Ratio analysis is a widely used tool to analyze a company’s performance. Management of the company uses it to see where the company ranks in comparison with its competitors. And also find out the areas where it is lacking and needs to work on. Similarly, investors also use ratio analysis to make an informed choice before investing in a company. Therefore, it makes sense to understand the limitations of ratio analysis.

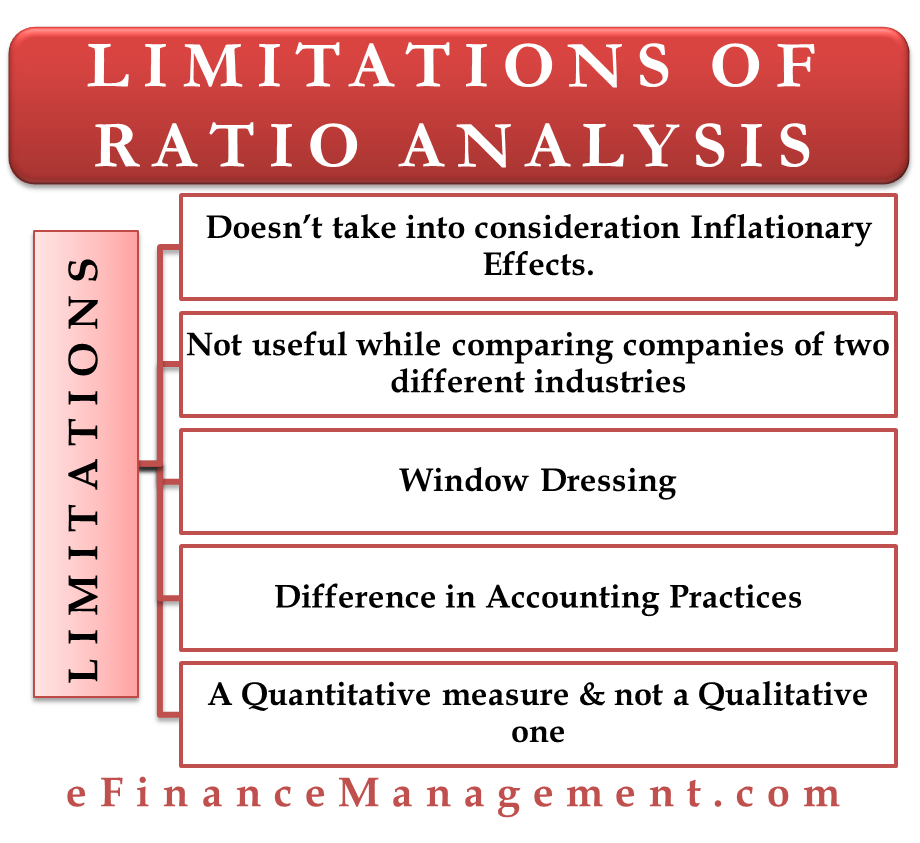

Disadvantages or Limitations of Ratio Analysis

There is no doubt that ratio analysis gives great insights into a company. Having said that, it also has a few limitations.

Inflationary Effects not Considered

Financial records are made over a period of time. These records may not give a true picture because the practice does not consider the effects of inflation while recording transactions. Financial statements are based on historical costs and might not reflect the current market value of assets and liabilities. This can lead to distortions in ratio calculations. For example, assets purchased years back are recorded at historical rates in the balance sheets. These rates may not have the same value currently due to inflation. The value of inventory and depreciation may not have the same value now as it had when it was recorded.

Not Useful in Comparing Companies belonging to Different Industries

You cannot compare apples with oranges. Similarly, if you compare the ratios of companies belonging to different industries, you may be fighting a lost cause. Different industries have different markets, gestation periods, capital structures, etc. For ratio analysis to hold any meaning, you need to compare companies belonging to the same industries only.

Difference in Accounting Practices

Different companies may use different accounting practices. Inventory valuation methods may differ, and so can depreciation methods. As a result, comparing ratios of such companies may not depict a correct picture. Different accounting methods and policies can affect the calculation of ratios and make comparisons between companies with varying accounting practices less meaningful.

Also Read: Advantages and Application of Ratio Analysis

Window Dressing

Ratio analysis uses the information present in the financial statements of a company. Companies can manipulate their financial statements to improve their ratios, making the company’s financial health appear better than it actually is. This can be done by inflating revenues, deferring expenses, or using other accounting tricks. If you analyze such a balance sheet or income statement, it will result in wrong conclusions only. Window dressing is not an accepted practice, but many companies do indulge in such malpractices to give a false impression to their investors.

E.g., a company may delay paying its creditors at the end of a financial year. This way, the company can show more cash balance on its balance sheet. This is the simplest form of window dressing.

Quality of Earnings

Sometimes a company’s financials may reflect huge profits and still have negative operating cash flows. Management adopts such practices to increase the value of their company’s share in the market. There are various methods that can be useful in reflecting higher profits. For example, including one-time (non-recurring) profits current year’s profit. The quality of earning ratio is a tool to identify if a company has higher or lower quality financials.

To learn more about it, refer to QUALITY OF EARNINGS.

A Quantitative Measure, not a Qualitative One

Ratio analysis primarily focuses on financial metrics and ignores non-financial factors like market trends, customer preferences, technological changes, and competitive landscape, which can significantly impact a company’s performance. At best, it can make sense out of the financial statements. It cannot give a cause or a reason if something is lacking or what one can do to correct the situation. Unless you dig into the ratios, performing ratio analysis makes very little sense.

Also Read: Ratio Analysis

Ratio analysis doesn’t consider qualitative factors such as management quality, employee morale, brand strength, and innovation capabilities, which can be crucial for a company’s success.

E.g., profitability ratios may suggest that you have a lower profit than your competitors. This does not help find the actual cause of this and what corrective actions one can take. Lower profit maybe because of the wrong pricing structure, the marketing team may not be doing its task, the production quality is not up to the mark, etc. So, one needs to dig into the ratios to find the actual cause of the problem. Simple ratio analysis may not suffice.

Learn more about its advantages – ADVANTAGES OF RATIO ANALYSIS

Mr Borad, This is wonderful contribution, I found it rich and precise. Good work.