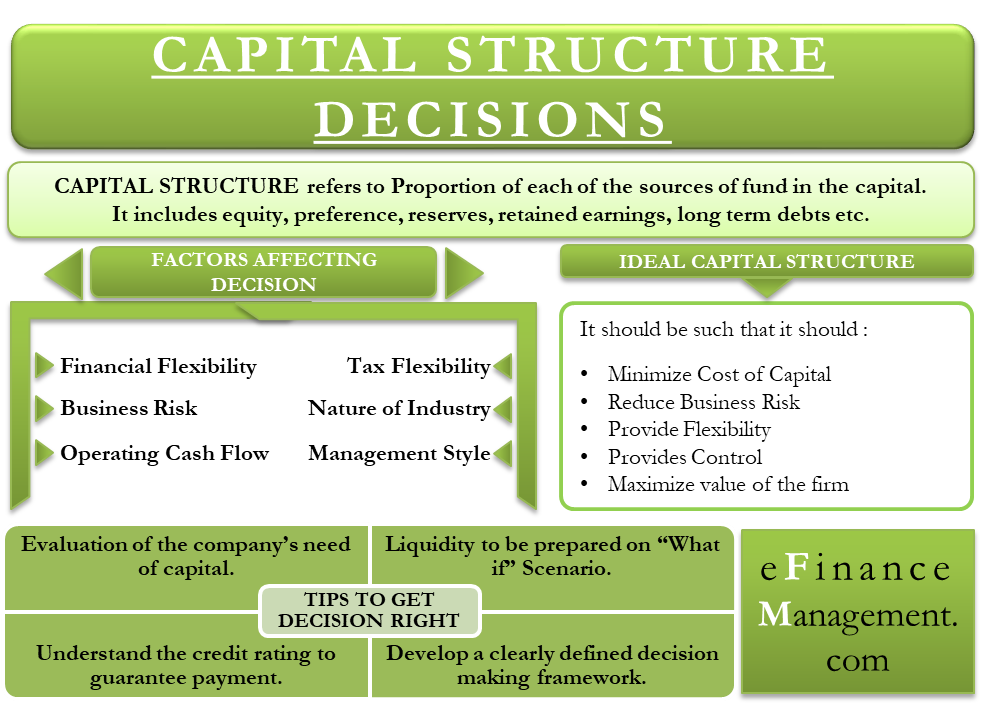

Capital Structure, as the name suggests, means arranging capital from various sources in order to meet the need for long-term funds for the business. It combines equities, preference share capital, long-term loans, debentures, retained earnings, and various other long-term sources of funds. We can say that capital structure refers to the proportion of each of these sources of funds in the capital, which the company should raise or arrange to carry out its business effectively. Thus, capital structure is extremely important. And capital structure decisions or practices have a significant role to play in corporate financial management.

Also, capital structure decisions impact the risk and return of equity owners. Owing to such importance, the management needs to make an informed decision about having a perfect capital mix.

Read our detailed article Capital Structure and its Theories to know more about what is capital structure and what are its theories.

The value of any firm is the net present value of its future free cash flows discounted by the Weighted Average Cost of Capital (WACC). Changes in capital structure will influence the risk and cost of each capital structure component and capital cost as a whole. Changes in capital structure can also affect free cash flow, therefore influencing CapEx decisions.

Ideal Capital Structure

A balanced capital structure is important for the overall health of the company. Excessive use of any component in the capital mix might not work in favor of the company. For instance, a company cannot excessively rely on debt. Because comparatively, debt will be more expensive than equity if the company excessively relies on debt. Similarly, excessive funds through equity can also prove costly.

To add more, many companies pay dividends which decrease retained earnings and increase the amount of funding a company must have to finance its business. So factors affecting the capital structure decision of a firm are interrelated with dividend policy.

Borrowed capital has two significant advantages. First, interest paid is exempt when calculating profit for tax. Second, lenders receive only fixed income on provided funds, and the shareholder doesn’t have to share profit with them.

Borrowed funds have disadvantages too. First, the higher the indebtedness ratio, the riskier the company, and the cost of funding and equity rise. Second, suppose the company faces harsh times, and its operating profit is not sufficient to cover interest expenses. In that case, shareholders will have to finance this deficit from their own wealth, and if they can’t – the company will be declared bankrupt.

An ideal capital structure should help the company to;

- Minimize the cost of capital

- Reduce business-related risks

- Provide needed flexibility

- Provide control to the owners

- Maximize the value of the firm

Capital structure decisions are affected by many factors and as you’ll see, determining optimal capital structure is not an exact science. So, even companies in the same industry can have significantly different structures of capital.

Also Read: Capital Structure Analysis

Factors Affecting Capital Structure Decisions

There are various factors that management must consider while making capital structure decisions. These factors are:

- A company with low debt in the mix would be better off in bad times. One of the most common mistakes that companies do is raising capital through debt without analyzing their ability to repay those. As a result, they fail to service the debt in bad times, thus losing the confidence of the investors.

- Usually, debt payments are tax-deductible and result in tax benefits. This is why companies prefer having some amount of debt in their capital structure.

- A lower debt asset ratio would make investors feel better about the company’s ability to meet responsibilities even in adverse situations.

- A company having stable cash flows will be more likely to go for debt, while a company with uneven cash flows will resist debt in its capital structure.

- The nature of the industry plays a very important role in defining the capital structure. For instance, in an industry where there is no barrier to competition, the profit margin of existing firms will be more at risk. Therefore, the firms will be hesitant to use fixed charge-bearing securities.

Apart from these factors, there are various other elements that affect the capital structure decisions of an organization. Management considers various ratios such as debt service coverage ratio, interest coverage ratio, and more. Cost of debt and return on investments are a few more factors that a company considers while making capital structure decisions.

Read about these factors in detail @ Factors affecting Capital Structure Decisions.

Tips for Getting Capital Structure Decisions Right

Along with the above factors, there are a few tips that can help management make better capital structure decisions;

Evaluate the Need for Capital

Management must evaluate the company’s needs for capital. Usually, a company needs capital for four things – operations, organic growth, acquisitions, and returning cash to shareholders. Management must determine the minimum liquidity that it will need to finance these four things.

Determine Liquidity Level

Management should determine liquidity level on the basis of “what if” scenarios. For instance, preparing a capital structure “if there is a 20% to 30% drop in the business activity.”

Credit Rating

It helps determine if the company’s credit position is good enough to guarantee instant access to funds. If the rating is not good, the company will not be able to raise much funds by the way of debt. It will then have to make adequate adjustments to the capital structure.

Decision-making Framework

The company requires to develop a clearly defined decision-making framework. This will guide the management when dealing with different liquidity scenarios. Having a framework also means that capital structure decisions are not just an instant reaction to a change in the condition. Instead, the decisions are based on a carefully thought framework.

Continue reading – Financial vs. Capital Structure.

Very educative and we are still learning a lot

Only learning